Our ruling elites, devoid of leadership, are little more than the scum of self-interested, greedy grifters who rose to the top of America’s foul-smelling stew of corruption. The Founding Fathers were wary of institutional threats to liberty and the citizenry’s sovereignty, which included centralized concentrations of power (monarchy, central banks, federal agencies, etc.) and the tyranny of corruption unleashed by small-minded, self-interested, greedy grifters who...

Read More »There’s No End in Sight to the Zombie Economy

The United States was waiting for the zombie apocalypse. The country was given a coronapocalypse instead. But could the two events merge and provide the nation with a dangerous economic trend? Corporate America’s worst-kept secret had been the swelling number of zombies kept on life support and hidden away during the boom phase of the business cycle. Now that the coronavirus pandemic has exposed the fault lines underneath the economy, the zombification may accelerate...

Read More »Michael Flynn, Lori Loughlin, and the Permanent Culture of Prosecutorial Abuse

When US attorney general William Barr recently announced that the Department of Justice was reversing course and dropping all charges against former Trump adviser Michael Flynn, the response from Democrats, the mainstream news media, and Never-Trump Republicans such as David French was thermonuclear, to put it mildly. The New York Times, which many times has editorialized against prosecutorial tactics that drive people to plead guilty instead of going to trial,...

Read More »FX Daily, June 1: US Dollar Losses are Extended, but Momentum Stalls in the European Morning

Swiss Franc The Euro has risen by 0.15% to 1.0689 EUR/CHF and USD/CHF, June 1(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: US stocks extended their gains ahead of the weekend after President Trump shied away from specific actions against China-Hong Kong, and today Hong Kong shares recovered smartly from last week’s 3.6% slide. The Hang Seng rose 3.3% today, and the Shanghai Composite gained over 2%. All the...

Read More »Coronavirus: number of tests stagnates in Switzerland

© Marcos del Mazo | Dreamstime.com The number of daily new cases has remained low in Switzerland throughout May. The highest number of new cases over this period was recorded on 1 May (119). The latest daily number, published on 29 May, was 31 new daily cases. Since the beginning of May the number has been as low as 10. The total number of reverse transcription polymerase chain reaction, or RT-PCR tests undertaken by 29 May 2020 was 390,688. At the beginning these...

Read More »Credit Suisse grants CHF2.8 billion in corona credit

Urs Rohner is Chairman of the Board of Directors at Credit Suisse (Keystone / Ennio Leanza) Major Swiss bank Credit Suisse has issued 15,400 emergency loans totaling CHF2.8 billion ($2.9 billion) during the coronavirus crisis, says board chairman Urs Rohner. The numbers are similar at competitor UBS. On March 25 the Swiss government announcedexternal link a scheme to provide cash-strapped small and medium-sized companies with emergency loans to get through the...

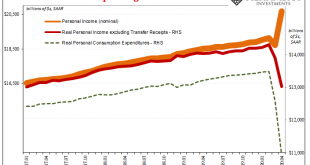

Read More »Personal Income and Spending: The Other Side

The missing piece so far is consumers. We’ve gotten a glimpse at how businesses are taking in the shock, both shocks, actually, in that corporations are battening down the liquidity hatches at all possible speed and excess. Not a good sign, especially as it provides some insight into why jobless claims (as the only employment data we have for beyond March) have kept up at a 2mm pace. These are second order effects. In terms of consumer spending, it’s, as always,...

Read More »This Is How Systems Collapse

Flooding the financial system with “free money” only restores the illusion of stability I updated my How Systems Collapse graphic from 2018 with a “we are here” line to indicate our current precarious position just before the waterfall: For those who would argue we’re nowhere near collapse, consider that over 20% of the Federal Reserve’s $2 trillion spew of free money went directly into the pockets of America’s billionaires: $434 billion by the latest estimates,...

Read More »Two Analogies for the Economy That the Media Keeps Getting Wrong

In an attempt to maintain the lockdown and their authority over our lives, politicians, health experts, and the mainstream media have been misusing some unusual analogies to describe the current economy. By using these analogies, our political overlords hope they can continue to keep the economy shut down, force companies to produce what the government forgot to purchase before the virus hit, and toss out trillions of dollars of handouts and bailouts to their...

Read More »Defining “Inflation” Correctly

Inflation is typically defined as a general increase in the prices of goods and services—described by changes in the Consumer Price Index (CPI) or other price indexes. If inflation is a general rise in measured prices, then why is it regarded as bad news? What kind of damage can it inflict? Mainstream economists maintain that inflation causes speculative buying, which generates waste. Inflation, it is maintained, also erodes the real incomes of pensioners and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org