The likelihood that either party will ever drain the fetid swamp of corruption that is our tax code is zero, because it’s far too profitable for politicos to operate their auction for tax favors.

To understand the U.S. tax code and the endless charade of tax reform, we have to start with four distasteful realities:

1. Ours is not a representational democracy, it’s a political auction in which wealth casts the votes that count. Those seeking political influence over issues such as taxation place their bids in the political auction via campaign contributions and lobbying. The winner of the political auction gets favorable treatment, and everyone else ends up subsidizing the gains of the winner.

2. The wealthy pay the vast majority of federal income taxes (as oposed to payroll taxes, i.e. Social Security and Medicare), so tax cuts end up benefiting the wealthy.

In 2014, people with adjusted gross income, or AGI, above $250,000 paid just over half (51.6%) of all individual income taxes, though they accounted for only 2.7% of all returns filed.

By contrast, people with incomes of less than $50,000 accounted for 62.3% of all individual returns filed, but they paid just 5.7% of total taxes.

After all federal taxes are factored in, the U.S. tax system as a whole is progressive. The top 0.1% of families pay the equivalent of 39.2% and the bottom 20% have negative tax rates (that is, they get more money back from the government in the form of refundable tax credits than they pay in taxes).

3. The unseen burden of the tax code is the complexity tax levied on small business, the self-employed and domestic corporations with no access to global tax-avoidance schemes.

4. This complexity is necessary to hide all the special favors won in the political auction. The tax code could be a few pages long: all accounting of income and expenses must conform to accepted accounting rules, and here are the tax rates on net income/earnings.

Any special tax breaks or subsidies would stick out like sore thumbs in a simple tax code, so it’s necessary to generate thousands of pages of tax code to create a thicket in which auctioned-off favors can be hidden from public view.

The Tax Foundation explains the three layers of compliance complexity: Title 26 of the U.S. Code, the tax statutes enacted by Congress, run to 2,600 pages. The details are left to the IRS (Internal Revenue Service), which publishes roughly 9,000 pages of regulations.

But wait, there’s more—much more. If you end up in tax court, there’s around 70,000 pages of case law to pore over to make your case.

Playing around with tax brackets skirts the core problem with the U.S. tax system: the entire tax code is little more than a clearing house of political bribes paid for tax breaks and a complexity thicket that requires the services of legions of accountants, tax attorneys, software coders, and specialists in tax avoidance strategies.

This clearing house and complexity thicket are intrinsically unfair, as insiders and the super-wealthy can avoid taxes via political influence and offshore tax havens. This systemic unfairness erodes the social contract’s key compact: that the playing field will be kept more or less level for all participants.

But the U.S. tax system is anything but level. The Institute on Taxation and Economic Policy (ITEP) recently published an analysis of the corporate taxes paid by Fortune 500 companies over the past eight years. Consistently profitable companies paid a federal tax rate of around 21%, considerably lower than the nominal corporate tax rate of 35%. But 18 profitable companies paid no federal taxes over the eight years, and about 50 corporations paid rates of 10% or less.

Immensely profitable corporations such as Apple have mastered the offshore tax avoidance game. Others persuade members of Congress (impolite term: bribe) to include obscure tax breaks tailored to their company in legislation.

So the most successful at gaming the system pay near-zero (saving tens of billions of dollars) while the chumps pay the top rate.

There’s another systemic source of unfairness in the tax code: the gap between the high rates on earned income (wages and salaries) and the much lower rates on unearned income– what we might characterize as income generated by capital rather than labor: rents, capital gains, speculative gains and so on.

If you manage to earn $500,000 in wages, most of that income is taxed at 33%, and the income above $415,000 is taxed at 39.6%. Meanwhile, the top rate for long-term capital gains is 20%. Over time, that 15% adds up.

In effect, the rich get richer because most of the lower-tax-rate unearned income flows to them.

If we really want to reform federal taxation, we’d do three things:

1. Radically simplify the tax code from thousands of pages to dozens of pages

2. Lower the corporate tax but eliminate all the overseas schemes and scams

3. Increase the tax rate on unearned income above (say) $100,000 annually.

|

Needless to say, the number of taxpayers with more than $100,000 in unearned income annually is tiny, so the vast majority of taxpayers with capital gains earned from selling a second home, exercising stock options, speculative trading, etc. would still pay the existing low rate.

But those reporting substantial unearned income would pay the same tax rates imposed on labor: up to 39.6% above $415,000 annually.

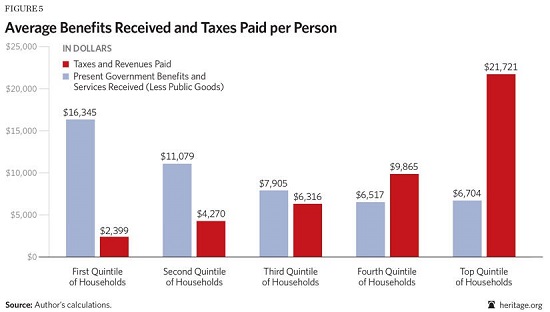

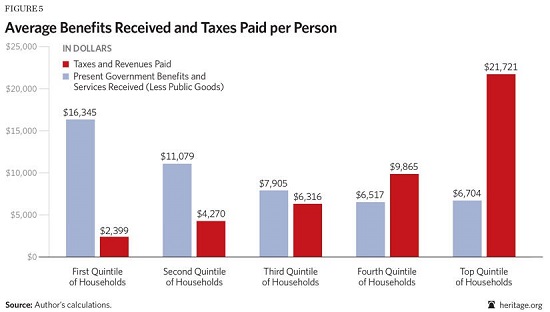

These charts help us understand that despite its crushing flaws, federal taxation is highly progressive. The bottom 75% pay little to no federal income tax and receive more federal benefits, while the wealthy pay the vast majority of federal income taxes:

|

Average Benefits Received and Taxes Paid per Person - Click to enlarge |

| These two charts break out who pays most of the taxes: |

Who pays income taxes? The rich, mostly - Click to enlarge |

|

Federal Income Tax  - Click to enlarge |

The likelihood that either party will ever drain the fetid swamp of corruption that is our tax code is zero, because it’s far too profitable for politicos to operate their auction for tax favors.

Tags:

Featured,

newsletter,

tax reform