Overview: The dollar is having one of the largest setbacks in recent weeks. We expected the dollar to soften ahead of next week’s CPI, which may fan ideas/hopes of a peak in US price pressures, but the magnitude and speed of the move is surprising, and likely speaks to the extreme positioning. Still, we caution that the intraday momentum indicators are stretched, and the underlying bullish sentiment, may see North American operators take advantage of the dollar’s...

Read More »ECB: Coping with Conflict, Covid, and Climate

Overview: Heightened warnings from Japanese officials has helped the dollar steady against the yen, while the euro hugs parity ahead of the outcome of the ECB meeting, where a 75 bp hike is anticipated. Most Asian equity markets rallied in the wake of yesterday’s gains in the US. China and Hong Kong were notable exceptions. Europe’s Stoxx 600 is practically flat as are US futures. The US 10-year yield is softer, a little below 3.25%, while European benchmark yields...

Read More »Ep 40 – Dan Oliver Jr: Markets Will Force the Fed to Balance

Dan Oliver of Myrmikan Capital joins Keith and Dickson on the Gold Exchange Podcast to talk about the history of credit bubbles, the inevitability of central bank failings, and what history can tell us about the Fed’s current trajectory. Connect with Dan on Twitter: @Myrmikan and at Myrmikan.com Connect with Keith Weiner and Monetary Metals on Twitter: @RealKeithWeiner@Monetary_Metals [embedded content] Additional Resources CMRE.org Myrmikan.com Gold Backwardation...

Read More »Turn Around Tuesday Began Yesterday, Likely Ends before Wednesday

Overview: Corrective pressures were evident yesterday and they extended today in Asia and Europe but seem to be running their course now. Market participants should view these developments as countertrend and be wary of waning risk appetites in North America today. Most Asia Pacific equities rallied earlier today, save China and Hong Kong. Europe’s Stoxx 600 has retraced most of yesterday’s losses and US futures are trading higher. Benchmark bond yields are softer...

Read More »Stocks and Bonds Sell Off, while the Dollar Rallies

Overview: The reverberations from last week continue to roil the capital markets today. Equities and bonds have been sold and the greenback bought. Most of the large markets in Asia Pacific fell by more 2%, including Japan’s Nikkei, Taiwan’s Taiex, and South Korea’s Kospi. Ironically, the Shanghai and Shenzhen Composites eked out minor gains, but the CSI 300 still eased. Europe’s Stoxx 600 is off 1% after falling nearly 1.7% before the weekend. US futures warn of...

Read More »The Week Ahead: Dollar Bulls Still in Charge

The poor preliminary PMI readings, the ongoing European energy crisis, and the recognized commitment of most major central banks to rein in prices through tighter financial conditions are risking a broad recession. These considerations are weighing on sentiment and shaping the investment climate. Most high-frequency data due in the days ahead will not change this, even if they pose some headline risk. What we have seen among some central bankers applies to market...

Read More »Jackson Hole and More

Overview: Ahead of the much-anticipated speech by Federal Reserve Chair Powell, the Fed funds futures are pricing in about a 70% chance of a 75 bp hike next month. The US 10-year yield is up nearly five basis points today to 3.07% and the two-year yield is firm at 3.38%. Asia Pacific equities were mostly higher, with China the main exception among the large markets, after US equities rallied yesterday. Europe’s Stoxx 600 is off about 0.3% to bring this week’s...

Read More »Dollar Longs Pared as Jackson Hole Gathering is set to Start

Overview: It seems that many market participants had the same thing in mind, cut dollar longs before the Jackson Hole gathering. The Antipodeans lead the majors move, encouraged perhaps by China’s new economic measures, with around a 1% gain. The euro and sterling are up about 0.35% and are the laggards. Emerging market currencies are higher as well, with the notable exception of India and Turkey, which are nursing small losses. Equities are having a good day. All...

Read More »Rate Hikes Are Working

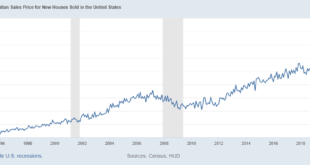

New home sales were reported for July as down nearly 13% to 511K, a number that is just about the average since 2010 (543k). But that doesn’t tell the whole story obviously. New home sales have fallen sharply since December of last year, down 39%. The drop from the peak in August 2020 is even more dramatic, down nearly 51%. Obviously, the fall this year is related to rising mortgage rates but that can’t be the reason sales have been falling for nearly two years....

Read More »New Recession Worry Stalls Dollar Express but Doesn’t Derail It

Overview: A simply dreadful flash US PMI stopped the dollar’s four-day rally in its tracks. It followed news that the eurozone, Japan, and Australia’s composite PMIs are below the 50 boom/bust level. However, the dollar recovered, even if not fully as the market seemed unconvinced that the data could change Fed Chair Powell’s message at Jackson Hole on Friday. A consolidative tone is evident today. Asia Pacific equities were mixed. China and Hong Kong fell more than...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org