The 11th Annual In Gold We Trust Report This year’s Incrementum In Gold We Trust report by our good friends Ronald Stoeferle and Mark Valek appears about one month earlier than usual (we already mentioned in our most recent gold update that it would become available soon). As always, the report is extremely comprehensive, discussing everything from fundamentals pertaining to gold, to technical analysis to statistical studies on the behavior of gold under different economic scenarios. August Gold, 2017(see more posts on Gold, ) - Click to enlarge In fact, there is no other gold study available that contains a comparable wealth of valuable statistical information in chart form. Anyone with the slightest interest

Topics:

Pater Tenebrarum considers the following as important: Featured, Gold and its price, newsletter, Precious Metals

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The 11th Annual In Gold We Trust ReportThis year’s Incrementum In Gold We Trust report by our good friends Ronald Stoeferle and Mark Valek appears about one month earlier than usual (we already mentioned in our most recent gold update that it would become available soon). As always, the report is extremely comprehensive, discussing everything from fundamentals pertaining to gold, to technical analysis to statistical studies on the behavior of gold under different economic scenarios. |

August Gold, 2017(see more posts on Gold, ) |

| In fact, there is no other gold study available that contains a comparable wealth of valuable statistical information in chart form. Anyone with the slightest interest in gold as an investment asset (and these days that should include everybody) will find interesting information in this report, which can serve as a highly useful “gold reference manual”.

The report also discusses a number of developments that may have a particularly noteworthy effect on gold prices in coming years. The future of the US dollar as the global reserve currency is one of the special topics tackled in great detail this year, as is the rise of populist politics, and potential “black swans” or “gray swans”, which continue to lurk in the global financial landscape, awaiting discovery by the unwary. |

Gold Production Versus Central Banks, 2003 - 2017 |

| An extra treat in this year’s report is an exclusive interview with Dr. Judy Shelton, one of president Trump’s economic advisors and a strong advocate of upgrading gold’s monetary role. It is clear that the unsustainable debt accumulation and the disastrous boom-bust cycles of recent decades have brought the world ever closer to an abyss. Eventually, something will have to be done to bring the monetary system back to a sustainable configuration – whether it happens voluntarily or not seems to be the main question. Dr. Shelton has a number of interesting ideas on how one might best go about this.

The dynamics of the debt money system, the phenomenon of capital consumption (which we believe is an “under-reported” major economic problem – although not on this web site, to be sure), the war on cash, and the rise of Bitcoin all have dedicated chapters in this year’s report. Recurring features such as gold’s portfolio characteristics, the history of gold’s purchasing power and a comprehensive technical, sentiment and market structure analysis section on mining shares as well as gold and silver round out the report. |

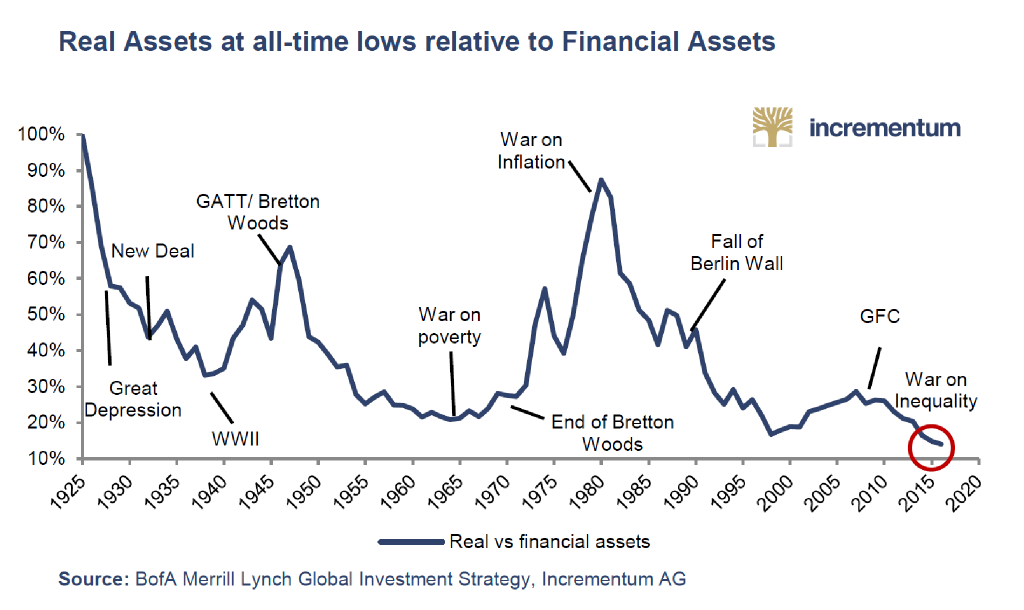

Real Assets Versus Financial Assets, 1925 - 2017 |

| Gold priced in an index of the most important non-dollar currencies vs. gold price in USD. In currencies other than the dollar, the secular bull market in gold has already resumed after a run-of-the-mill correction in 2012-2014. |

World Gold Price Versus Dollar Gold Price, 2011 - 2017 |

Tags: Featured,newsletter,Precious Metals