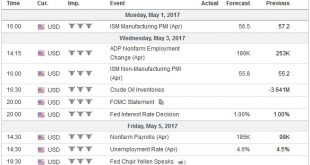

Summary: US jobs and auto sales data may be more important than the FOMC meeting. Norway and Australia’s central bank meets. Neither is expected to change policy. All three large countries that reported Q1 GDP figures last week – US, UK, France – disappointed expectations. A Federal Reserve meeting always draws market interest, as investors are on guard for policy signals. However, the statement from this...

Read More »FX Weekly Preview: Four Sets of Questions and Tentative Answers for the Week Ahead

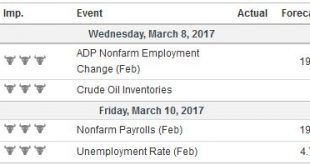

The week ahead features the ECB meeting and the US February jobs report. The Reserve Bank of Australia meets, Europe reports industrial production, Japan reports January current account figures, and China reports its latest inflation and lending figures. We frame this week’s discussion of the drivers in terms of four sets of questions and offer some tentative answers. United States What is the significance of the...

Read More »FX Weekly Preview: Six Thumbnail Sketches of This Week’s Dollar Drivers

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Four central banks meet, but expectations for fresh action are low. The US latest election news does not appear to be altering the projected electoral college outcome. UK press are speculating about Carney possibly resigning. We are skeptical. The...

Read More »FX Weekly Preview: Six Thumbnail Sketches of This Week’s Dollar Drivers

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Four central banks meet, but expectations for fresh action are low. The US latest election news does not appear to be altering the projected electoral college outcome. UK press are speculating about Carney possibly resigning. We are skeptical. The...

Read More »Dollar Continues to Push Lower

The US dollar’s downtrend is extending. The euro traded above $1.16 for the first time since last August. With Japanese markets closed for the second half of the Golden Week holidays, perhaps participants felt less hampered by the risk of intervention and pushed the dollar to almost JPY105.50. Despite an unexpectedly large fall in the UK’s manufacturing PMI (49.2 from 50.7), sterling has pushed to its highest level in four months (~$1.4770). The Australian dollar is the main exception. ...

Read More »Another Strong Jobs Report may Not be Sufficient to Reignite Dollar Rally

The die is cast. The Federal Reserve is on an extended pause after the rate hike last December. The market remains convinced that the risk of a June hike are negligible (~ less than 12% chance). The ECB has yet to implement the TLTRO and corporate bond purchase initiatives that were announced in March. The impact of its programs have to be monitored before being evaluated. It is unreasonable to expect any new initiative in the coming months. The Bank of Japan did not take...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org