On April 2, the benchmark 10-year US Treasury yield traded below 2.75%. It had been as high as 2.94% in later February at the tail end of last year’s inflation hysteria. But after the shock of global liquidations in late January and early February, liquidity concerns would override again at least for a short while. After April 2, the BOND ROUT!!!! was re-energized and away went interest rates. Between that date and May...

Read More »FX Daily, October 04: Dollar Consolidates Gains while Yields Continue to Rise

Swiss Franc The Euro has risen by 0.29% at 1.1419 EUR/CHF and USD/CHF, October 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is consolidating yesterday’s gains against most of the major currencies, though the dollar bloc is underperforming. Bond yields are moving higher, and equities are lower. With a light data and events stream, the price action itself...

Read More »FX Daily, October 02: Greenback Advances

Swiss Franc The Euro has fallen by 0.32% at 1.135 EUR/CHF and USD/CHF, October 02(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is rising against most of the major and emerging market currencies. The Swiss franc and the Japanese yen are the exceptions and are holding their own. Global equities are mixed. Asia, excluding Japan, was mostly lower,...

Read More »A Word About the Q2 COFER Report

The IMF reports the most authoritative currency allocation of global reserves at the end of every quarter with a quarter delay. Invariably, an economist, strategist, or journalist is inspired to write why some data nugget confirms the demise of the dollar as the dominant currency. Given the unorthodox US President, his criticism of Fed policy, and desire for a weaker dollar, the protectionism, and trillion-dollar...

Read More »FX Daily, October 01: NAFTA Deal Struck, Softer EMU Mfg PMI, and Firm Greenback Starts Week

Swiss Franc The Euro has risen by 0.16% at 1.1415 EUR/CHF and USD/CHF, October 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Canadian dollar and Mexican peso are extending its pre-weekend gains on news that a new NAFTA deal (US-Mexico-Canada Agreement USMCA) has been struck. Against most of the other major and emerging market currencies, the US dollar...

Read More »FX Daily, September 28: Dollar Remains Firm While Italy is Punished

Swiss Franc The Euro has fallen by 0.49% at 1.1317 EUR/CHF and USD/CHF, September 28(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar’s post-Fed gains have been extended, though the upside momentum appears to be stalling. Japan’s Nikkei advanced 1.35% on the back of the yen’s declines and reached its highest level since 1991. Chinese shares (A and H)...

Read More »FX Daily, September 26: The Dollar Index has Fallen Four of the Five Times the FOMC met this Year

Swiss Franc The Euro has risen by 0.13% at 1.1373 EUR/CHF and USD/CHF, September 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is trading with a softer bias in tight ranges. The euro and sterling have been confined to yesterday’s ranges, while the greenback briefly traded above JPY113.00 for the first time in two months. The South African rand and Turkish...

Read More »FX Daily, September 25: Greenback Remains at the Fulcrum

Swiss Franc The Euro has risen by 0.35% at 1.137 EUR/CHF and USD/CHF, September 25(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The major currencies are mixed in quiet turnover. Most of the European currencies are firmer, while the dollar-bloc currencies, yen and Swiss franc are softer. Emerging market currencies are steady to higher, though there are a few...

Read More »FX Weekly Preview: Next Week’s Drivers

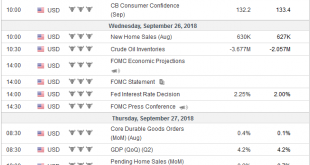

It is a testament to the Federal Reserves communication and the evolution of investors’ understanding that we can say that the rate hike that the central bank will deliver is not as important as what it says. A rate hike is a foregone conclusion. According to the CME’s model, there is about an 85% chance of December hike discounted as well. The effective Fed funds rate is 1.92% with the target range of 1.75%-2.00%. The...

Read More »FX Daily, September 20: The Mixed Performance Makes it Difficult to Talk about The Dollar

Swiss Franc The Euro has fallen by 0.40% at 1.1244 EUR/CHF and USD/CHF, September 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro poked through $1.18 for the first time since the June ECB meeting. There is an option for about 740 mln euros that expires there today and another at $1.1775 for 890 mln euros. That June high was near $1.1850, which was a five-high. If...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org