Summary: The dollar’s downside momentum faded today, but it has not shown that it has legs. Watch 96.45 in the DXY and $1.3055 in sterling. The US 2-year note yield is low, given expectations for overnight money. The US premium needs to widen. The US dollar’s downside momentum faded today. While one should not read much into it, it could be an early sign that the market has discounted the recent news stream,...

Read More »FX Daily, May 23: Greenback Remains Soft

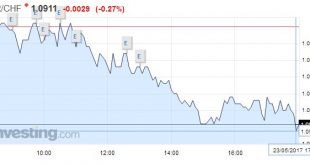

Swiss Franc EUR/CHF - Euro Swiss Franc, May 23(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar cannot get out of its own way, it seems. With a light economic schedule, there is little to offset the continued drumbeat of troubling political developments. The latest turn, as reported first in the Washington Post, that President Trump asked heads of intelligence groups to also publicly deny...

Read More »FX Daily, May 22: Dollar Pushes Back

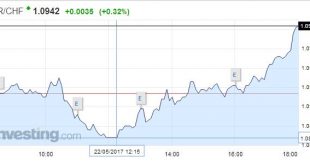

Swiss Franc EUR/CHF - Euro Swiss Franc, May 22(see more posts on EUR/CHF, ) - Click to enlarge FX Rates After being shellacked last week, the US dollar is trading with a firmer bias against all the major currencies, but the euro and New Zealand dollar. To be sure, it is not that a new development has emerged to take investors’ minds from intensifying political uncertainty in the US. Rather it seems to be simply...

Read More »FX Weekly Preview: Nothing Like A Good US Drama

Summary: US drama distracts from the difficult and ambitious economic program. European and Japanese developments have been constructive. Bank of Canada is the only G7 central bank that meets, and it is not expected to shift from its cautious stance. The no-drama Obama has given way to “The Donald” who appears to be providing more melodrama than an Emmy-winning soap opera. To be sure it is not just him. Hope...

Read More »FX Daily, May 18: Some Respite from US Politics as Sterling Surges Through $1.30

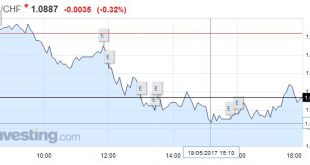

Swiss Franc EUR/CHF - Euro Swiss Franc, May 18(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Yesterday’s dramatic response to the political maelstrom in Washington is over. The appointment of a special counsel to head up the FBI’s investigation into Russia’s attempt to influence the US election appears to have acted a circuit breaker of sorts. It is not sufficient to boost confidence that the Trump...

Read More »FX Daily, May 17: Drama In Washington Adds To Dollar Woes

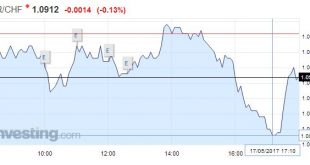

Swiss Franc EUR/CHF - Euro Swiss Franc, May 17(see more posts on EUR/CHF, ). GBP/CHF Inflation data weakens Sterling. Yesterday saw the release of Consumer Price Index (CPI) data. CPI is a measure of inflation and yesterday we saw a rise from 2.3% to 2.7% month on month. Usually a rise in inflation is deemed as good for an economy, but on this occasion it is a worrying sign. The rapid rise is a direct result of the...

Read More »FX Daily, May 16: Greenback and Dollar Bloc Lose Ground to Europe and Yen

Swiss Franc EUR/CHF - Euro Swiss Franc, May 16(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Dollar selling pressure emerged at the end of last week, partly in response to disappointing US economic data. This selling pressure carried over into yesterday’s activity. It appeared to have been trying to stabilize yesterday in the North American session. News that President Trump may have shared...

Read More »FX Daily, May 15: Softer Dollar and Yen to Start the Week

Swiss Franc . FX Rates The US dollar has opened the week softer against the major currencies, except for the Japanese yen. The disappointing US inflation and retail sales data before the weekend have not been shrugged off, even though the US 10-year yield is a little higher and expectations for a Fed hike next month continue to be elevated. There is more focus on positive developments elsewhere, especially in...

Read More »Yen is the Weakest Currency in the World over the Past Month

Summary: Yen was the strongest currency in the world from mid-March to mid-April. Yen has been the weakest currency over the past month. US rates have risen relative to Japan. Japan has shifted away from QE and toward targeting interest rate. USD/JPY From March 10 through April 11, the Japanese yen was the strongest currency in the world. It appreciated 4.7% against the dollar. Among the majors, sterling...

Read More »FX Weekly Preview: Two Known Unknowns

Summary: The Trump Administration seems to be trying to cast the US as a revisionist power. Or perhaps it is like Roman emperors long ago trying to draw greater tribute from others. The outlook of US interest rates is critical to the outlook of the dollar. The main risk to investors in the week ahead comes from two unknowns. On the international stage, the biggest change in the last six months is not China or...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org