Swiss Franc The Euro has fallen by 0.18% to 1.0837 EUR/CHF and USD/CHF, July 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The biggest rally in US equities in four months has helped stabilize global shares today. In the Asia Pacific region, Japan, China, and Australian markets advanced. Led by information technology and consumer discretionary sectors, Europe’s Dow Jones Stoxx 600 is up around 1.35% near the...

Read More »FX Daily, July 15: Strong Gains in US CPI and PPI Don’t Stop the Bond Market Rally

Swiss Franc The Euro has risen by 0.08% to 1.0837 EUR/CHF and USD/CHF, July 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Strong inflation prints this week have not prevented the long-term US interest rates from tumbling. The 10-year yield is about 10 bp lower than where it closed on Tuesday after the lackluster 30-year auction. The 30-year yield itself is 11 bp lower. Fed Chair Powell did not break new...

Read More »FX Daily, May 27: Narrow Ranges in FX Prevail Amid Month-End Considerations

Swiss Franc The Euro has risen by 0.20% to 1.0967 EUR/CHF and USD/CHF, May 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Dollar demand linked to the month-end gave the greenback a bit of a reprieve, helped by firmer bond yields. Some momentum players may have been forced out of the euro and yen when the $1.22 and JPY109 levels yielded. However, follow-through dollar buying has been limited, and it has...

Read More »FX Daily, December 9: Hope Burns Eternal

Swiss Franc The Euro has fallen by 0.05% to 1.0753 EUR/CHF and USD/CHF, December 9(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The market is hopeful today. The Johnson-von der Leyen dinner is seen as evidence that both sides see one more opportunity, and sterling is among the strongest currencies today. Hopes of a $900 bln+ fiscal stimulus package in the US helped stir animal spirits and lift US stocks to...

Read More »FX Daily, July 13: Risk Appetites Firm, but the Greenback is Mixed

Swiss Franc The Euro has risen by 0.46% to 1.068 EUR/CHF and USD/CHF, July 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities began the week on a firm note in the Asia Pacific region. The Nikkei gained more than 2%, and the profit-taking seen in China ahead of the weekend was a one-day phenomenon. The Shanghai Composite rose 1.8%, and the Shenzhen Composite surged 3.5%. Taiwan and South Korea markets...

Read More »FX Daily, November 29: Equities Slip While Investors Mark Time

Swiss Franc The Euro has risen by 0.21% to 1.1011 EUR/CHF and USD/CHF, November 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global equities are trading heavily. Both the MSCI Asia Pacific and the Dow Jones Stoxx 600 snapped four-day advancing streaks yesterday and have seen some follow-through selling today. In the Asia Pacific region, all the markets fell but Jakarta. Hong Kong’s Hang Seng slipped a...

Read More »FX Daily, October 14: Optimism Took the Weekend Off

Swiss Franc The Euro has fallen by 0.16% to 1.0979 EUR/CHF and USD/CHF, October 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Japanese and Canadian markets are on holiday today. While the US bond market is closed, equities maintain their regular hours today. Asia Pacific equities rallied, led by 1% of more gains in China, Taiwan, South Korea, and Thailand. The buying did not continue in Europe, and after a...

Read More »EM Preview for the Week Ahead

EM benefited greatly from the improvement in US-China trade relations and quite possibly Brexit. The dollar is likely to remain under some pressure near-term as a result. Yet we must caution investors against getting too optimistic. The details of the partial trade deal still need to be worked out, while existing tariffs will still remain in place if the deal is signed next month as most expect. Brexit negotiations have accelerated but we note that any deal must...

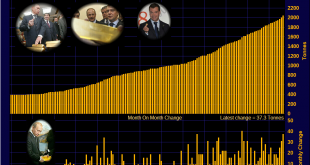

Read More »Does the recent spate of Central Bank gold buying impact demand and price?

There has been a lot of media coverage recently about the re-emergence of central bank gold buying and the overall larger quantity of gold than central banks as a group have been buying recently compared to previous years. For example, according to the World Gold Council’s Gold Demand Trends for Q3 2018, net purchases of gold by central banks in the third quarter of this year were 22% higher than Q3 2017, and the...

Read More »In surprise move, Central Bank of Hungary announces 10-fold jump in its gold reserves

In one of the most profound developments in the central bank gold market for a long time, the Hungarian National Bank, Hungary’s central bank, has just announced a 10 fold jump in its monetary gold holdings. The central bank, known as Magyar Nemzeti Bank (MNB) in Hungarian, made the announcement in Budapest, Hungary’s capital. The details of Hungary’s dramatic new gold purchase are as follows: Before this month,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org