The Economics textbook says that when faced with a downturn, the central bank turns to easing and the central government starts borrowing and spending. This combined “stimulus” approach will fill in the troughs without shaving off the peaks; at least according to neo-Keynesian doctrine. The point is to raise what these Economists call aggregate demand. If everyday folks don’t want to spend – because a lot of them can’t – then the government will spend on their...

Read More »That Can’t Be Good: China Unveils Another ‘Market Reform’

The Chinese have been reforming their monetary and credit system for decades. Liberalization has been an overriding goal, seen as necessary to accompany the processes which would keep the country’s economic “miracle” on track. Or get it back on track, as the case may be. Authorities had traditionally controlled interest rates through various limits and levers. It wasn’t until October 2004, for example, that the upper limit on lending rates was rescinded. In August...

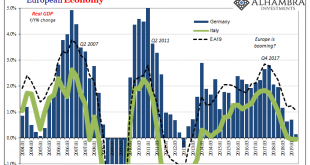

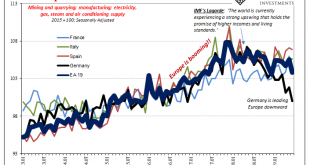

Read More »Some Brief European Leftovers

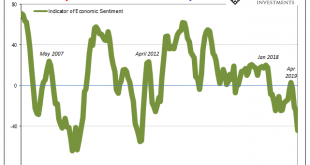

Some further odds and ends of European data. Beginning with Continent-wide Industrial Production. Germany is leading the system lower, but it’s not all just Germany. And though manufacturing and trade are thought of as secondary issues in today’s services economies, the GDP estimates appear to confirm trade in goods as still an important condition and setting for all the rest. The weakness is persisting and intensifying – particularly after May 2019. Europe...

Read More »Retail Sales’ Amazon Pick Up

The rules of interpretation that apply to the payroll reports also apply to other data series like retail sales. The monthly changes tend to be noisy. Even during the best of times there might be a month way off trend. On the other end, during the worst of times there will be the stray good month. What matters is the balance continuing in each direction – more of the good vs. more of the bad. Or when what seems to be a good month is less good than it used to be....

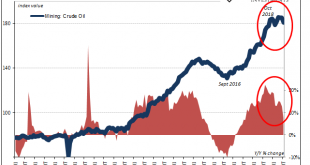

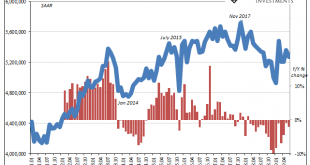

Read More »US Industrial Downturn: What If Oil and Inventory Join It?

Revised estimates from the Federal Reserve are beginning to suggest another area for concern in the US economy. There hadn’t really been all that much supply side capex activity taking place to begin with. Despite the idea of an economic boom in 2017, businesses across the whole economy just hadn’t been building like there was one nor in anticipation of one. The only place where there was a truly robust trend was the oil patch. Since the last crash a few years ago,...

Read More »The Path Clear For More Rate Cuts, If You Like That Sort of Thing

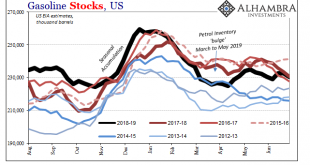

If you like rate cuts and think they are powerful tools to help manage a soft patch, then there was good news in two international oil reports over the last week. The US Energy Information Administration (EIA) cut its forecast for global demand growth for the seventh straight month. On Friday, the International Energy Agency (IEA) downgraded its estimates for the third time in four months. That wasn’t all, as the EIA’s report focused in on some more sobering aspects...

Read More »Why You Should Care Germany More and More Looks Like 2009

What if Germany’s economy falls into recession? Unlike, say, Argentina, you can’t so easily dismiss German struggles as an exclusive product of German factors. One of the most orderly and efficient systems in Europe and all the world, when Germany begins to struggle it raises immediate questions about everywhere else. This was the scenario increasingly considered over the second half of 2018 and the first few months of 2019; whether or not recession. Over the past...

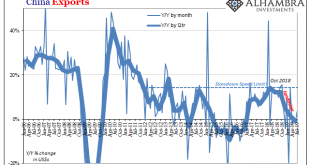

Read More »The Myth of CNY DOWN = STIMULUS Won’t Die

On the one hand, it’s a small silver lining in how many even in the mainstream are beginning to realize that there really is something wrong. Then again, they are using “trade wars” to make sense of how that could be. For the one, at least they’ve stopped saying China’s economy is strong and always looks resilient no matter what data comes out. Even after all that supposed “stimulus” starting in the middle of last year...

Read More »Real Estate Perfectly Sums Up The Rate Cuts

It’s only a confusing when you just accept the booming economy of the unemployment rate. From this perspective, 2018 was, and more so 2019 is, a downright conundrum. By all mainstream accounts, this just shouldn’t be happening. Home sales are running at a pace similar to 2015 levels – even with exceptionally low mortgage rates, a record number of jobs and a record high net worth in the country. Not only that, 2015...

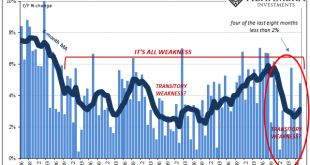

Read More »US Economic Crosscurrents Reach the 50 Mark

In the official narrative, the economy is robust and resilient. The fundamentals, particularly the labor market, are solid. It’s just that there has arisen an undercurrent or crosscurrent of some other stuff. Central bankers initially pointed the finger at trade wars and the negative “sentiment” it creates across the world but they’ve changed their view somewhat. A few billion in tariffs, even if we include what is to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org