Swiss Franc The Euro has fallen by 0.24% to 1.1077 EUR/CHF and USD/CHF, March 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are beginning a new and busy week in a non-committal fashion. Equities are mixed. Except for Japan, Hong Kong, and Australia, most markets in the Asia Pacific region were lower, led Chinese and Indian shares. Europe’s Dow Jones Stoxx 600 ended a four-day advance...

Read More »FX Daily, January 19: Even When She Speaks Softly, She’s Yellen

Swiss Franc The Euro has fallen by 0.07% to 1.0754 EUR/CHF and USD/CHF, January 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The animal spirits are on the march today. Equities are mostly higher, peripheral European bonds are firm, and the dollar is mostly softer. After posting the first back-to-back decline this year, the MSCI Asia Pacific Index bounced back today, led by a 2.7% gain in Hong Kong...

Read More »FX Daily, November 27: Dollar Offered Ahead of the Weekend

Swiss Franc The Euro has risen by 0.19% to 1.0814 EUR/CHF and USD/CHF, November 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities are finishing the week on a firm tone, while the US dollar remains heavy. In the Asia Pacific, only Australia and India did not end the week on a firm note. The MSCI Asia Pacific completed its fourth consecutive weekly gain, for around a 13% gain. Europe’s Dow Jones Stoxx...

Read More »FX Daily, April 15: Dollar Rises as Equities Slump

Swiss Franc The Euro has fallen by 0.12% to 1.0528 EUR/CHF and USD/CHF, April 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The recovery in equities stalled, and the risk-off mood has helped lift the US dollar, which had been trending lower. Taiwan and Malaysia were notable exceptions in the Asia Pacific regions to the heavier equity tone. The Nikkei gave back almost 0.5% after surging more than 3% on...

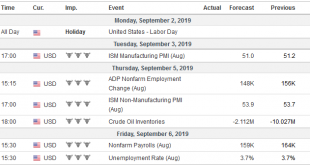

Read More »FX Weekly Preview: Economic Data in the Holiday-Shortened Week

The capital markets will turn increasingly quiet in the week ahead as the Christmas holiday thins participation. If this is the season of goodwill, investors are lapping it up. Global equity markets are finishing a strong year on a high note. Record highs were recorded in the S&P 500 and the Dow Jones Stoxx 600. The MSCI Emerging Markets equity index is at its best level since August 2018. Risk assets are doing well, while interest rates have backed up. The CRB...

Read More »FX Daily, November 5: Animal Spirits Remain Animated

Swiss Franc The Euro has risen by 0.05% to 1.0994 EUR/CHF and USD/CHF, November 5(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The prospects that the US-China deal could include some rolling back of existing US tariffs helped underpin risk appetites. After new record highs in the US S&P 500 and NASDAQ, Asia Pacific markets marched higher, and the MSCI Asia Pacific reached its highest level since August...

Read More »FX Daily, October 24: Flash PMIs Disappoint Despite Negative Interest Rates

Swiss Franc The Euro has fallen by 0.08% to 1.1014 EUR/CHF and USD/CHF, October 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: As the UK awaits the EU’s decision on its request, disappointing flash PMI readings Japan, Australia, and Germany have filled the news vacuum. Sweden’s Riksbank retained a hawkish tone while keeping rates on hold, and Norway’s Norges Bank also stood pat. The market expects Turkey to...

Read More »FX Daily, September 10: Turn Around Tuesday

Swiss Franc The Euro has fallen by 0.22% to 1.0933 EUR/CHF and USD/CHF, September 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The momentum from the end of last week carried into yesterday’s activity, but the momentum began fading. Today, equities were mixed in Asia Pacific and weaker in Europe. The Dow Jones Stoxx 600 reversed lower yesterday and is slipped further today. The S&P 500 may gap lower at...

Read More »FX Weekly Preview: Talking and Fighting in the Week Ahead

Equity markets and the US dollar closed last week and August on a firm note. Ahead of the weekend, the dollar rose to new highs for the year against the euro, Swedish krona, Norwegian krone, and the New Zealand dollar. While the next set of US and Chinese tariffs start September 1, the market is making the most of the lull. At the same time, US and Chinese officials probe each other to see if sufficient disruption has been felt to force concessions. Talking and...

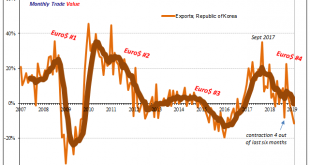

Read More »Globally Synchronized…

The economic sickness is predictably spreading. While unexpected in most of the world which still, somehow, depends on central banking forecasts, it really has been almost inevitable. From the very start, just the utterance of the word “decoupling” was the kiss of death. What that meant in the context of globally synchronized growth, 2017’s repeatedly dominant narrative, wasn’t the end of synchronized as many tried to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org