Impact investing is a growing industry that has gained in popularity and importance in the last few years. This is not surprising, says Harvard Professor Michael Chu: It is driven by the concept that a social or ecological problem may be addressed via a commercial platform, which many people find attractive. Due to the high demand, some of the main focus...

Read More »Supertrends: Climate Protection – a Key Value for Millennials

The Millennials are one of the largest generations in history and soon reaching maturity as investors. Their values – particularly caring about the environment and climate change – are most likely to become ever more influential topics and fuel growth in areas such as sustainable investment and clean energy. ...

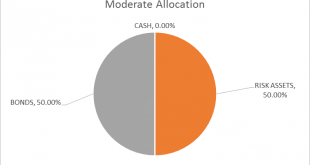

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are, however, changes within the asset classes. We are reducing the equity allocation and raising the allocation to REITs. Based on the bond markets there has been little change in the growth and inflation outlook since the last asset allocation update. Based on...

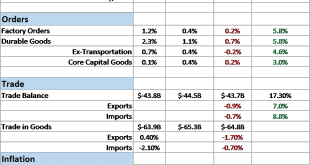

Read More »Bi-Weekly Economic Review

The economic data releases since the last update were generally upbeat but markets are forward looking and the future apparently isn’t to their liking. Of course, it is hard to tell sometimes whether bonds, the dollar and stocks are responding to the real economy or the one people hope Donald Trump can deliver when he isn’t busy contradicting his communications staff. Politics has been front and center recently but...

Read More »Supertrends Shape the Future of Investing

Five long-term themes expected to provide attractive investment opportunities in the years ahead. When Alfred Escher, the founding father of Credit Suisse, started his business, he spotted upcoming big trends – railways and industrialization – and did his best to enable investors to reap returns....

Read More »Where Europe Meets Asia

For two decades now, the Asian Investment Conference (AIC), the region's largest and most exclusive investment conference, has delivered unrivalled access to expert speakers from around the world and provided thought-provoking insights. And this year was no different. Over 3,000 attendees joined an impressive line-up of political leaders, entrepreneurs,...

Read More »Credit Suisse Yearbook 2017: Low Interest Rates Hit Returns on Equities

The risk premiums on equities are unlikely to be as high in the future as they have been. This is the conclusion reached by the 2017 Yearbook published by Credit Suisse. In order to make statements regarding future market developments, it is worth taking a look at the past. Therefore, in the latest...

Read More »Bi-Weekly Economic Review

The Fed did, as expected, hike rates at their last meeting. And interestingly, interest rates have done nothing but fall since that day. As I predicted in the last BWER, Greenspan’s conundrum is making a comeback. The Fed can do whatever it wants with Fed funds – heck, barely anyone is using it anyway – but they can’t control what the market does with long term rates. At least not without making a commitment like the...

Read More »Conservation Finance – Where Wall Street Meets Nature

The more boring sustainable investment products in nature are, the better. That is one of the findings of the 4th Annual Conservation Finance Conference that was recently held at Credit Suisse in New York. Investing in such products can provide a good, stable, current yield. "The return on...

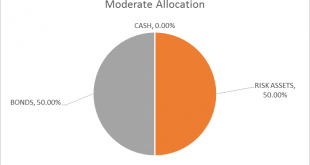

Read More »Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle. Post meeting, a lot of the rise came out of the market. Nominal and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org