Senior population is expected to grow to more than 2 billion people by 2050. Aging society means gains for companies focused on seniors: healthcare and insurance sectors are expected to benefit in particular. The population aging is a global fact. It will strongly influence markets and economies...

Read More »Sources of Low Real Interest Rates

In a (December 2015) Bank of England Staff Working Paper, Lukasz Rachel and Thomas Smith dissect the global decline in long-term real interest rates over the last thirty years. A summary of their executive summary: Market measures of long-term risk-free real interest rates have declined by around 450bps. Absent signs of overheating this suggests that the global neutral rate fell. Expected trend growth as well as other factors affecting desired savings and investment determine the neutral...

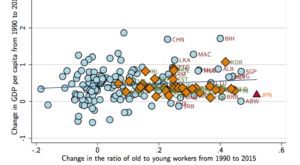

Read More »Ageing Economies Grew Faster

That’s what Daron Acemoglu and Pascual Restrepo document in an NBER working paper. Figure 2 [below] provides a glimpse of the relevant pattern by depicting the raw correlation between the change in GDP per capita between 1990 and 2015 and the change in the ratio of the population above 50 to the population between the ages of 20 and 49. … even when we control for initial GDP per capita, initial demographic composition and differential trends by region, there is no evidence of a negative...

Read More »Determinants of (Low) Real Interest Rates

On his blog, James Hamilton summarizes a Bank of England working paper by Lukasz Rachel and Thomas Smith on the determinants of low real interest rates.

Read More »“Fehldiagnose Secular Stagnation (Secular Stagnation Skepticism),” FuW, 2016

Finanz und Wirtschaft, November 23, 2016. PDF. The diagnosis is far from clear. Nor is the therapy.

Read More »When It Comes To Household Income, Sweden & Germany Rank With Kentucky

Submitted by Ryan McMaken via The Mises Institute, Annual Median Equivalized Disposable Household Income in USD Last year, I posted an article titled “If Sweden and Germany Became US States, They Would be Among the Poorest States” which, produced a sizable and heated debate, including that found in the comments below this article at The Washington Post. The reason for the controversy, of course, is that it has nearly...

Read More »Yellen and Fischer Still Singing from the Same Song Book

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: Many see Yellen and Fischer at odds over benefits of high pressure economy. However, this fails to put the comments in the proper context–same message different styles. They are arguing against the doves who don’t want to hike this year. Many observers are...

Read More »Financial Repression Is Now “In Play”

Submitted by Gordon T Long via FinancialRepressionAuthority.com, A FALLING MARKET CANNOT BE ALLOWED – at any cost! The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment, excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and...

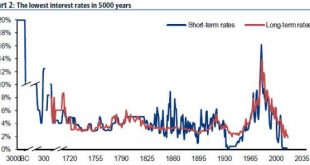

Read More »Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML’s Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financial assets, interest rates & bond yields, economic growth, inflation & debt… The Longest Pictures reveals the astonishing history investors are living through...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org