ABN Amro, Natixis and Wells Fargo have issued bearish calls on gold. Natixis even expects three Fed rate hikes next year. Pater Tanebrarum discusses these opinions critically.Since gold is correlated to CHF, this is a bearish for the Swiss Franc, too. One additional points speaks against a rate hike. The U.S. capacity utilization that is 75% compared to 90% in 1967. So Far a Normal Correction In last week’s update...

Read More »Ganging Up on Gold

So Far a Normal Correction In last week’s update on the gold sector, we mentioned that there was a lot of negative sentiment detectable on an anecdotal basis. From a positioning perspective only the commitments of traders still appeared a bit stretched though, while from a technical perspective we felt that a pullback to the 200-day moving average in both gold and gold stocks shouldn’t be regarded as anything but a...

Read More »FX Weekly Preview: Four Key Events in the Week Ahead

United States Of the forces driving prices in the week ahead, events appear more important than economic reports. There are four such events that investors must navigate. The Bank of Canada and the European Central Bank meet. The UK High Court will deliver its ruling on the role of Parliament in Brexit. The rating agency DBRS updates its credit rating for Portugal. The Bank of Canada is not going to change interest...

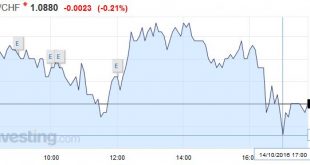

Read More »FX Daily, October 14: Firm Dollar Consolidating, Awaiting US Retail Sales

Swiss Franc EUR/CHF - Euro Swiss Franc, October 14 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is firm against most of the major currencies, but within yesterday’s ranges, which seems somewhat fitting amid the light new stream. The high-yielding Australian and New Zealand dollars are resisting the stronger greenback, while on the week the Aussie and the Canadian dollar are the...

Read More »FX Daily, October 05: Euro Remains Firm Despite Dubious Tapering Story

Swiss Franc EUR/CHF - Euro Swiss Franc, October 05 2016. Federal Reserve While the markets can be an incredibly efficient discounting mechanism, it sometimes is also an echo chamber. What began off as a Bloomberg report indicated that there was an agreement at the ECB that when it decided to end its asset purchases, it would gradually taper back rather than come to a fast stop, by the end of the day, it had...

Read More »FX Daily, September 28: Dollar Mostly Firmer, but Going Nowhere Quickly

Swiss Franc Click to enlarge. FX Rates The US dollar is enjoying a firmer bias today, but it remains narrowly mixed on the week. It is within well-worn ranges. Of the several themes that investors are focused on, there have not significant fresh developments. In terms of monetary policy, both Draghi and Yellen speak today. The former is behind closed doors with a Germany parliamentary committee. While Draghi’s...

Read More »FX Daily, September 27: US Debate Lifts Peso, but Leaves the Dollar Non-Plussed

Swiss Franc Click to enlarge. FX Rates The first US Presidential debate may not sway many voters but has lifted the Mexican peso. The peso, which has fallen by about 1.3% over the past two sessions, has stormed by 1.5% today as the seemingly biggest winner of the debate. Snap polls immediately following the debate gave the edge to Clinton. FX Performance, September 27Source Dukascopy. Click to enlarge....

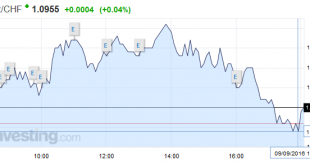

Read More »FX Daily, September 9: Ahead of the Weekend

(Dublin business trip is ending, London next week, sporadic posts to continue) Swiss Franc Click to enlarge. FX Rates The US dollar is lower against all the major currencies this week as North American participants close it out. On the day, the dollar is consolidating swings yesterday and is narrowly mixed. Bond yields are higher and equities are mostly lower. The euro has finished lower the last three Fridays....

Read More »Swiss stocks fluctuate as central bank decisions dominate the landscape

SMI The Swiss Market Index, along with other European markets, fluctuated this week as central bank decisions dominated the landscape. Click to enlarge. Economic Data Equity markets advanced at the beginning of the week as chances of the Federal Reserve raising US interest rates later this month declined after a surprisingly weak report on the US service-sector earlier this week. The report followed data last week...

Read More »FX Daily, August 19: Dollar Recovers into the Weekend

Swiss Franc: In the real effective exchange rate calculation, the PPI plays an important role. The Swiss producer price index fell by 0.8% YoY, while the German one is down 2.0%. Thismeans that in 2016 the CHF overvaluation is rising, when compared to the major Swiss trading partner Germany. The values for 2015 were -6% for the Swiss and -2.5% for Germany, the CHF overvaluation was reduced. Click to enlarge. Source...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org