Swiss Franc The Euro has fallen by 0.13% to 1.1632 CHF. EUR/CHF and USD/CHF, July 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro was already trading with a heavier bias, having been turned back after approaching the $1.18 level yesterday. The disappointing Geman survey data encouraged some late longs to be cut, driving the euro to the session low near $1.1715,...

Read More »FX Daily, June 28: US Dollar Remains Firm, Sends Yuan, Rupee, Sterling and Kiwi to New 2018 Lows

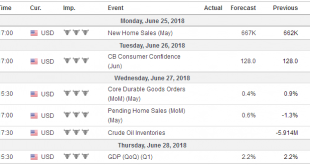

Swiss Franc The Euro has risen by 0.24% to 1.1545 CHF. EUR/CHF and USD/CHF, June 28(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is consolidating its gains against most of the major currencies, but the underlying strength remains evident. Several major and emerging market currencies are at new lows for the year, including sterling and the New Zealand...

Read More »FX Daily, June 27: Renminbi Slide Continues and Oil Extends Surge

Swiss Franc The Euro has risen by 0.07% to 1.1542 CHF. EUR/CHF and USD/CHF, June 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mostly firmer today, though has slipped back below the JPY110 level, as lower yields and equities support the Japanese yen. The main story in the foreign exchange market today is the continued slide in the Chinese renminbi....

Read More »FX Daily, June 26: Trade Tensions and Approaching Quarter-End Cast Pall Over Markets

Swiss Franc The Euro has fallen by 0.08% to 1.1539 CHF. EUR/CHF and USD/CHF, June 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets have stabilized today after yesterday’s rout in equities, softer yields, and US dollar. The implementation of US tariffs on China and China’s retaliatory tariffs on the US is still ten days off. The immediate...

Read More »FX Weekly Preview: Trade Tensions and EU Summit Highlight Q2’s Last Week

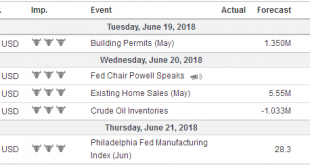

We argue there are three major disruptive forces that are shaping the investment climate: the US policy mix in relative and absolute terms, the escalation of trade tensions, and immigration. In the week ahead, trade issues may eclipse the US policy mix, and immigration will compete with the economic and financial agenda at the European heads of state summit at the end of the week. China The People’s Bank of China made...

Read More »FX Weekly Preview Warning: Treacherous Week Ahead

All three of the major central banks met last week and confirmed that monetary policy would continue to diverge for at least another year. The clarity of the trajectory of monetary policy reduces the impact of high-frequency economic data. There are three major disruptive forces the make for a challenging investment climate just the same: the US policy mix, trade tensions, and immigration. The mix of tighter monetary...

Read More »FX Daily, June 5: Sterling Jumps Ahead, While US Equities Have Small Coattails

Swiss Franc The Euro has fallen by 0.23% to 1.1526 CHF. EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are several euro options that expire today and are stacked every quarter of a cent from $1.1675 to $1.1750. The size of the options increase with the price beginning with 688 mln euros at $1.1675, then 775 euros at $1.17, 1.1 bln euros...

Read More »FX Daily, May 18: EUR/CHF Continues the Collapse

Swiss Franc The Euro is down by 0.54% to 1.1743 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. Reasons are: Weaker than expected euro zone GDP growth in Q1, in particular in Germany. However this “soft-patch” should have been clear to everybody. So it cannot be the main reason. Still the weak German GDP was the trigger for EUR weakness. A dovish European Central Bank. Already at the press...

Read More »FX Daily, May 04: US Jobs-Not the Driver it Once Was

The US dollar fell last month in response to the disappointing non-farm payroll report. However, in general, the jobs report is not the market mover that it was in the past. With unemployment is at cyclical lows of 4.1% and poised to fall further. Weekly jobless claims and continuing claims at or near lows in a generation, though over qualification is more difficult than previously. The monthly net job creation is a...

Read More »FX Daily, May 03: Respite to Dollar Short Squeeze

Swiss Franc The Euro has fallen by 0.03% to 1.1944 CHF. EUR/CHF and USD/CHF, May 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The Australian dollar is higher for a second session. It has been helped today by stronger than expected data in the form of a larger than expected March trade surplus (A$1.57 bln vs. expectations for A$865 mln) and building permits up...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org