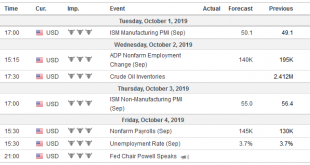

United States The world’s largest economy appears to have grown by about 2% in Q3 at an annualized pace, the same as in Q2, and in line with what many Fed officials understand to be trend growth. The strength of the US labor market underpins consumption, the powerful engine of the US economy. The latest readings of both the labor market and consumption will highlight the economic data in the week ahead. The strength of the recent housing data (starts and sales)...

Read More »FX Daily, September 03: Pound Punished in High Drama

Swiss Franc The Euro has fallen by 0.29% to 1.0831 EUR/CHF and USD/CHF, September 03(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A showdown between UK Prime Minister Johnson and Parliament over Brexit pushed sterling below $1.20. The euro is extended its losses after finishing last week below $1.10. Growth concerns are seeing equities retreat. Japanese and Chinese shares managed to eke out gains, but...

Read More »FX Weekly Preview: Talking and Fighting in the Week Ahead

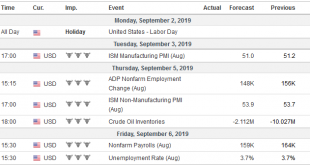

Equity markets and the US dollar closed last week and August on a firm note. Ahead of the weekend, the dollar rose to new highs for the year against the euro, Swedish krona, Norwegian krone, and the New Zealand dollar. While the next set of US and Chinese tariffs start September 1, the market is making the most of the lull. At the same time, US and Chinese officials probe each other to see if sufficient disruption has been felt to force concessions. Talking and...

Read More »FX Daily, June 18: Draghi Ends Calm Ahead of FOMC, Sending the Euro and Yields Down

Swiss Franc The Euro has fallen by 0.08% at 1.1196 EUR/CHF and USD/CHF, June 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: ECB President Draghi underscoring the likely need for more stimulus broke the subdued tone as market participants took a “wait and see” stance ahead of tomorrow’s FOMC decision. Draghi’s comments sent the euro through $1.12 for the first...

Read More »FX Daily, June 04: Nervous Calm Settles Over Markets

Swiss Franc The Euro has risen by 0.13% at 1.117 EUR/CHF and USD/CHF, June 04(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets are stabilizing today after taking a body blow of broadening the use of US tariffs (in migration dispute with Mexico), threatening the ratification of NAFTA 2.0, and still escalating hostile rhetoric between...

Read More »FX Weekly Preview: Curiouser and Curiouser

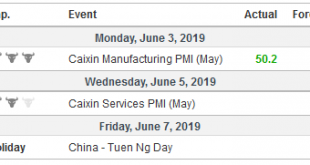

The first week of June features the Reserve Bank of Australia meeting, an ECB meeting, and the US employment data. The RBA is expected to deliver its first rate cut in three years. The market appears to have discounted not only a second cut in H2 but has priced nearly half of a third cut as well. A soft inflation reading after the seasonal bump in April and disappointing survey data, with Brexit and trade tensions,...

Read More »FX Daily, May 10: Waiting for the Other Shoe to Drop

Swiss Franc The Euro has fallen by 0.08% at 1.1372 EUR/CHF and USD/CHF, May 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Contrary to hopes and expectations, the US made good on the presidential tweet and raised the tariff on around $200 bln of Chinese goods from 10% to 25%. Trump indicated that the process that will levy a 25% tariff on the remaining Chinese...

Read More »FX Daily, April 02: Herding Cats

Swiss Franc The Euro has fallen by 0.07% at 1.1189 EUR/CHF and USD/CHF, April 02(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After surging yesterday, equities are struggling to maintain the momentum that carried that S&P 500 to its best level since last October. Most Asia Pacific equity markets advanced. Japan’s small losses were a notable exception....

Read More »FX Weekly Preview: Thumbnail Sketch Four Central Bank Meetings and US Jobs Data

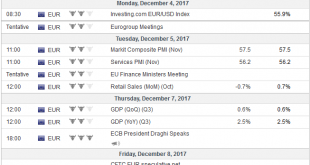

The German Social Democrats have endorsed the Grand Coalition, ending the period of political uncertainty and paralysis in Germany since the last September’s election. The polls have suggested nearly 60% of the SPD would support joining the government and the actual outcome looks to be closer to 66%. In 2013, when the SPD had a similar vote, three-quarters favored a Grand Coalition. Among the differences is that the SPD...

Read More »FX Weekly Preview: Politics may Continue to Overshadow Economics

The new monthly cycle of high frequency economic data has begun. The manufacturing PMI shows the synchronized global recovery is continuing. The service sector and composite PMI will be reported in the week ahead. They are unlikely altering the general expectation for robust growth in Q4. Even the disappointing US auto sales (17.35 mln seasonally-adjusted annual pace vs. expectations for 17.5 mln and 18.0 mln in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org