© Mcwilli1 | Dreamstime.com Health care in Switzerland is funded by a mixture of taxes and health insurance premiums. Much of the insurance premiums paid are compulsory with no discounts offered to non-smokers. According to figures recently published by the Swiss association for smoking, the annual direct medical costs of smoking are CHF 3 billion (2015), or CHF 350 per person. This sum represents 3.9% of Switzerland’s total annual health spending. Tobacco use is the...

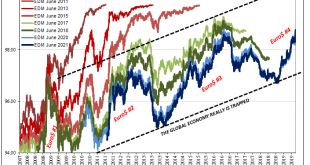

Read More »Your Unofficial Europe QE Preview

The thing about R* is mostly that it doesn’t really make much sense when you stop and think about it; which you aren’t meant to do. It is a reaction to unanticipated reality, a world that has turned out very differently than it “should” have. Central bankers are our best and brightest, allegedly, they certainly feel that way about themselves, yet the evidence is clearly lacking. When Ben Bernanke wrote for the Washington Post in November 2010 announcing somehow the...

Read More »Turkey Monetary Policy Planting Seeds of Future Crisis

Turkey central bank meets September 12 and is expected to cut rates 275 bp. With Erdogan talking about single digit rates and inflation, it’s clear that rates are headed significantly lower. At some point soon, we think the risk/reward for investing in Turkey will send investors fleeing for the exits.POLITICAL OUTLOOK President Erdogan sacked central bank Governor Murat Cetinkaya on July 6, ostensibly for not cutting rates quickly enough. In early August, several...

Read More »FX Daily, September 13: Bonds and the Dollar Remain Heavy Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.19% to 1.0932 EUR/CHF and USD/CHF, September 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets are digesting ECB’s actions and an easing in US-Chinese rhetoric. Next week features the FOMC meeting and three other major central banks (Japan, Switzerland, and Norway). The US equity rally that saw the S&P 500 edge closer to the record high set in late July...

Read More »Housing vacancies rise in 20 Swiss cantons

© Ppvector | Dreamstime.com Recent figures show an annual 4.2% rise in the number of vacant homes in Switzerland, extending a trend that started 10 years ago, according to the Federal Statistical Office. At the start of June 2019, there were 75,323 vacant homes, representing 1.66% of Switzerland’s total stock of homes. However, high vacancy rates in some regions masked low ones in others. While cantons such as Solothurn (3.40%), Thurgau (2.65%), Jura (2.59%), Aargau...

Read More »The Obligatory Europe QE Review

If Mario Draghi wanted to wow them, this wasn’t it. Maybe he couldn’t, handcuffed already by what seems to have been significant dissent in the ranks. And not just the Germans this time. Widespread dissatisfaction with what is now an idea whose time may have finally arrived. There really isn’t anything to this QE business. But we already knew that. American officials knew it in June 2003 when the FOMC got together to savage the Bank of Japan for their lack of...

Read More »The remarkable rise of GDP per capita in Switzerland

© Mr.siwabud Veerapaisarn | Dreamstime.com In 1998, GDP per person in Switzerland was CHF 59,693. Recently published statistics put the figure at CHF 80,986 in 2018, a rise of 36%. When Swiss GDP per capita is expressed in globally comparable US dollar terms its rise is even greater. In US dollar terms Swiss GDP per capita grew from US$ 41,497 to US$ 82,839 between 1998 and 2018, a rise of 100%. In Germany the same figure went from US$ 27,341 to US$ 48,196, a rise of...

Read More »FX Daily, September 12: Focus on the ECB, while the Dollar Slips below CNY7.09

Swiss Franc The Euro has fallen by 0.13% to 1.0914 EUR/CHF and USD/CHF, September 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Some gestures in the US-China trade spat have given the market the reason to do what it had been doing, and that is taking on more risk. Equities are higher in Asia Pacific and opened in Europe higher before slipping. The MSCI Asia Pacific and the Dow Jones Stoxx 600 are advancing...

Read More »100-franc note enters circulation today

SNB banknote app with information on all new denominations Issuance of the new 100-franc note presented a week ago begins today, 12 September. The complete version of the Swiss National Bank’s ‘Swiss Banknotes’ app is now also available. It has been updated to include the 100-franc note and features information on all six new denominations. The app, which has been downloaded some 123,000 times, can be obtained free of charge from the Apple (apps.apple.com) and Google...

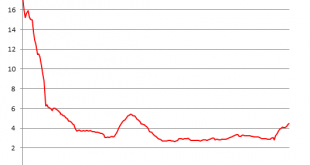

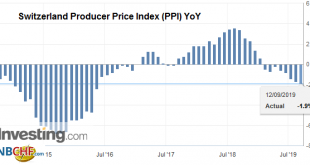

Read More »Swiss Producer and Import Price Index in August 2019: -1.9 percent YoY, -0,2 percent MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015 (see below), compared to -3% in Europe or -1% in...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org