See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Frexit Threat Macronized The dollar moved strongly, and is now over 25mg gold and 1.9g silver. This was a holiday-shortened week, due to the Early May bank holiday in the UK. The big news as we write this, Macron beat Le Pen in the French election. We suppose this means markets can continue to do what they wanted to do...

Read More »UBS escapes shareholder rebellion fate of rival

UBS shareholders overwhelmingly approved executive bonuses at the bank’s annual general meeting on Thursday. Why such a difference from the Credit Suisse shareholder rebellion seen just one week ago? Both Swiss banks have experienced hard times since their heyday before the financial crash. The shares of both banks have been trading in similar territory (CHF15-17) in recent months from 2007 highs of CHF89 for Credit...

Read More »Bi-Weekly Economic Review

The economic reports since the last economic update were generally less than expected and disappointing. The weak growth of the last few years had been supported by autos and housing while energy has been a wildcard. When oil prices fell, starting in mid-2014 and bottoming in early 2016, economic growth suffered as the shale industry retrenched. I said during that entire time that while the problems in the energy...

Read More »Weekly SNB Interventions and Speculative Positions: Macron will Probably Win the French Elections

Headlines Week May 08, 2017 The centre-left politician Macron has won the French elections. He is a politician that – similar to Hollande four years ago – promises economic improvements, move investment, more jobs. Mostly probably he will fail similar to his predecessor because the French economic reality is simply different. His success moved the EUR/CHF up to 1.0865, mostly caused by FX speculators. But serious...

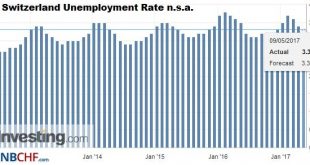

Read More »Switzerland Unemployment in April 2017: Unchanged at 3.3 percent seasonally adjusted

Unemployment Rate (not seasonally adjusted) Registered unemployment in April 2017 – At the end of April 2017, 146,327 unemployed persons were registered with the Regional Employment Services Centers (RAV), according to the SECO surveys, 5,953 less than in the previous month. The unemployment rate thus fell from 3.4% in March 2017 to 3.3% in the reporting month. Switzerland Unemployment Rate Not Seasonally Adjusted,...

Read More »“Mystery” Central Bank Buyer Revealed, Goes On Q1 Buying Spree

In the first few months of the year, a trading desk rumor emerged that even as institutional traders dumped stocks and retail investors piled into ETFs, a “mystery” central bank was quietly bidding up risk assets by aggressively buying stocks. And no, it was not the BOJ: while the Japanese Central Bank’s interventions in the stock market are familiar to all by now, and as we reported last night on sessions when the “the...

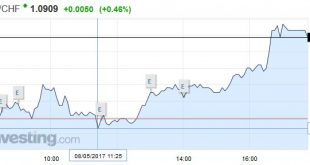

Read More »FX Daily, May 08: Euro Bought on Rumor, Sold on Fact

Swiss Franc EUR/CHF - Euro Swiss Franc, May 08(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge FX Rates The US Dollar Index initially fell to its lowest level since mid-November to 98.50. It rebounded but stalled in front of the pre-weekend high near 99.00. This area must be overcome to lift the tone. Sterling stretched to a marginal high but faded in front of $1.30. Initial support is seen...

Read More »Thousands of cross-border workers risk big bills for health insurance

© Pogonici | Dreamstime.com Tribune de Genève. Thousands of cross-border workers working in the canton of Geneva, who have not yet formally sorted out their health insurance situation, risk getting a big bill. This week the canton made a final call to those living in France and working in Geneva to make a formal choice between the French and Swiss health systems, something which must be done before the final deadline on...

Read More »Weekly Speculative Positions (as of May 02): Euro Shorts Covered, Yen Longs Liquidated

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Dollar Drivers

Summary: US retail sales and CPI should help bolster confidence that the Fed was right about the transitory nature of Q1 slowdown. Bank of England meets; Forbes will likely continue with her dissent, but likely failed to convince her other colleagues of the merit of an immediate rate hike. French politics are center stage, but German state election and South Korea’s national election are also important....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org