Submitted by Thorstein Polleit via The Mises Institute, The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar. The...

Read More »Japan: an export-led recovery is underway

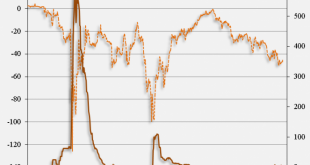

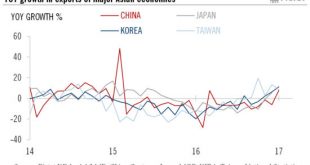

Fourth straight quarter of growth poses upside risk to our Japanese GDP forecast.The first preliminary reading of Japan’s real GDP growth for Q4 2016 came in at 1% q-o-q annualised, roughly in line with the consensus forecast of 1.1% but below the 1.3% growth in Q3. The growth in Q4 almost all came from external demand (+1.0%), while the contribution from domestic demand was virtually 0%. Japanese exports have shown clear signs of improvement in recent months, consistent with the export...

Read More »FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new – or to some forgotten – skill: how to read trade flows. As Bloomberg’s Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world’s reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to...

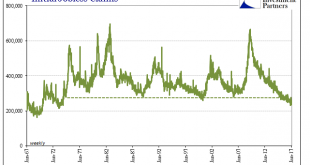

Read More »Jobless Claims Look Great, Until We Examine The Further Potential For What We Really, Really Don’t Want

Initial jobless claims fell to just 234k for the week of February 4, nearly matching the 233k multi-decade low in mid-November. That brought the 4-week moving average down to just 244k, which was a new low going all the way back to the early 1970’s. Jobless claims seemingly stand in sharp contrast to other labor market figures which have been suggesting an economic slowdown for nearly two years. Unemployment insurance...

Read More »Europe Proposes “Restrictions On Payments In Cash”

Having discontinued its production of EUR500 banknotes, it appears Europe is charging towards the utopian dream of a cashless society. Just days after Davos’ elites discussed why the world needs to “get rid of currency,” the European Commission has introduced a proposal enforcing “restrictions on payments in cash.” With Rogoff, Stiglitz, Summers et al. all calling for the end of cash – because only terrorists and...

Read More »Policy Makers – Like Generals – Are Busy Fighting The Last War

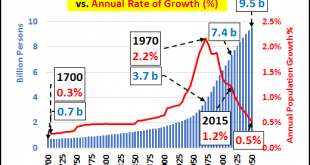

Submitted by Chris Hamilton via Econimica blog, The Maginot Line formed France’s main line of defense on its German facing border from Belgium in the North to Switzerland in the South. It was constructed during the 1930s, with the trench-based warfare of World War One still firmly in the minds of the French generals. The Maginot Line was an absolute success…as the Germans never seriously attempted to attack it’s...

Read More »What Vice Costs – The World’s Cheapest (& Most Expensive) Countries For Drugs, Booze, & Cigarettes

Indulging in a weekly habit of drugs, booze and cigarettes can cost you as little as $41.40 in Laos and a whopping $1,441.50 in Japan, according to the Bloomberg Vice Index. Bloomberg compared the price of a basket of goods — tobacco, alcohol, amphetamine, cannabis, cocaine and opioids — in more than 100 countries relative to the U.S., where your fix of the vices adds up to almost $400, or about a third of the weekly...

Read More »Trump Is Set To Label China A “Currency Manipulator”: What Happens Then?

While China has been banging the nationalist drums in its government-owned tabloids, warning daily of the adverse consequences to the US from either a trade war, or from Trump’s violating the “One China” policy, a more tangible concern for deteriorating relations between China and the US is that Trump could, and most likely will, brand China a currency manipulator shortly after taking over the the Oval Office. Even Bank...

Read More »Nomi Prins’ Political-Financial Road Map For 2017

As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet. My prognosis is...

Read More »A Biased 2017 Forecast, Part 1

“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.” – Daniel Kahneman, Thinking, Fast and Slow A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org