Swiss Franc The Euro has risen by 0.10% to 1.165 CHF. EUR/CHF and USD/CHF, December 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Trends The two main legislative initiatives in the US this year, the repeal of the Affordable Care Act and the tax changes, are not particularly popular. However, the next items on the agenda appear to enjoy broader support. The infrastructure...

Read More »Emerging Market Preview: Week Ahead

Stock Markets EM FX was mixed last week, with political optimism driving the big winners ZAR and CLP. We remain cautious, as the Fed has signaled its intent to continue tightening in 2018. Stock Markets Emerging Markets, December 18 Source: economist.com - Click to enlarge Brazil Brazil reports October monthly GDP proxy Monday, which is expected to rise 2.8% y/y vs. 1.3% in September. Brazil then reports...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »Jim Grant: “Markets Trust Too Much In The Presence Of Central Banks”

James Grant, Wall Street expert and editor of the renowned investment newsletter «Grant’s Interest Rate Observer», warns of the unseen consequences of super low interest rate and questions the extraordinary actions of the Swiss National Bank. Nearly ten years after the financial crisis, extraordinary monetary policy has become the norm. The financial markets seem to like it: Stocks are close to record levels...

Read More »A crucial step towards US tax cuts

With the approval of the Senate tax bill in the early hours of Saturday 2 December, a key step has been taken toward tax cuts. The next chapter in the process is to reconcile this version with the House of Representatives’ tax bill, most likely in a ‘conference committee ’ from which a final version will emerge. Various lobbies have been taken by surprise by the speed with which tax legislation has moved forward in...

Read More »FX Daily, December 15: Premium for Dollar-Funding is not Helping Greenback Very Much

Swiss Franc The Euro has risen by 0.28% to 1.168 CHF. EUR/CHF and USD/CHF, December 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The cross-currency basis swap continues to lurch in the dollar’s direction, especially against the euro, and yet the dollar is not drawing much support from it. The increasing cost reflects pressure for the year-end and does not appear to...

Read More »Swiss food imports are growing faster than the population

Imported mineral water has been increasingly popular in Switzerland over the last 25 years. (Keystone) - Click to enlarge A government study shows that imports of food products have grown by 80% — three times faster than the Swiss population — between 1990 and 2016. In that time, the quantity of imported food consumed per inhabitant went from 344 kilograms to 490 kg. The figures, published Tuesday by the...

Read More »Year-end Rate Hike Once Again Proves To Be Launchpad For Gold Price

Year-end rate hike once again proves to be launchpad for gold price – FOMC follows through on much anticipated rate-hike of 0.25%– Spot gold responds by heading for biggest gain in three weeks, rising by over 1%– Final meeting for Federal Reserve Chair Janet Yellen– Yellen does not expect Trump’s tax-cut package to result in significant, strong growth for US economy– No concern for bitcoin which ‘plays a very small...

Read More »Defining The Economy Through Payrolls

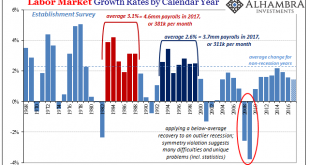

The year 2000 was a transition year in a lot of ways. Though Y2K amounted to mild mass hysteria, people did have to get used to writing the date with 20 in front of the year rather than 19. It was a new millennium (depending on your view of Year 0) that seemed to have started off under the best possible terms. Not only were stocks on fire at the outset, the economy was, too. The idea of this “new economy” leading...

Read More »Euro Area Forecast to Grow 2.3percent in 2018

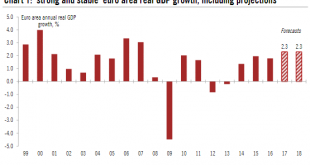

We have upgraded our growth projection for this year and next. There are upside risks to our forecast that the ECB will start hiking rates in Q3 2019. Taking account of stronger growth momentum, the carryover effect and upward revisions to past data, we have upgraded our euro area annual GDP growth forecasts to 2.3% both in 2017 and 2018. Our forecasts remain consistent with a very gradual slowdown in the quarterly...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org