Swiss Franc The Euro has fallen by 0.44% to 1.1877 CHF. EUR/CHF and USD/CHF, May 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates US 10-year rates are again probing the air above 3%, and this is encouraging a push back toward JPY110, with the euro slipping toward $1.19. Asian equities fell, with the MSCI Asia Pacific shedding 0.8%, the most in nearly a month, snapping a...

Read More »FX Daily, May 14: US Dollar Slips in Quiet Turnover

Swiss Franc The Euro has fallen by 0.10% to 1.1939 CHF. EUR/CHF and USD/CHF, May 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is sporting a softer profile against most of the major and emerging market currencies to start the new week. It already seemed to be tiring in the second half of last week. With today’s mild losses, Dollar Index is off for a...

Read More »FX Weekly Preview: Fed Can Look Through the Data Easier than the ECB and BOJ

Geopolitical issues will continue to bubble below the surface for the capital markets. The fallout from the reimposition of US sanctions on Iran has apparently helped lift oil prices in the face of the rising dollar, which often acts as a drag. In the coming days, the US will take the symbolic step of moving its embassy to Jerusalem. The conflict between Israel and Iranian forces in Syria is escalating. Meanwhile, US...

Read More »FX Daily, May 11: Dollar Momentum Sapped, Near-Term Pullback Likely

Swiss Franc The Euro has fallen by 0.11% to 1.1937 CHF. EUR/CHF and USD/CHF, May 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar pulled back following yesterday’s slightly softer than expected CPI report and this likely marks the beginning of a new phase, with the dollar moving lower. Investors have learned over the past two weeks that neither wages nor...

Read More »FX Daily, May 10: Kiwi Tumbles on Dovish RBNZ, While Sterling Goes Nowhere Ahead of BOE

Swiss Franc The Euro has risen by 0.18% to 1.1931 CHF. EUR/CHF and USD/CHF, May 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is consolidating in narrow trading against most of the major currencies as participants digest several developments ahead of what was expected to be the highlight today, the BOE meeting and US April CPI. The greenback’s...

Read More »FX Daily, May 09: Oil Prices Surge and Dollar Gains Extended Post Withdrawal Announcement

Swiss Franc The Euro has risen by 0.29% to 1.1914 CHF. EUR/CHF and USD/CHF, May 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is broadly higher as the 10-year yield probes above 3.0%. Disappointing French industrial production and manufacturing data for March provided additional incentive, as if it were needed, to extend the euro’s losses. The euro...

Read More »FX Daily, May 08: Dollar Races Ahead

Swiss Franc The Euro has fallen by 0.56% to 1.1885 CHF. EUR/CHF and USD/CHF, May 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s surge continues. The Dollar Index is testing the space above 93.00. A month ago it was below 90. It does not appear to require fresh developments. The market continues to trade as if there are short dollar positions that are...

Read More »FX Daily, May 07: Greenback Starts Week on Firm Note

Swiss Franc The Euro has risen by 0.08% to 1.1959 CHF. EUR/CHF and USD/CHF, May 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar recovered from a softer tone in early Asia and is higher against nearly all the major and emerging market currencies as North American market prepare to start the new week. The news stream is light and investors remain on edge...

Read More »FX Weekly Preview: Geopolitics Becomes More Salient as Monetary Policy Plays for Time

Say what one will, US President Trump is vigorously projecting what he believes are American interests. There is virtually no sign of the isolationism that many observers had anticipated. Indeed, as we have argued, the America First rejection of the League of Nations that Trump harkens back to was not isolationist as much as unilateralist. And the same is true of the Trump Administration. He is trying to get North Korea...

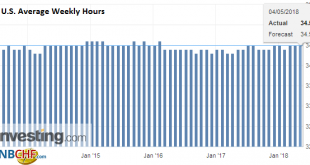

Read More »Look Past Disappointing Jobs Data, Luke

The US jobs report was broadly disappointing. However, the Federal Reserve will look through it and investors should too. A June hike is still by far the most likely scenario. The US created 164k net new jobs in April, and when coupled with the 32k upward revision in March, it was near expectations. The source of disappointment hourly earnings. March’s 2.7% year-over-year pace was revised to 2.6%, and there it remained...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org