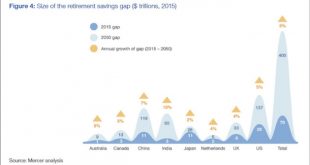

Today we’ll continue to size up the bull market in governmental promises. As we do so, keep an old trader’s slogan in mind: “That which cannot go on forever, won’t.” Or we could say it differently: An unsustainable trend must eventually stop. Lately I have focused on the trend in US public pension funds, many of which are woefully underfunded and will never be able to pay workers the promised benefits, at least without...

Read More »Key Events In The Coming Week: All Eyes On Fed Balance Sheet Announcement

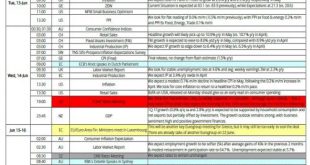

This week attention will fall on US FOMC rate decision, BoJ policy rate announcement, German and NZ elections. Economic data releases include PMI in the Euro area, retail sales in the UK and existing home sales in US. In Emerging Markets, there are monetary policy meetings in South Africa, Indonesia, Hungary, Taiwan and Philippines. BofA highlights the week's key global events: Central bank meetings: US FOMC and BoJ The Fed will make policy announcement on Wednesday. Balance sheet...

Read More »The Secret History Of The Banking Crisis

Accounts of the financial crisis leave out the story of the secretive deals between banks that kept the show on the road. How long can the system be propped up for? - Click to enlarge It is a decade since the first tremors of what would become the Great Financial Crisis began to convulse global markets. Across the world from China and South Korea, to Ukraine, Greece, Brexit Britain and Trump’s America it has shaken...

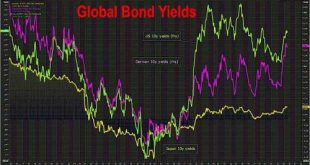

Read More »Bond Selloff Returns As EM Fears Rise; Oil Slides; BOJ Does Not Intervene

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

Read More »Beunruhigende Lehren aus Italien und Griechenland

Für einen symbolischen Euro übernommen: Banca Popolare di Vicenza, hier eine Mailänder Filiale. Foto: Luca Bruno (Keystone) Was war das für ein Schwärmen, als noch zu Monatsbeginn die spanische Pleitebank Banca Popular von der Grossbank Santander übernommen wurde. «Europe reaches Mastery on Banks» – «Europa erreicht Meisterhaftigkeit bei den Banken» – titelte etwa der europhile «Financial Times»-Blogger Martin Sandbu seinen Beitrag zu dieser Lösung. Tatsächlich, alles lief, wie es...

Read More »Beunruhigende Lehren aus Italien und Griechenland

Für einen symbolischen Euro übernommen: Banca Popolare di Vicenza, hier eine Mailänder Filiale. Foto: Luca Bruno (Keystone) Was war das für ein Schwärmen, als noch zu Monatsbeginn die spanische Pleitebank Banca Popular von der Grossbank Santander übernommen wurde. «Europe reaches Mastery on Banks» – «Europa erreicht Meisterhaftigkeit bei den Banken» – titelte etwa der europhile «Financial Times»-Blogger Martin Sandbu seinen Beitrag zu dieser Lösung. Tatsächlich, alles lief, wie es...

Read More »Key Events In The Coming Busy Week: Fed, BOJ, BOE, SNB, US Inflation And Retail Sales

After a tumultous week in the world of politics, with non-stop Trump drama in the US, a disastrous for Theresa May general election in the UK, and pro-establishment results in France and Italy, this is shaping up as another busy week ahead with multiple CB meetings, a full data calendar and even another important Eurogroup meeting for Greece. Wednesday’s FOMC will be the main event, with the Fed expected to hike 25bp...

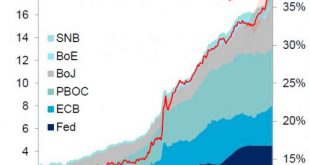

Read More »A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, “the largest CB buying on record.” Aggregate Balance Sheet Of Large Central Banks, 2000 - 2017 - Click to enlarge BofA’s Michael Hartnett noted that supersized central bank...

Read More »Euro Saves Germany, Slaughters the PIGS, & Feeds the BLICS

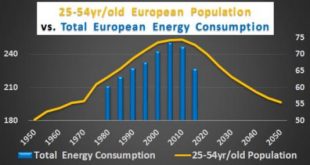

Authored by Chris Hamilton via Econimica, The change in nations Core populations (25-54yr/olds) have driven economic activity for the later half of the 20th century, first upward and now downward. The Core is the working population, the family forming population, the child bearing population, the first home buying, and the credit happy primary consumer. Even a small increase (or contraction) in their quantity drives...

Read More »Blocher and the People That Ruined the EU

Last weekend, European leaders gathered in Rome for the 60th anniversary of the Treaty of Rome. They discussed, not for the first time, how to get the EU back on track. And they told each other they are still committed to the Union and believe in its future. (We’ve heard that one before, too.) But let’s just suppose that, when the European leaders sat down for lunch at the Quirinal Palace, some of them had a little too...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org