The value of cryptocurrencies like bitcoin, just like any other kind of money, comes fundamentally from what you can do with it. As a follow up to What Backs Bitcoin, I want to dig into that value. The idea, which comes from Austrian economist Carl Menger, is that just as a shovel’s value comes from its ability to dig, a currency’s value comes from its ability to help you do two things: transactions and savings. Think...

Read More »New Gold-Backed Debit Card Launched In Partnership With MasterCard

In recent years, there has been a major debate about the respective merits of gold versus Bitcoin, even though many, not all, gold bulls are also supporters of the latter. Gold advocates generally view favourably Bitcoin’s inherent characteristics of decentralisation, finite supply and ability to operate (so far) outside of the usual interference by western central banks. Having said that, the launch of Bitcoin futures...

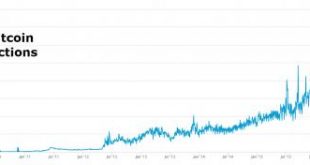

Read More »Each Bitcoin Transaction Uses As Much Energy As Your House In A Week

While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic. All it took was a Powerpoint presentation,...

Read More »Each Bitcoin Transaction Uses As Much Energy As Your House In A Week

While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic. All it took was a Powerpoint presentation, some computer programming expertise and a “research” report,...

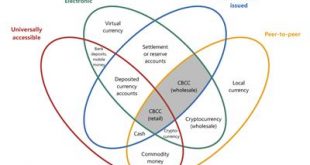

Read More »Arguments for Interest Paying, Account Based, CBDC

In an NBER working paper and a column on VoxEU, Michael Bordo and Andrew Levin make the case for central bank issued digital currency (CBDC). Bordo and Levin favor an account-based CBDC system (managed or supervised by the central bank) rather than central bank issued tokens in the blockchain. They emphasize the Friedman rule and the fact that interest paying CBDC affords the possibility to satisfy the rule: These … goals – … a stable unit of account and an efficient medium of exchange –...

Read More »A Taxonomy of Money

In a BIS Quarterly Review article, Morten Bech and Rodney Garratt offer a taxonomy of money, with special emphasis given to central bank issued digital and crypto currency. They stress four dimensions: issuer (central bank or other); form (electronic or physical); accessibility (universal or limited); and transfer mechanism (centralised or decentralised). The taxonomy defines a CBCC as an electronic form of central bank money that can be exchanged in a decentralised manner known as...

Read More »Should a Central Bank Issue Cryptocurrency?

On Alphaville, Izabella Kaminska asks why a central bank would want to issue cryptocurrency rather than conventional digital currency. … if anonymity is not the objective of issuing a centrally supervised cryptocurrency, what really is the point of using blockchain or crypto technology? Just issue a conventional digital currency and be done with it. If, on the other hand, anonymity is the objective of issuing a centrally supervised cryptocurrency, how can this be justified by a central...

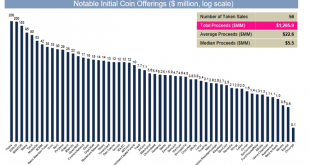

Read More »Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver Latest developments show risks in crypto currencies Confusion as bitcoin may split tomorrow SEC stepped into express concern over ICOs ICOs have so far raised $1.2 billion in 2017 ICOs preying on lack of understanding from investors Physical gold not vulnerable to technological risk Beauty and safety in simplicity of gold and silver Forks and ICOs solves bitcoin v...

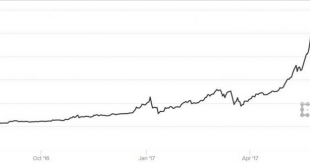

Read More »Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

– Bitcoin volatility shows not currency or safe haven but speculation – Volatility still very high in bitcoin and crypto currencies (see charts) – Bitcoin fell 25% over weekend; Recent high of $3,000 fell to below $1,900 – Bitcoin least volatile of cryptos, around 75% annualised volatility – Gold much more stable at just 10% annualised volatility – Bitcoin volatility against USD about 5-7 times vol of traditional...

Read More »Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term - Bitcoin volatility shows not currency or safe haven but speculation- Volatility still very high in bitcoin and crypto currencies (see charts)- Bitcoin fell 25% over weekend; Recent high of $3,000 fell to below $1,900- Bitcoin least volatile of cryptos, around 75% annualised volatility- Gold much more stable at just 10% annualised volatility- Bitcoin volatility against USD about 5-7 times vol of traditional...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org