The year started off poorly, to say the least. Equity markets plunged from the get-go. The Nikkei, DAX and S&P 500 gapped lower on the first trading day of the year. Emerging markets and commodities were smashed. Many economists blamed the Federal Reserve for hiking rates in mid-December. Pundits warned that the seven-year bull market and weak economic recovery in the US was ending. A recession loomed, and worse because monetary policy had lost its effectiveness and fiscal...

Read More »Speculators Pile into Sterling and Take Profits on Long Aussie Positions

After a relatively quiet period into the run-up to the ECB, speculative activity markedly increased in the CFTC reporting week ending the day prior to the conclusion of the FOMC meeting. Two speculative gross currency position adjustments stand out. First, speculators appeared to have bought a record amount of sterling contracts. The gross long position more than doubled; increasing 33.5k contracts to 62.9k. Despite the continued recovery of sterling in the spot market, the bears...

Read More »This Is How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8, 2016 Via Paris

Submitted by Ronan Manly of Bullionstar Blogs Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exported 36t Of Its Official Gold Reserves To Switzerland In January“, there have now been further interesting developments in this ongoing saga. It has now come to light that on Tuesday 8 March, the Banco Central de Venezuela (BCV) sent another 12.5...

Read More »The Greenback Remains Technically Vulnerable

The US dollar had a difficult week. The price action after the ECB meeting had undermined the technical tone, and the dollar took another leg down after the FOMC moved closer to the market expectation by reducing the number of rate hikes the median official thinks will be appropriate this year from four to two. The US Dollar Index fell for the third consecutive week and the fifth week of the past seven. The minor gains ahead of the weekend failed to improve the technical tone. ...

Read More »Emerging Markets: What has Changed

(from my colleague Dr. Win Thin) China press is reporting that policymakers are drafting rules for a so-called Tobin tax on yuan transactions Former President Lula was named to the cabinet post of Chief of Staff by his protégé, President Rousseff The Brazilian central bank said it “sees room” to partially unwind the FX swaps program Egypt devalued the pound by almost 13% and said it would adopt a “more flexible exchange rate” The National Executive Committee of the ruling African...

Read More »Thoughts on Conspiracy Theories of the Dollar’s Losses

In our work, we have argued that the dollar is having its third significant rally since the end of Bretton Woods. The first rally was associated with Reagan though it began under Carter and followed 100 bp hike by a new Federal Reserve Chairman (Volcker). On a real broad trade-weighted basis, the dollar appreciated by more than 50% over the seven years and in 1985, the G7 met at the Plaza Hotel in NY and agreed to coordinate intervention to drive the dollar down. Before last...

Read More »Dollar Trims Losses Ahead of the Weekend

The US dollar is firmer against most major and emerging market currencies to pare this week's decline. There are three notable exceptions, and they are all in Asia. For all practical purposes, the dollar is flat against the Japanese yen near JPY11.30. The South Korean won is up almost 1% to extend this week's pace-setting the gain to 2.65%. The dollar has fallen 7.2% against the won since it peaked at the end of last month. The Taiwanese dollar is 0.6% higher, which essentially...

Read More »SNB Monetary Policy Assessment and Critique

We examine the SNB monetary assessment statement of March 17 and the Swiss economy. We explain why negative rates may be a “toothless measure” if a central bank wants to weaken a currency. They have rather an inexpected consequence, they slow down GDP growth, in particular for banks and pension funds. The following are the extracts from the monetary policy assessment of Swiss National Bank, 17 March 2016, and my comments.All SNB statements appear in quotes, my comments without quotes....

Read More »When Doves Cry: Imprudently Cautious

If there was one word Yellen emphasized yesterday it was caution. The dot plot reflected that as well. Can one ask if the Fed is being too cautious? Yellen acknowledged that the Fed's assessment of the US economy had not changed much from December. There is little reason it should. However, it is difficult to reconcile that with the substantial change in the forward guidance, and the halving of the rates hikes that are deemed appropriate this year. The US labor market continues to...

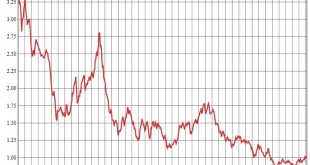

Read More »Great Graphic: Dollar Index Retracement, Too Soon To Say Top is In

The cry that the dollar has peaked is gaining ground. We are not convinced. The macro-fundamental case remains intact. Divergence between the US and other high income countries continues, even if at a more gradual pace than the Federal Reserve expected a few months ago. This Great Graphic of the Dollar Index, created on Bloomberg, shows that shows the broad consolidation over the past year continues to hold. The break of 95.00 today seems to point to a test on the low from last...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org