Swiss Franc Currency Index After a certain recovery in the last month, the Swiss Franc index lost ground again in this month. It is down one percent for this month, while the dollar index is up one percent. Trade-weighted index Swiss Franc, February 25(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the...

Read More »FX Daily, February 24: Anxiety? What Anxiety?

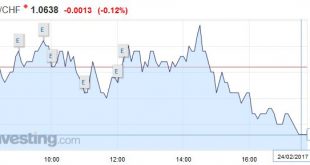

Swiss Franc EUR/CHF - Euro Swiss Franc, February 24(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is finishing the week on a mixed note in choppy activity in narrow ranges. It is an apt way to finish this week, which has been largely directionless as investors wait for fresh incentives, and are especially looking toward Trump’s speech to a joint session of Congress next week. It is...

Read More »FX Daily, February 23: Dollar Chops About, as “Fairly Soon” Does not Mean mid-March

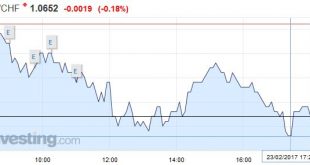

Swiss Franc EUR/CHF - Euro Swiss Franc, February 23(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF This week the House of Lords have been debating the issue of the Brexit bill and assuming there are no amendments made this could see a free run towards the triggering of Article 50 due to take place during March. This helped the Pound to hit its best rate to buy Swiss Francs in 2017 creating some...

Read More »FX Weekly Review, February 13 – 18: Why still long the dollar?

Swiss Franc Currency Index The Swiss Franc index was mostly unchanged against the U.S. Dollar Index in the last week. One word about Marc Chandler’s argumentation below: Three types of investors are long the dollar: FX investors/speculators are long the dollar because of the difference in monetary policy (e.g. higher US rates). Cash investors, for example rich people from China and other Emerging Markets, currently...

Read More »FX Weekly Review, February 06 – 11: Further Dollar and CHF Strength versus Euro weakness ahead?

Swiss Franc Currency Index The major information about the Swiss economy since the beginning of the year were: New record in exports and in the trade surplus, albeit mostly driven by a few sectors: pharmaceuticals and chemicals. Considerable improvement of the consumer sentiment Improvement of the UBS consumption indicator. While in 2015, the trade surplus still expanded, we see clear tendencies that in 2017 the...

Read More »FX Daily, February 09: Dollar Bounce in Asia is Sold in the European Morning

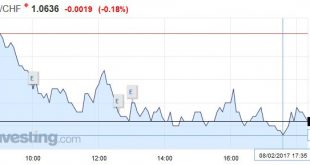

Swiss Franc EUR/CHF - Euro Swiss Franc, February 09(see more posts on EUR/CHF, ) - Click to enlarge Currency manipulation is becoming a hot topic now that Donald Trump has been inaugurated as the US President. Followers of his social media accounts will be aware of his criticism’s of a number of countries for artificially weakening their currency’s in order to remain competitive on a global scale, and recently...

Read More »FX Daily, February 08: EUR/CHF down to 1.630, Swiss Boom Starting?

Will EUR/CHF fall to 1.00 The reader might have seen the latest Swiss Consumer Sentiment and the UBS consumption indicator. They suggest that the Swiss boom phase should finally come. I anticipated the boom already in my slides for the CFA Society. The Swiss boom was postponed when the SNB decided to remove the euro peg in early 2015. What is the definition of a “boom”? It is economic activity mostly driven by...

Read More »FX Weekly Review, January 30 – February 04: Reversal of Trump Reflation Trade Continues

Swiss Franc Currency Index The Swiss Franc index remained around the 2% gain that for the last month, the recovery from the Trump reflation trade. In this trade, investors preferred U.S. against European stocks. This tendency, however, is reversing now – and with it the franc recovered. Trade-weighted index Swiss Franc, February 04(see more posts on Swiss Franc Index, ) Source: market.ft.com - Click to...

Read More »FX Daily, January 31: Markets Look for Solid Footing

Swiss Franc EUR/CHF - Euro Swiss Franc, January 31(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The immigration imbroglio in the United States is being cited in various accounts for the price action, including yesterday’s drop in the S&P 500, where the intraday loss was the largest since before the election. The drama is also being blamed for the dollar’s losses yesterday, which it is...

Read More »FX Weekly Review, January 23 – 28: Dollar Downwards and CHF Upwards Correction, for how long?

Swiss Franc Currency Index The Swiss Franc index has a solid performance of 2.5% in the last month, while the dollar index is down nearly 3%. Trade-weighted index Swiss Franc, January 28(see more posts on Swiss Franc Index, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency performance (see the currency basket)On a three...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org