Swiss Franc The Euro has fallen by 0.07% to 1.1661 CHF. EUR/CHF and USD/CHF, November 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro and yen are extending their gains, casting a pall over the US dollar. The euro is extending its advance into a sixth consecutive session, which is the longest streak since May. It is approaching last month’s highs in the...

Read More »Credit Suisse Fined $135 million for Malpractices

The bank has had various disputes with US authorities in recent years. (Keystone) Credit Suisse bank has been ordered to pay a fine of $135 million (CHF134.5 million) to the US authorities after an enquiry into the Swiss bank’s practices in setting foreign exchange rates. The figure was reached in a consultation between both parties. The bank confirmed the fine, as well as its willingness to pay it, in a...

Read More »Swiss justice minister calls for commodities crackdown

Switzerland's justice minister Simonetta Sommaruga is part of the country's executive body (Keystone) - Click to enlarge Following revelations in the so-called “Paradise Papers” of questionable deals done by Swiss-based commodities companies in Africa, Switzerland’s justice minister has said that the country – historically hands-off in regulating the sector – needs new legislation to force those companies to...

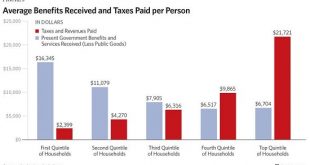

Read More »The Fetid Swamp of Tax Reform

The likelihood that either party will ever drain the fetid swamp of corruption that is our tax code is zero, because it’s far too profitable for politicos to operate their auction for tax favors. To understand the U.S. tax code and the endless charade of tax reform, we have to start with four distasteful realities: 1. Ours is not a representational democracy, it’s a political auction in which wealth casts the votes that...

Read More »Weekly Technical Analysis: 13/11/2017 – USDJPY, EURUSD, GBPUSD, EURGBP

USD/CHF USD/CHF, November 15(see more posts on EUR/CHF, ) Source: economies.com - Click to enlarge USD/JPY [embedded content] USD/JPY with Technical Indicators, November 15(see more posts on USD/JPY, ) - Click to enlarge EUR/USD [embedded content] EUR/USD with Technical Indicators, November 15(see more posts on EUR/USD, ) - Click to enlarge GBP/USD [embedded content] GBP/USD with Technical Indicators,...

Read More »Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. A Different Vantage Point The prices of the metals were up slightly this week. But in between, there was some exciting price action. Monday morning (as reckoned in Arizona), the prices of the metals spiked up, taking silver from under $16.90 to over $17.25. Then, in a series of waves, the price came back down to within...

Read More »FX Daily, November 14: Euro Rides High After German GDP

Swiss Franc The Euro has risen by 0.22% to 1.1646 CHF. EUR/CHF and USD/CHF, November 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sterling is trading in the lower end of yesterday’s range and has been confined to about a quarter a cent on either side of $1.31. On the other hand, the euro has pushed a bit through GBP0.8950 to reach its best level since October 26....

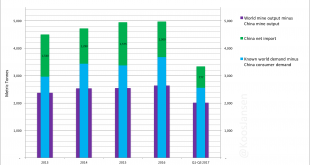

Read More »China Gold Import Jan-Sep 777t. Who’s Supplying?

While the gold price is slowly crawling upward in the shadow of the current cryptocurrency boom, China continues to import huge tonnages of yellow metal. As usual, Chinese investors bought on the price dips in the past quarters, steadfastly accumulating for a rainy day. The Chinese appear to be price sensitive regarding gold, as was mentioned in the most recent World Gold Council Demand Trends report, and can also be...

Read More »Where are Europe’s Fault Lines?

Beneath the surface of modern maps, numerous old fault lines still exist. A political earthquake or two might reveal the fractures for all to see. Correspondent Mark G. and I have long discussed the potential relevancy of old boundaries, alliances and structures in Europe’s future alignments.Examples include the Holy Roman Empire and the Hanseatic League, among others. In the long view, Europe has cycled between periods...

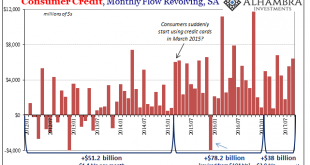

Read More »Consumer Credit Both Accelerating and Decelerating Toward The Same Thing

Federal Reserve revisions to the Consumer Credit series have created some discontinuities in the data. Changes were applied cumulatively to December 2015 alone, rather than revising downward the whole data series prior to that month. The Fed therefore estimates $3.531 trillion in outstanding consumer credit (seasonally-adjusted) in November 2015, and then just $3.417 trillion the following month. Of that $114.3 billion...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org