Swiss Franc The Euro has risen by 0.14% at 1.1373 EUR/CHF and USD/CHF, April 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The equities are finishing softly after the rally stalled in the middle of the week. The large markets in Asia fell, led by China, and the MSCI Asia Pacific Index fell for a third session, the longest losing streak in two months. Europe’s...

Read More »FX Weekly Preview: The Week Ahead: Don’t Skip Steps on Escalation Ladders

United States The drop in US yields and disappointing economic data weighed on sentiment and the dollar last week. Even weakness in equities, which had seemed to lend the greenback support, failed to do so at the end of last week. With the real Fed funds rate (adjusted for inflation) below zero, employment at 50-year lows, and some fiscal stimulus still in the pipeline, the doom and gloom cant of a recession next year...

Read More »FX Daily, May 31: Don’t Confuse Calmer Markets with Resolution

Swiss Franc The Euro has fallen by -0.42% to 1.1485 CHF. EUR-CHF and USD-CHF, May 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets that were in panic mode on Tuesday stabilized yesterday, and corrective forces have carried into today’s activity. However, the underlying issues in Italy and Spain are hardly clarified in the past 48 hours. ...

Read More »FX Weekly Preview: ECB and BOJ Meetings Could be Key to Dollar Direction

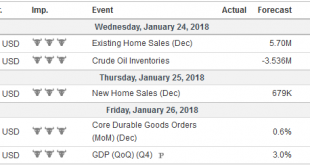

The US dollar has been marked lower since the middle of last month. It flies in the face strong growth, rising inflation expectations, and greater conviction that the Fed will continue to raise interest rates this year. Moreover, an oft-cited knock on the dollar, the widening current account, may be offset this year by the impact from US corporations repatriating earnings that have been kept offshore. Another weight on...

Read More »Italian Election–Two Months and Counting

- Click to enlarge Germany does not have a government, though the election was more than three months ago. Spain, Portugal, and Ireland have minority governments. Austria is the first government since the financial crisis to include the populist right. The EU is trying to press the Visegrad group of central European countries to conform to the values of Western European members. And yet it is Italian politics...

Read More »FX Weekly Preview: Thumbnail Sketch of the Week’s Big Events

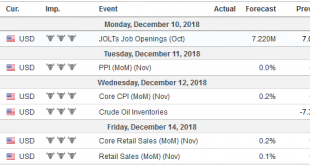

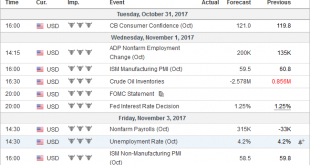

Summary Busiest week of Q4. Fed, BOJ, and BOE, only the last is expected to change policy. Flash EMU CPI and US jobs. Positive developments in Italy, less so in Spain. The week ahead will be among the busiest in Q4. In this note, we provide a brief sketch of the different events and data points that will shape the investment climate. Given the importance of initial conditions, we will begin with an overview of the...

Read More »FX Daily, October 11: Markets Looking for a New Focus

Swiss Franc The Euro has risen by 0.04% to 1.1515 CHF. EUR/CHF and USD/CHF, October 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is consolidating after retreating since reversing lower following the US jobs data at the end of last week. While the greenback has largely been confined to yesterday’s ranges against the major currencies, the euro has made a...

Read More »FX Daily, October 03: Dollar Retains Firm Tone, Spanish Markets Stabilize

Swiss Franc The Euro has risen by 0.17% to 1.1452 CHF EUR/CHF and USD/CHF, October 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Firm US interest rates and a strong manufacturing ISM yesterday help support the greenback, while disappointing construction PMI in the UK weighs on sterling. The euro briefly slipped below $1.17 in Asia for the first time in six weeks. It...

Read More »FX Daily, June 07: Markets Mark Time Ahead of Tomorrow

Swiss Franc The euro is higher at 1.0854 CHF (+0.06%). EUR/CHF - Euro Swiss Franc, June 07(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Tomorrow may be the most important day of the quarter for investors. The ECB meets. The UK goes to the polls. Former FBI Comey testifies. Ahead of these significant events, the global capital markets are mostly quiet, with some pockets of activity. The US dollar is...

Read More »Single Resolution Board and Banco Popular Bailin

In the FT, Martin Arnold, Tobias Buck, and Rachel Sanderson discuss the significance of the Banco Popular bailin. The Single Resolution Board was created at the start of 2015 as a pan-European authority for dealing with failing banks. Since then however, the institution has remained almost entirely untested. Now with Banco Popular it has shown its teeth at last. The SRB, chaired by Elke Koenig, acted swiftly after it was informed by the European Central Bank that Popular was “failing or...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org