Our earlier articles on bitcoin discuss the crypto asset as a currency and a commodity. Both papers focused on the consequences of bitcoin’s defining feature: the asymptotic supply limit of 21 million coins. This gives it an unusual juxtaposition of demand uncertainty and supply certainty (as well as inelasticity). As a currency, it gives rise to a tension between its use as a store of value and as medium of exchange....

Read More »Each Bitcoin Transaction Uses As Much Energy As Your House In A Week

While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic. All it took was a Powerpoint presentation,...

Read More »Each Bitcoin Transaction Uses As Much Energy As Your House In A Week

While Bitcoin bulls will probably never have it so good as they have in 2017, we wonder whether many of them have stopped to think about the environmental downside of this roaring bull market. After all, back in the dot.com boom, people had ideas about potential internet businesses, issued pieces of paper representing ownership and watched their prices go parabolic parabolic. All it took was a Powerpoint presentation, some computer programming expertise and a “research” report,...

Read More »“Fiscal Federalism, Grants, and the U.S. Fiscal Transformation in the 1930s” UoCH, 2017

University of Copenhagen, Department of Economics Discussion Paper 17-18, July 2017, with Martin Gonzalez-Eiras. PDF. We propose a theory of tax centralization and intergovernmental grants in politico-economic equilibrium. The cost of taxation differs across levels of government because voters internalize general equilibrium effects at the central but not at the local level. The equilibrium degree of tax centralization is determinate even if expenditure-related motives for centralization...

Read More »The World’s Largest ICO Is Imploding After Just 3 Months

Earlier this summer, Tezos smashed existing sales records in the white-hot IPO market after the company’s pitch to build a better blockchain for cryptocurrencies made it one of the buzziest ICOs in the world. As we noted at the time, the company capitalized on that buzz by courting VC firms and other institutional investors with a $50 million token pre-sale. After the company opened up selling to the broader public,...

Read More »Does Decentralized Intermediation Add Value?

On the FT’s Alphaville blog, Izabella Kaminska questions the value of decentralization (and thus, blockchain technology) in intermediation. Decentralisation is, in almost all cases, not an efficiency. To the contrary, it’s a cost that adds complexity and creates an unnecessary burden for both users and operators unless centralised layers are added on top of it — defying the whole point. … At the end of the day, there are only two groups of people prepared to go to costly lengths to...

Read More »“Causes of the Transformation of the US Fiscal System in the 1930s,” VoxEU, 2016

VoxEU, October 11, 2016, with Martin Gonzalez-Eiras. HTML. The US fiscal system underwent a radical transformation around the time of the Great Depression. Perceived cost differences of revenue collection across levels of government, due to general equilibrium effects, can partly explain the rise of tax centralization and intergovernmental grants. We develop a micro-founded general equilibrium model that blends politics and macroeconomics. (See the working paper.)

Read More »“Fiscal Federalism, Taxation and Grants,” CEPR, 2016

CEPR Discussion Paper 11482, August 2016, with Martin Gonzalez-Eiras. PDF. Also published as CESifo Working Paper 6062, Study Center Gerzensee Working Paper 16-05. PDF, PDF. We propose a theory of tax centralization and inter governmental grants in politico-economic equilibrium. The cost of taxation differs across levels of government because voters internalize general equilibrium effects at the central but not at the local level. This renders the degree of tax centralization and the tax...

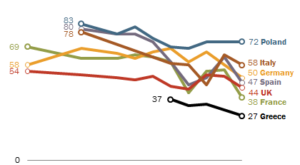

Read More »Skeptical Europeans

According to a Pew Research Center survey, Poles and Hungarians hold the most favorable view of the European Union. In most countries, attitudes have become more skeptical.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org