Not only will Fed policy not fix what’s broken, it will actively make the structural problems worse. Yesterday I described the conditions that render the U.S. ungovernable. Here is a chart of why the U.S. economy will also be ungovernable. Longtime readers are acquainted with the S-curve model of expansion, maturity, stagnation and decline. This is why the economy will be ungovernable: all the financial gambits that...

Read More »What Triggers Collapse?

A variety of forces will disrupt or obsolete existing modes of production and the social order. Though no one can foretell the future, it is self-evident that the status quo—dependent as it is on cheap oil and fast-expanding debt—is unsustainable. So what will trigger the collapse of the status quo, and what lies beyond when the current arrangements break down? Can we predict how-when-where with any accuracy? All...

Read More »Will Tax Cuts and More Federal Borrowing/Spending Fix What’s Broken?

Charles Hugh Smith combines the best graphs on the declining wage share of GDP in this post. He answers the question if the tax cuts and more federal borrowing and spending can solve what is broken in the U.S. economy. Solutions abound, but not within our centralized state-cartel neofeudal system. Not to rain on the new administration’s parade, but one question needs to be asked of any new administration: will tax...

Read More »How You Become a Crony

Trump Bump BALTIMORE – Who’s the biggest winner so far? “Government Sachs!” Fortune magazine reports that the winningest person since Trump’s election is Goldman Sachs CEO Lloyd Blankfein. Goldman’s stock price is back to where it was just before the last crash in 2008. And Blankfein is back in high cotton, too; his holdings in the firm have gained $140 million in the last four weeks. Donald Trump pledged to take the...

Read More »When Did Our Elites Become Self-Serving Parasites?

Combine financialization, neoliberalism and moral bankruptcy, and you end up with self-serving parasitic elites. When did our financial and political elites become self-serving parasites? Some will answer that elites have always been self-serving parasites; as tempting as it may be to offer a blanket denunciation of elites, this overlooks the eras in which elites rose to meet existential crises. Following in Ancient...

Read More »FX Daily, December 30: Dollar Slips into Year End

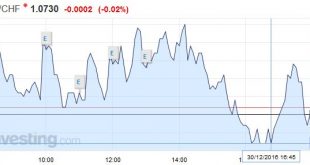

Swiss Franc EUR/CHF - Euro Swiss Franc, December 30(see more posts on EUR/CHF, ) The EUR/CHF remained close the SNB intervention point of 1.07. - Click to enlarge FX Rates In exceptionally thin conditions that characterize the year-end markets, a reportedly computer-generated order lifted the euro from about $1.05 to a little more than $1.0650 in a few minutes early in the Asian sessions. Before European markets...

Read More »Miners, including Swiss-based Glencore, unearth a profit bonanza with rally set to last into 2017

Miners had been digging in one of Australia’s oldest collieries for almost a century until operations wound down a year ago, the victim of plunging global commodity prices. Now owner Glencore Plc is resuming output at the Queensland site, the latest sign of a profit bonanza bringing the world’s top metals and energy producers back from the brink. © Carol Buchanan | Dreamstime.com - Click to enlarge Everything from coal...

Read More »Fake News, Mass Hysteria and Induced Insanity

The “fake news” is that we’ve never been healthier, healthcare costs are under control and our economy has fully “recovered.” We’ve heard a lot about “fake news” from those whose master narratives are threatened by alternative sources and analyses. We’ve heard less about the master narratives being threatened: the fomenting of mass hysteria, which turns the populace into an easily manipulated and managed herd,...

Read More »India’s Rapid Progression Toward a Police State

India’s Currency Ban – Part VI India’s Prime Minister, Narendra Modi, announced on 8th November 2016 that Rs 500 (~$7.50) and Rs 1,000 (~$15) banknotes would no longer be legal tender. Linked are Part-I, Part-II, Part-III, Part-IV, and Part-V, which provide updates on the demonetization saga and how Modi is acting as a catalyst to hasten the rapid degradation of India and what remains of its institutions. There are...

Read More »Wreck the Halls

Arrested Development Despite the best efforts of the bulls to make history happen, they’ve been unable to ‘git-r-done.’ At the time of this writing, the Dow is facing another bout of arrested development; it has yet to notch 20,000 for the very first time. What a feat it will be when this remarkable, but trivial, event comes to pass. After a near eight year run, the Dow will likely eclipse this exquisitely round...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org