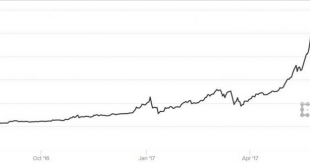

– Bitcoin volatility shows not currency or safe haven but speculation – Volatility still very high in bitcoin and crypto currencies (see charts) – Bitcoin fell 25% over weekend; Recent high of $3,000 fell to below $1,900 – Bitcoin least volatile of cryptos, around 75% annualised volatility – Gold much more stable at just 10% annualised volatility – Bitcoin volatility against USD about 5-7 times vol of traditional...

Read More »Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term - Bitcoin volatility shows not currency or safe haven but speculation- Volatility still very high in bitcoin and crypto currencies (see charts)- Bitcoin fell 25% over weekend; Recent high of $3,000 fell to below $1,900- Bitcoin least volatile of cryptos, around 75% annualised volatility- Gold much more stable at just 10% annualised volatility- Bitcoin volatility against USD about 5-7 times vol of traditional...

Read More »Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

The following article by David Haggith was first published on The Great Recession Blog: We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%. Tech stocks nosedived while others rose to create new highs. Is this a one-off, or has a...

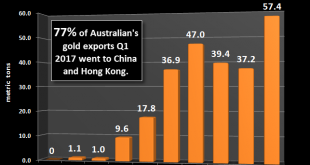

Read More »“Mystery” Central Bank Buyer Revealed, Goes On Q1 Buying Spree

In the first few months of the year, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a “mystery” central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: while the Japanese Central Bank’s interventions in the stock market are familiar to all by now, and as we reported last night on sessions when the “the...

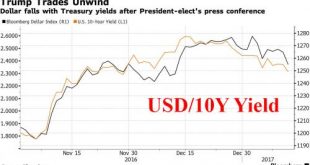

Read More »Dollar, Futures Slump; Gold Spikes Over $1,200 After Trump Disappoints Markets

Risk assets declined across the globe, with European, Asian shares and S&P 500 futures all falling, while the dollar slumped against most currencies after a news conference by President-elect Donald Trump disappointed investors with limited details of his economic-stimulus plans, and the Trumpflation/reflation trade was said to be unwinding. "The risk was always that a president like Trump would end up upsetting that consensus (of faster U.S. growth, stronger dollar) view by introducing...

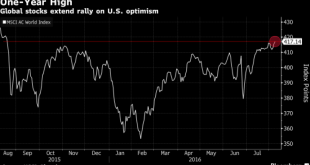

Read More »S&P To Open At New Record High As Commodities Rise, China Trade Disappoints

The meltup continues with the S&P500 set to open at new all time highs as futures rise 0.2% overnight, with European, Asian stocks higher, as job data pushed MSCI Asia Pacific Index towards highest close since Aug. 2015. Germany, U.K. economic data seen positive, with dollar, oil rising, and gold declining. Global equities advanced with commodities and emerging markets on speculation the U.S. economy is strong enough to sustain growth while only triggering a gradual increase in interest...

Read More »Chart up-date: Stocks, Bonds, Copper, Bonds

Well that escalated quickly…All-time highs within reach… everything is awesome…wait what… Quite a week: Gold +5.25% in last 2 weeks – best run in 4 months Silver +5.65% this week – best week since May 2015 Copper -4% this week to lowest weekly close since January Sterling -2.5% in last 2 weeks – worst drop in 3 months US Dollar Index +0.6% – up 7 of last 9 weeks 30Y Yields -21bps in last 8 days – best rally in 4...

Read More »Chart up-date: Stocks, Bonds, Copper, Gold

Well that escalated quickly…All-time highs within reach… everything is awesome…wait what… Quite a week: Gold +5.25% in last 2 weeks – best run in 4 months Silver +5.65% this week – best week since May 2015 Copper -4% this week to lowest weekly close since January Sterling -2.5% in last 2 weeks – worst drop in 3 months US Dollar Index +0.6% – up 7 of last 9 weeks 30Y Yields -21bps in last 8 days – best rally in 4...

Read More »Global Stocks Jump; Oil Rises As Yen Plunges After Another Japanese FX Intervention Threat

In what has been an approximate repeat of the Monday overnight session, global stocks and US futures rose around the world as oil prices climbed toward $44 a barrel, with risk-sentiment pushed higher by another plunge in the Yen which has now soared 300 pips since the Friday post-payroll kneejerk reaction, and was trading above 109.20 this morning. At the same time base metals regained some of Monday’s steep losses following Chinese CPI data that came in line while PPI declined for 50...

Read More »Inside The Most Important Building For U.S. Capital Markets, Where Trillions Trade Each Day

Ask people which is the most important structure that keeps the US capital markets humming day after day, and most will likely erroneously say the New York Stock Exchange, which however over the past decade has transformed from its historic role into nothing more than a TV studio for financial cable networks. Some might be closer to the truth and say that the most important building is the true New York Stock Exchange located in Mahwah, New Jersey however that also is not true as the NYSE...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org