Since we are this week hypocritically obsessing over monetary policy, particularly the federal funds rate end of it, it’s as good a time as any to review the full history of 21st century “conundrum.” Janet Yellen’s Fed has run itself afoul of the bond market, just as Alan Greenspan’s Fed did in the middle 2000’s. But that latter example wasn’t truly the first conundrum for monetary policy. There remain a great many...

Read More »China Imports and Exports: The Ghost Recovery

To the naked eye, it represents progress. China has still an enormous rural population doing subsistence level farming. As the nation grows economically, such a way of life is an inherent drag, an anchor on aggregate efficiency Chinese officials would rather not put up with. Moving a quarter of a billion people into cities in an historically condensed time period calls for radical thinking, and radical doing. In one...

Read More »Competing CPI,PPI, Industrial Production and Retail Sales: No Luck China, Either

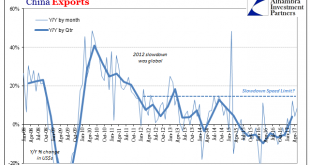

Former IMF chief economist Ken Rogoff warned today on CNBC that he was concerned about China. Specifically, he worried that country might “export a recession” to the rest of Asia if not the rest of the world. I’m not sure if he has been paying attention or not, but the Chinese economy since 2012 has been doing just that to varying degrees often just shy of that level. If there’s a country in the world which is really...

Read More »Questions Persist About China Trade

Chinese trade statistics were for May 2017 better than expected by economists, but on the export side questions remain as to their accuracy. Earlier this year discrepancies between estimates first published by the General Administration of Customs (GAC), those you find reported in the media, and what is captured by the National Bureau of Statistics (NBS), backed up by data from the Ministry of Commerce, became...

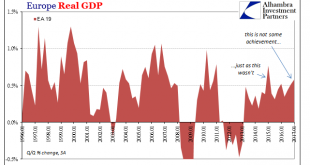

Read More »Europe’s Non-linear

Europe is as we all are. Ben Bernanke wrote a few years ago that his tenure at the Fed must have been a success in his view because the US economy didn’t perform as badly as Europe’s. As usual, this technically true comparison is for any meaningful purpose irrelevant. For one, the European economy underperformed before 2008, too. Second, after 2008, really August 9, 2007, there isn’t nearly as much difference as...

Read More »All About Inventory

Andy Hall has been called the God of Oil. As chief of Astenbeck Capital, he has proven at times that even gods can be mortal. In the “rising dollar” period, for example, after making money on the way down Mr. Hall went bullish. That was March 2015: We suspect their projection of current prices into the future will again be frustrated by the market. For that reason we have closed out all of our bearish bets (at a...

Read More »Forced Finally To A Binary Labor Interpretation

JOLTS figures for the month of April 2017, released today, highlight what is in the end likely to be a more positive outcome for them. It has very little to do with the economy itself, as what we are witnessing is the culmination of extreme positions that have been made and estimated going all the way back to 2014. At that time, the BLS in its various data series suggested an almost perfect labor market acceleration...

Read More »Signs of Something, Just Not Wage Acceleration

I have been writing for many years that they really don’t know what they are doing. I only wish it was that simple. There has been developing another layer or dimension to that condition, a second derivative of stupid, whereby when faced with this now well-established fact the same people, experts and authorities all, they have no frame of reference to figure out what next to do. In other words, they really don’t know...

Read More »The Anti-Perfect Jobs Condition

The irony of the unemployment rate for the Federal Reserve is that the lower it gets now the bigger the problem it is for officials. It has been up to this year their sole source of economic comfort. Throughout 2015, the Establishment Survey improperly contributed much the same sympathy, but even it no longer resides on the plus side of the official ledger. So many people may have exited the labor force in May that the...

Read More »Dollars And Sent(iment)s

Both US manufacturing PMI’s underwhelmed just as those from China did. The IHS Markit Index was lower than the flash reading and the lowest level since last September. For May 2017, it registered 52.7, down from 52.8 in April and a high of 55.0 in January. Just by description alone you can appreciate exactly what pattern that fits. The ISM Manufacturing PMI was slightly higher in May than April, 54.9 versus 54.8, but...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org