USD/CHF The USDCHF pair fluctuates around 0.9800 level, accompanied by stochastic reach to the overbought areas now, while the EMA50 keeps pushing negatively on the price and protects trading inside the bearish channel that appears on chart. Therefore, these factors encourage us to continue suggesting the bearish trend in the upcoming sessions, and breaking 0.9800 will confirm opening the way to head towards 0.9730...

Read More »FX Daily, November 27: Slow Start to Busy Week

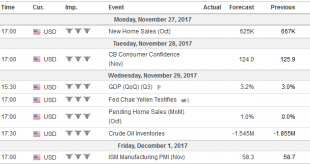

Swiss Franc The Euro has risen by 0.08% to 1.1702 CHF. EUR/CHF and USD/CHF, November 27(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is narrowly mixed and is largely consolidating last week’s losses as the market waits for this week’s numerous events that may impact the investment climate. These include the likelihood of the US Senate vote on tax reform,...

Read More »FX Weekly Preview: Events + Market = Potential for Combustible Price action

There are a number of events and economic reports in the week ahead that will help shape the investment climate in the weeks and months ahead. In recognition of the importance of initial conditions, let’s briefly summarize the performance of the dollar and main asset markets. After recovering from a five-month decline in September and October, the dollar has lost ground against all the major currencies here in November,...

Read More »Great Graphic: Is that a Potential Head and Shoulders Pattern in the Euro?

Summary The euro is breaking out to the upside. The measuring objective is near $1.2150, which is near the 50% retracement of the euro’s drop from the mid-2014 high. Key caveat: It is about the upper Bollinger Band and rate differentials make it the most expensive to hold since the late 1990s. The head and shoulders pattern in technical analysis is most commonly seen as a reversal pattern. As this Great...

Read More »FX Daily Rates, November 24: Euro Continues to Push Higher

Swiss Franc The Euro has risen by 0.38% to 1.1674 CHF. EUR/CHF and USD/CHF, November 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro is edging higher to trade at its best levels since the middle of last month. It is drawing closer to the $1.1880 area, which if overcome, could point to return to the year’s high seen in early September near $1.2100. There is a...

Read More »Cool Video: Bitcoin Discussion on Bloomberg

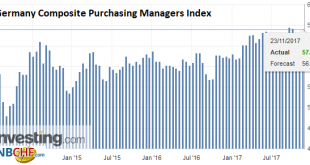

- Click to enlarge I had to be on Bloomberg’s Day Break with David Westin and Alix Steel earlier today. We talked about the collapse of talks to put together a new coalition following the results of the September election. I suggested that the initial reaction was exaggerated, negotiations will likely resume in some fashion, and speculation of Merkel’s demise are premature. We also discussed Brexit. I opined that...

Read More »German Politics: What’s Next?

Summary: Coalition talks will resume in the coming days, and failing this a minority government is more likely than new elections. The is a general agreement among the political elites, and a hubris of small differences. The rate differentials and cross currency swaps show the incentive structure for holding dollars is increasing. Talks to forge a new coalition government in Germany passed the self-imposed...

Read More »FX Daily, November 22: Global Equity Rally Resumes, while Dollar Slips

Swiss Franc The Euro has fallen by 0.32% to 1.1599 CHF. EUR/CHF and USD/CHF, November 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Global equities are on the march. US indices shrugged off their first back-to-back weekly decline in three months to set new record highs yesterday. The MSCI Asia-Pacific followed suit and recorded their highest close. The Dow Jones...

Read More »Weekly Technical Analysis: 20/11/2017 – USDJPY, EURUSD, GBPUSD, GBPAUD

USD/CHF The USDCHF pair broke 0.9892 level and settles below it now, which supports the continuation of our correctional bearish trend efficiently in the upcoming period, and the way is open to head towards 0.9800 level that represents our next main target. The EMA50 supports the negative overview, which will remain valid and active unless breaching 0.9930 followed by 0.9970 levels and holding above them. Expected...

Read More »FX Daily, November 21: Dollar Marks Time

Swiss Franc The Euro has fallen by 0.17% to 1.1635 CHF. EUR/CHF and USD/CHF, November 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are a couple of exceptions to the inside trading days. First, the dovish twist to the minutes from the Reserve Bank of Australia’s recent meeting saw the Australian dollar make a marginal new five-month low of almost $0.7530 before...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org