Exterminating Angel LOVINGSTON, VIRGINIA – Amid all the sound and fury of the Trump news cycle, hardly anyone noticed. There is a specter haunting this economy. It is the specter of inflation… Bloomberg has the report: The U.S. cost of living increased in January by the most since February 2013, led by higher costs for gasoline and other goods and services that indicate inflation is gathering momentum. The...

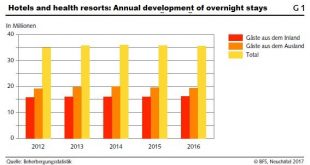

Read More »Statistics on tourist accommodation in December and year 2016: Overnight stays declined by 0.3percent in 2016 in Switzerland

Neuchâtel, 21.02.2017 (FSO) – The hotel sector registered 35.5 million overnight stays in Switzerland in 2016, representing a moderate decline of 0.3% (-96,000 overnight stays) compared with 2015. Foreign visitors registered 19.3 million overnight stays, a decline of 1.5% (-288,000). The number of overnight stays by domestic visitors (16.2 million) showed an increase of 1.2% (+192,000) and thus registering a positive...

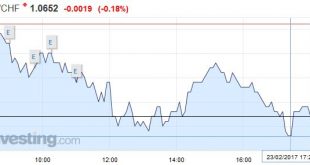

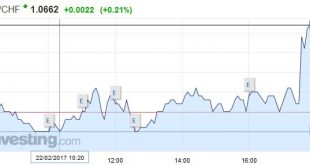

Read More »FX Daily, February 23: Dollar Chops About, as “Fairly Soon” Does not Mean mid-March

Swiss Franc EUR/CHF - Euro Swiss Franc, February 23(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF This week the House of Lords have been debating the issue of the Brexit bill and assuming there are no amendments made this could see a free run towards the triggering of Article 50 due to take place during March. This helped the Pound to hit its best rate to buy Swiss Francs in 2017 creating some...

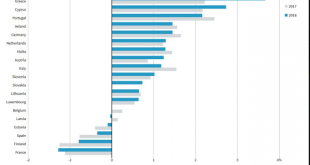

Read More »Primary Budget Balances in EMU

Summary: Greece debt has rallied as a repeat of the 2015 crisis seems less likely. The EC may turn its attention to Italy’s structural deficit. There are several countries, including France that is forecast to have a larger primary deficit in 2018 than 2017. With the official creditors on their way back shortly to Athens, there is a sense that a repeat of 2015 crisis can be avoided. There is a collective sigh...

Read More »The Market Is Not The Economy, But Earnings Are (Closer)

My colleague Joe Calhoun likes to remind me that markets and fundamentals only sound like they should be related, an observation that is a correct one on so many different levels. Stock prices, in general, and GDP growth may seem to warrant some kind of expected correlation, but it has proven quite tenuous at times especially in a 21st century sense. This divergence has sown a great deal of doubt and sometimes apathy...

Read More »How to Outperform Hedge Funds with Just a Few Trades

A Simple Way In their efforts to beat the market, many investors are spending a lot of time searching for rare undiscovered gems or sophisticated trading rules. There is actually a simpler way. I will show below how one could have beaten the market by a sizable margin over approximately the past 90 years – with only two trades per month, while being invested only one third of the time and without employing any...

Read More »The Problem with Gold-Backed Currencies

Any currency is only truly “backed by gold” if it is convertible to gold. There is something intuitively appealing about the idea of a gold-backed currency -money backed by the tangible value of gold, i.e. “the gold standard.” Instead of intrinsically worthless paper money (fiat currency), gold-backed money would have real, enduring value-it would be “hard currency”, i.e. sound money, because it would be convertible to...

Read More »FX Daily, February 22: Euro Meltdown Continues

Swiss Franc EUR/CHF - Euro Swiss Franc, February 22(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound has made good gains against the Swiss Franc this morning with rates for GBP CHF now sitting at 1.2650 for this pair. The pound seems to have found support as the Brexit bill is still expected to pass through the House of Lords next week when the bill comes under additional scrutiny. There is a...

Read More »Don’t Short This Dog – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Fundamental Developments Last week, the prices of the metals mostly moved sideways. There was a rise on Thursday but it corrected back to basically unchanged on Friday. This will again be a brief Report, as Monday was a holiday in the US. Below, we will show the only true picture of the gold and silver supply and demand...

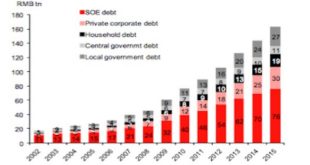

Read More »Gold To Benefit from Rising Inflation and Higher Than “Official” China Gold Demand

Frank Holmes joins Lawrie Williams, Koos Jansen and many others in questioning the “official” Chinese gold demand numbers. Real gold demand is likely much higher than the official numbers by Frank Holmes Inflation just got another jolt, rising as much as 2.5 percent year-over-year in January, the highest such rate since March 2012. Led by higher gasoline, rent and health care costs, consumer prices have now advanced...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org