College students are back at their desks this month facing bleak prospects. With tightening job markets leaving kids with no place else to go, universities continue to jack up fees. The upshot is growing signs that America is in the midst of an “education bubble,” just as big as those in stock, bond, and real estate markets. Case in point: four years at Harvard University now costs nearly $250,000 [1]. If you want an...

Read More »The Education Bubble: Is A Harvard MBA Worth $500,000?

The Education Bubble: Is A Harvard MBA Worth $500,000? Written by Peter Diekmeyer College students are back at their desks this month facing bleak prospects. With tightening job markets leaving kids with no place else to go, universities continue to jack up fees. The upshot is growing signs that America is in the midst of an “education bubble,” just as big as those in stock, bond, and real estate markets. Case in point: four years at Harvard University...

Read More »Negative Rates and The War On Cash, Part 1: “There Is Nowhere To Go But Down”

[unable to retrieve full-text content]As momentum builds in the developing deflationary spiral, we are seeing increasingly desperate measures to keep the global credit ponzi scheme from its inevitable conclusion. Credit bubbles are dynamic — they must grow continually or implode — hence they require ever more money to be lent into existence.

Read More »Gold Wins In Three Out Of Four Scenarios, Macquarie Warns “None Of Them Are Good For The Economy”

Submitted by Valentin Schmid via The Epoch Times, Warren Buffett claims that gold is worthless because it doesn’t produce anything. Fair point, but what if the other sectors of the economy also stop producing? “If you think of gold, the only way gold loses is if normal business and private sector cycles come back. If that is the case, gold goes back 100 dollars per ounce. The other outcomes, deflation, stagflation, hyperinflation are good for gold,” said Viktor Shvets,...

Read More »The Helicopter Mortgage

Medical vs. Financial Engineering I broke my elbow a month ago, pretty badly as I was told. The surgeon screwed the pieces back together, using a steel alloy bracket and six screws. Two hours later, I left the hospital with no cast, a bandage (just to cover a very ugly scar), a prescription for painkillers and therapy started a week later. What would have happened if I had suffered the same accident in 1975? The...

Read More »US To Seize $1 Billion In Embezzled Malaysian Assets Which Goldman Sachs Helped Buy

The last time we wrote about the long-running saga of the scandalous collapse and constant corruption at the Malaysian state wealth fund, 1MDB, which also happened to be an unconfirmed slush fund for president Najib, was a month ago when we learned that the NY bank regulator was looking into fundraising by the fund’s favorite bank, Goldman Sachs. Then overnight, the story which already seemed like it has every possible...

Read More »Yahoo Finance Editor “We’re Suffering Of Too Much Democracy”

Following James Traub’s mind-numbingly-elitist rebuttal of the democratic rights of “we, the people” in favor of allowing “they, the elite” to ensure the average joe doesn’t run with scissors, “It’s time for the elites to rise up against the ignorant masses.” The Brexit has laid bare the political schism of our time. It’s not about the left vs. the right; it’s about the sane vs. the mindlessly angry… The Guardian’s...

Read More »Housing Affordability – A Dose of Reality

Restless Peasants First, a few quick words on Brexit. Being the always positive and optimistic person that I am (big grin), I see one very positive outcome of Brexit – it is a revolution without bloodshed. For once, I’m not digressing. Brexit has a lot of parallels with housing affordability in the US. Brexit is a clear illustration of how politicians, policy makers and the establishment have lost touch with the...

Read More »Need Safe havens: CHF or Gold?

A warped manifestation of the fear and greed trade-off that used to characterize investor behavior has developed, according to Bloomberg’s Richard Breslow. Asset managers are exhibiting the manic depressive drive to simultaneously throw caution to the wind, ignoring all risk metrics while plaintively bemoaning the lack of safe havens. S&P 500, 2016 EPS Expectations Fear and greed was a continuum, allowing for an...

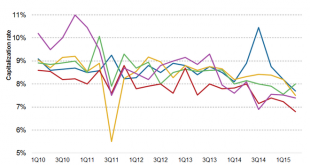

Read More »Is it Time to Buy Real Estate? Yes and No

Is it Time to Buy Income-Producing Real Estate? No, No, No. Much to the dismay of my real estate buddies, who are complaining about how high prices while watching the cash flow of their portfolios bursting at the seams from a few good years of rent increases, the answer is no. Capitalization Rates REIT cap rates (as of mid 2015, they have declined further since then) Capitalization Rates Valuation is one big red...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org