Swiss Franc EUR/CHF - Euro Swiss Franc, December 29(see more posts on EUR/CHF, ) - Click to enlarge FX Rates In thin holiday markets, a correction to the trends seen in Q4 has materialized. The US dollar is heavy. Japanese and European equities are lower. Bonds are firmer. Some reports try to link the moves to the unexpected weakness in the US pending home sales, but this is a stretch and merely seeks to...

Read More »Davos Staff May Sleep In Shipping Containers As Billionaires Swarm Resort

With January just around the corner, the world’s billionaires, CEOs, politicians and oligarchs prepare to take their private planes to Davos, Switzerland for their annual convocation at the World Economic Forum, where they discuss such diverse topics as global warming due to greenhouse gases (which exempts Gulfstream jets) and the dangers of record wealth inequality (which exempts them), while snacking on $39 hot dogs...

Read More »Fake News? It’s All Fake!

Barbarous Huns Life is one long struggle in the dark. – Lucretius BALTIMORE – In January of this year, the Empire Herald reported that a “meth-addled couple” had eaten a homeless man in New York City’s Central Park. Later, Now8News reported that a can of cookie dough had “exploded in a woman’s vagina”; the woman was alleged to be shoplifting. . The fellows depicted above certainly mesh perfectly with the image of...

Read More »Gold – Ready to Spring Another Surprise

Sentiment Extremes Below is an update of a number of interesting data points related to the gold market. Whether “interesting” will become “meaningful” remains to be seen, as most of gold’s fundamental drivers aren’t yet bullishly aligned. One must keep in mind though that gold is very sensitive with respect to anticipating future developments in market liquidity and the reaction these will elicit from central banks....

Read More »A Tale of Two Housing Markets: Hot and Not So Hot

If we had to guess which areas will likely experience the smallest declines in prices and recover the soonest, which markets would you bet on? Though housing statistics such as average sales price are typically lumped into one national number, this is extremely misleading: there are two completely different housing markets in the U.S. One is hot, one is not so hot. Just as importantly, one may stay relatively hot while...

Read More »UBS Consumption Indicator: Subdued private consumption in 2017 despite solid November figures

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. The UBS Consumption Indicator climbed to 1.43 points in November from 1.39. Another strong month in domestic tourism and the positive trend on the automobile market made the rise possible. Initially a solid...

Read More »Cool Video: Double Feature on Bloomberg

I am finishing the year like I began it, on Bloomberg Television, talking about the dollar and Fed policy. Bloomberg has made two clips of my interview available. In the first clip (here), I discuss the dollar. I reiterate my forecast for the the Dollar Index to head toward 120.00. The consolidation between Q2 15 and end of Q3 16 appears to me to be the base of the new leg up that has already begun.[embedded...

Read More »FX Daily, December 28: Short Note for Holiday Markets

Swiss Franc EUR/CHF - Euro Swiss Franc, December 28(see more posts on EUR/CHF, ) - Click to enlarge FX Rates Equities: Good day in Asia, where the MSCI Asia-Pacific Index rose 0.3% to snap a six-day slide. Of note the Hang Seng re-opening from a long holiday weekend rose (0.8%) from a five-month low. Chinese shares that trade in HK also did well, rising 1.5%. Indonesia, which broke a nine-day slide yesterday,...

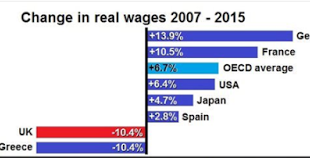

Read More »Great Graphic: Real Wages

This Great Graphic caught my eye. It was tweeted by Ninja Economics. Her point was about immigration. German had much higher immigration than the UK, but also saw real wage increase of nearly 14% in the 2007-2015 period, while real wages in the UK fell nearly 10.5%. She noted that Greece is the only developed country where real wages have collapsed as much as in the UK. This is amazing, and not because of...

Read More »Grab-Bag of Resolutions for 2017

I resolve to acquire skills, not credentials. Here’s a grab-bag of resolutions with something for just about every persuasion. 1. I resolve to never utter or write the word “Trump” in 2017. (Good luck with that…) 2. Having watched bitcoin rise from $250 (or perhaps from $25 or even 25 cents) to $900+, I resolve to finally buy some bitcoin before it soars over $1,000. (Please file under “this is intended as bemused...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org