© Octavian Lazar | Dreamstime.com Over the last week there have been an average of 15 new SARS-CoV-2 cases a day. The first confirmed case in Switzerland was recorded on 24 February 2020. In the week that followed the number of new daily infections rose to 31. Another week later the number of new daily cases was 192. The daily new case number then took another 14 days to rise to a peak of 1,464 cases on 23 March 2020 before declining. By 1 May 2020, 39 days later it...

Read More »Saint-Gobain to drop its shareholding in Swiss chemical maker Sika

Sika has more than 300 plants worldwide (Keystone) The French building materials and distribution group Saint-Gobain has announced the sale of its 10.75% stake in the capital of the Swiss chemical manufacturer Sika. Saint-Gobain said in a press releaseexternal link on Tuesday that it would dispose of “of its entire stake in Sikaexternal link of approximately 15.2 million shares, representing 10.75% of Sika’s share capital”, without mentioning any financial amount....

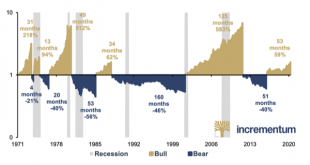

Read More »Pandemic, Economic Shutdowns, Debt Crisis and Gold At $5,000/oz

◆ GoldCore are delighted to publish the 14th edition of the annual “In Gold We Trust” report, “The Dawning of a Golden Decade” by by our friends Ronald-Peter Stoeferle & Mark J. Valek of Incrementum AG. Gold prices should rise to over $5,000/oz and may rise as high as $9,000/oz in the coming decade and by 2030, according to the respected report. Gold is “on everyone’s lips again” and “we are now in a new phase of the bull market”. The question that now occupies...

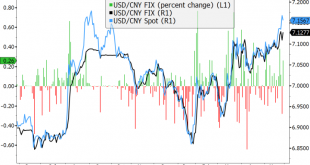

Read More »Dollar Firm as US-China Tensions Continue to Rise

Tensions between the US and China continue to rise; the dollar is finding some traction Fed Beige Book contained no surprises; NY Fed President Williams said the Fed is “thinking very hard” about targeting yields; weekly jobless claims are expected at 2.1 mln vs. 2.438 mln last week Germany reports May CPI; ECB is likely to ease next week; BOE continues to show its dovish colors; Poland is expected to keep rates steady at 0.5% Japan’s Cabinet Office maintained its...

Read More »Swiss Covid-19 contact tracing app ready for privacy testing

The decentralised SwissCovid app is the first in the world to use the OS updates from Apple and Google. (Keystone / Laurent Gillieron) Authorities have released the source code of the SwissCovid app to the public to allow experts and hackers to detect any risks to privacy before the official launch. The source code of the decentralised contact tracing app DP-3T, developed by the two Swiss federal institutes of technology in Zurich (ETH Zurich) and Lausanne (EPFL)...

Read More »Coronavirus: Switzerland plans to lift all restrictions on Schengen movement

© Scaliger | Dreamstime.com Switzerland’s Federal Council plans to lift all travel restrictions and re-establish free movement of persons across the Schengen area no later than 6 July 2020 and possibly as early as mid June, it announced today. If the epidemiological evolution allows, restrictions on entering, working and living in Switzerland will be lifted for all Schengen states from mid-June and no later than 6 July, said the government. The Schengen area, which...

Read More »Asia Lockdowns vs. Re-Openings

By Ilan Solot and Kieran Chard We apply the five-factor model used to analyse lockdowns and openings in developed markets and in Latin America to Asian Markets. It evaluates the restrictions imposed by different countries in the region, how they compare in terms of severity of lockdown, and where they are heading in the spectrum of reopening. The scale we use measures grade restrictions from 1 (open) to 4 (closed) across the following five factors: (a)...

Read More »Is Your Pension ‘Good as Gold’?

Published on Independent Trustee Company (27/05/2020) ◆ With the current level of uncertainty in world markets we have received numerous requests for information on how self directed pension schemes (pre and post retirement) can hold gold and silver. It is accepted that if gold bullion is held via a gold certificates ( Perth Mint Certificates with GoldCore) or in Secure Storage in a variety of local or international locations with GoldCore, then it is not considered...

Read More »FX Daily, May 29: Month-End Profit-Taking Weighs on Equities as the Euro Pops Above $1.11

Swiss Franc The Euro has risen by 0.30% to 1.0709 EUR/CHF and USD/CHF, May 29(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The announcement that President Trump will hold a press conference on China later today rattled investors yesterday after they had earlier shrugged off the escalation of tension between the US and China to take the S&P 500 up to its highest level in nearly three months. The S&P...

Read More »2021 Geneva Motor Show ‘very uncertain’ as organisers reject loan

This year’s car show was cancelled four days prior to its opening due to the coronavirus outbreak, costing an estimated loss of CHF11 million for the organisers of Switzerland’s largest event. (Keystone / Salvatore Di Nolfi) The 2021 edition of the Geneva International Motor Show remains touch and go after the organisers rejected the terms surrounding a state rescue loan. This year’s car show was cancelled four days prior to its opening due to the coronavirus...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org