The euro put in a low on May 29 a little above $1.15. That is nearly a 10.5 cent decline since the three-year high was set in mid-February. The thing that is difficult for investors and analysts to get their head around is that the speculators in the futures market, who as seen as proxies for trend-followers and momentum traders, continue to carry large euro exposure. Too many observers mistakenly focus on the net...

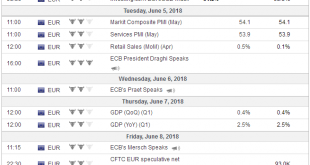

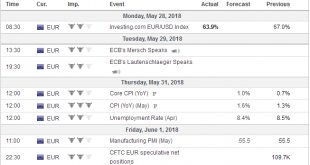

Read More »FX Daily, June 5: Sterling Jumps Ahead, While US Equities Have Small Coattails

Swiss Franc The Euro has fallen by 0.23% to 1.1526 CHF. EUR/CHF and USD/CHF, June 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are several euro options that expire today and are stacked every quarter of a cent from $1.1675 to $1.1750. The size of the options increase with the price beginning with 688 mln euros at $1.1675, then 775 euros at $1.17, 1.1 bln euros...

Read More »FX Weekly Preview: Macro Matters Now, Just Not the Data

The main concerns of investors do not arise from the high-frequency data that are due in the coming days. Last week, the somewhat firmer than expected preliminary May CPI for the EMU failed to bolster the euro. The stronger than expected US jobs data, even if tipped by the President of the United States, and the pendulum of market sentiment swinging back in favor of two more Fed rate hikes this year did not trigger new...

Read More »FX Daily, June 01: Ironic Twists to End the Tumultuous Week

Swiss Franc The Euro has risen by 0.30% to 1.1558 CHF. EUR/CHF and USD/CHF, June 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The week is ending quite a bit different than it began. The main banking concern is not in Italy but in German, where shares in Deutsche Bank shares fell to a record low yesterday, and S&P Global cut its credit rating one step to BBB+...

Read More »Great Graphic: Euro Bulls Stir but Hardly Shaken

Summary: Euro has fallen 10.5 cents since mid-February. Net speculative longs in the futures market remain near record. Gross long euros have actually increased over the past month. When one trades futures, one declares whether one has an underlying business need, in which case one is considered a commercial. If no underlying business need exists, one is classified as a non-commercial, which in the vernacular of...

Read More »FX Daily, May 31: Don’t Confuse Calmer Markets with Resolution

Swiss Franc The Euro has fallen by -0.42% to 1.1485 CHF. EUR-CHF and USD-CHF, May 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets that were in panic mode on Tuesday stabilized yesterday, and corrective forces have carried into today’s activity. However, the underlying issues in Italy and Spain are hardly clarified in the past 48 hours. ...

Read More »FX Daily, May 30: Italian Reprieve, Euro Bounces, Trade Tensions Rise

Swiss Franc The Euro rise by 0.38% to 1.1479 CHF. This is the fifth day in sequence that the Swiss Franc appreciated. EUR/CHF and USD/CHF, May 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After what could be described as a 15-sigma event yesterday in the Italian bond market, a reprieve today has seen the euro recover a cent from yesterday’s lows. While the...

Read More »What Happened Monday?

Italian politics dominated Monday’s activity. Initially, the euro reacted positively in Asia to news that the Italian President had blocked the proposed finance minister. A technocrat government would be appointed to prepare for new elections. The euro reversed course by midday in Asia, several hours before European markets opened. The move accelerated and by midday in Europe, with London markets on holiday as well as...

Read More »FX Weekly Preview: Political Crises in Europe Rivals Economic Data and Trade to Drive Capital Markets

The end of the Greek assistance program that allowed them to keep their primarily official creditors whole, and the broad expansion in the eurozone, was supposed to usher in a new period of convergence. Monetary union was once again feted as a success, and some observers were forecasting a substantial increase in the euro as a reserve asset. Instead, the economy lost momentum, core inflation returned to its trough,...

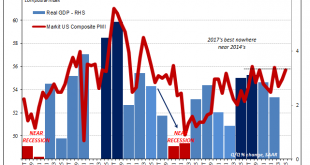

Read More »The Currency of PMI’s

Markit Economics released the flash results from several of its key surveys. Included is manufacturing in Japan (lower), as well as composites (manufacturing plus services) for the United States and Europe. Within the EU, Markit offers details for France and Germany. Given the nature of sentiment surveys, we tend to ignore these most months unless they suggest either pending changes or extremes. Beginning with the US,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org