Don’t let “traditional biases” stop you from diversifying into gold – Dalio on Linkedin “Risks are now rising and do not appear appropriately priced in” warns founder of world’s largest hedge fund Geo-political risk from North Korea & “risk of hellacious war” Risk that U.S. debt ceiling not raised; technical US default Safe haven gold likely to benefit by more than dollar, treasuries Investors should allocate at...

Read More »Bitcoin Has No Yield, but Gold Does – Precious Metals Supply and Demand Report

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Bitcoin and Credit Transactions Last week, we said: It is commonly accepted to say the dollar is “printed”, but we can see from this line of thinking it is really borrowed. There is a real borrower on the other side of the transaction, and that borrower has powerful motivations to keep paying to service the debt. Bitcoin...

Read More »Bitcoin Forked – Precious Metals Supply and Demand Report

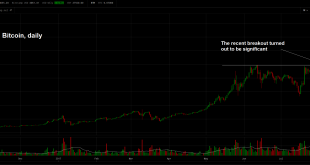

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. A Fork in the Cryptographic Road So bitcoin forked. You did not know this. Well, if you’re saving in gold perhaps not. If you’re betting in the crypto-coin casino, you knew it, bet on it, and now we assume are happily diving into your greater quantity of dollars after the fork. You don’t have a greater quantity of...

Read More »Bitcoin, Gold and Silver

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Precious Metals Supply and Demand Report That’s it. It’s the final straw. One of the alternative investing newsletters had a headline that screamed, “Bitcoin Is About to Soar, But You Must Act by August 1 to Get In”. It was missing only the call to action “call 1-800-BIT-COIN now! That number again is 800...

Read More »Against Irredeemable Paper – Precious Metals Supply and Demand

The Antidote Something needs to be said. We are against the existence of irredeemable paper currency, central banking and central planning, cronyism, socialized losses and privatized gains, counterfeit credit, wealth transfers and bailouts, and welfare both corporate and personal. When we write to debunk the conspiracy theories that say manipulation is keeping gold from hitting $5,000 (one speaker here at Freedom Fest...

Read More »Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

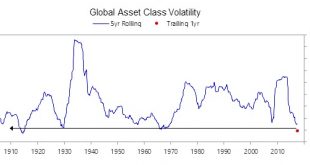

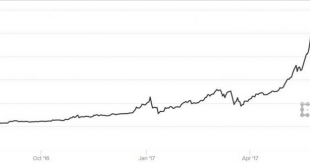

– Bitcoin volatility shows not currency or safe haven but speculation – Volatility still very high in bitcoin and crypto currencies (see charts) – Bitcoin fell 25% over weekend; Recent high of $3,000 fell to below $1,900 – Bitcoin least volatile of cryptos, around 75% annualised volatility – Gold much more stable at just 10% annualised volatility – Bitcoin volatility against USD about 5-7 times vol of traditional...

Read More »Stockholm Syndrome – Precious Metals Supply and Demand

Hostages of Irredeemable Scrip Stockholm Syndrome is defined as “…a condition that causes hostages to develop a psychological alliance with their captors as a survival strategy during captivity.” While observers would expect kidnapping victims to fear and loathe the gang who imprison and threaten them, the reality is that some don’t. There is a loose analogy between being held hostage and being an investor in a regime...

Read More »The Anatomy of Brown’s Gold Bottom – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Socialist Politician-Bureaucrat with the Worst Timing Ever As most in the gold community know, the UK Chancellor of the Exchequer Gordon Brown announced on 7 May, 1999 that HM Treasury planned to sell gold. The dollar began to rise, from about 110mg gold to 120mg on 6 July, the day of the first sale. This translates...

Read More »In Gold We Trust, 2017

The 11th Annual In Gold We Trust Report This year’s Incrementum In Gold We Trust report by our good friends Ronald Stoeferle and Mark Valek appears about one month earlier than usual (we already mentioned in our most recent gold update that it would become available soon). As always, the report is extremely comprehensive, discussing everything from fundamentals pertaining to gold, to technical analysis to statistical...

Read More »Stocks, Bonds, Euro, and Gold Go Up – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Driven by Credit The jobs report was disappointing. The prices of gold, and even more so silver, took off. In three hours, they gained $18 and 39 cents. Before we try to read into the connection, it is worth pausing to consider how another market responded. We don’t often discuss the stock market (and we have not been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org