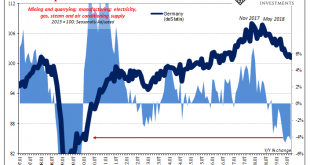

Germany’s vast industrial sector continued in the tank in September. According to new estimates from deStatis, that country’s government agency responsible for maintaining economic data, Industrial Production dropped by another 4% year-over-year during the month of September 2019. It was the fifth consecutive monthly decline at around that alarming rate. Four percent doesn’t sound like much, but in the context of German IP it is well within recession territory....

Read More »FX Daily, November 8: Risk Appetites Satiated Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.06% to 1.0987 EUR/CHF and USD/CHF, November 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are consolidating the recent moves ahead of the weekend. Equities are paring this week’s gains, though the Nikkei, which was closed on Monday, extended its advance for the fourth consecutive session. Despite the profit-taking today, the MSCI Asia Pacific Index...

Read More »FX Daily, November 7: Trade Optimism Boosts Sentiment but Weighs on the Dollar

Swiss Franc The Euro has risen by 0.08% to 1.0992 EUR/CHF and USD/CHF, November 7(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Indications that a phase one agreement between the US and China would include rolling back some existing tariffs is boosting risking appetites, sending stocks higher, and pushing up yields. However, this appears to be simply a restating of China’s views rather than a new breakthrough....

Read More »FX Daily, October 28: Politics Dominates Start of the Week before Yielding to Policy and Economics

Swiss Franc The Euro has risen by 0.24% to 1.104 EUR/CHF and USD/CHF, October 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The pre-weekend rally in US shares, with the S&P 500 flirting with record highs and the back-up in US yields, set the tone for Asia Pacific trading earlier today. Nearly all the equity markets advanced, and bond yields rose. Europe’s Dow Jones Stoxx 600 took a five-day advancing...

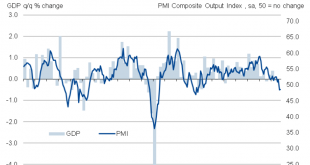

Read More »Somehow Still Decent European Descent

How times have changed. In the middle of 2018, we were told the risks to the global economy were all tilted to the upside. If central bankers weren’t careful, they chanced an uncontrollable inflationary breakout, the kind that would make the last few years of the 2010’s look too much like the 1970’s. Always eager to bottle up the inflation genie, Germany out of everyone actually welcomed negative factors as they built up during the year. From last August: In spite of...

Read More »The Scientism of Trade Wars

One year ago, last October, the IMF published the update to its World Economic Outlook (WEO) for 2018. Like many, the organization began to talk more about trade wars and protectionism. It had become a topic of conversation more than concern. Couched as only downside risks, the IMF still didn’t think the fuss would amount to all that much. Especially not with world’s economy roaring under globally synchronized growth. Even though there were warning signs already by...

Read More »FX Daily, October 8: Not a Good Day for Negotiators

Swiss Franc The Euro has fallen by 0.27% to 1.0881 EUR/CHF and USD/CHF, October 8(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The re-opening of Chinese markets after a long holiday did not produce the volatility that many expected. Chinese stocks alongside most Asia markets traded higher today, and the yuan advanced. After opening higher and extending its recent rally, Europe’s Dow Jones Stoxx 600 turned...

Read More »The Consequences Of ‘Transitory’

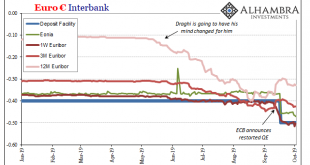

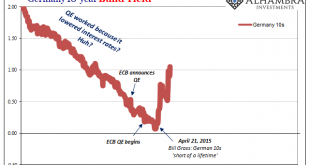

Europe’s QE, as noted this weekend, is off to a very rough start. In the bond market and in inflation expectations, the much-ballyhooed relaunch of “accommodation” is conspicuously absent. There was a minor back up in yields between when the ECB signaled its intentions back in August and the few weeks immediately following the actual announcement. Other than that, and that wasn’t much, you wouldn’t have known QE is already back on the table. It barely registered,...

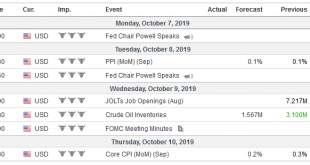

Read More »FX Weekly Preview: China Returns, ECB Record, Fed Minutes and the Week Ahead

Many high-income countries experienced little growth but strong price pressures in the 1970s. Since the mainstream economics said the two were mutually exclusive, a new term had to be created, hence stagflation. Fast forward almost half a century later, and mainstream economists are still having a problem deciphering the linkages between prices and economic activity, such as inflation and employment. Theory needs to accommodate the new facts. Theory is being...

Read More »Big Trouble In QE Paradise

Maybe it was a sign of things to come, a warning how it wasn’t going to go as planned. Then again, when it comes to something like quantitative easing there really is no plan. Other than to make it sound like there is one, that’s really the whole idea. Not what it really is and what it actually does, to make it appear like there’s substance to it. After experimenting with NIRP for the first time and then adding a bunch of sterilized asset purchases in 2014, Europe’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org