USD/CHF EUR/CHF EUR/CHF and USD/CHF, October 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge USD/JPY [embedded content] USD/JPY with Technical Indicators, October 2 - Click to enlarge EUR/USD [embedded content] EUR/USD with Technical Indicators, October 2 - Click to enlarge GBP/USD [embedded content] GBP/USD with Technical Indicators, October 2 - Click to...

Read More »Weekly Technical Analysis: 25/09/2017 – USDJPY, EURUSD, GBPUSD, NZDUSD

USD/CHF EUR/CHF EUR/CHF and USD/CHF, September 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge EUR/USD [embedded content] USD/JPY [embedded content] GBP/USD [embedded content] NZD/USD [embedded content] Related posts: FX Weekly Review, August 28 – September 02: The end of big euro rise? FX Weekly Review, June 26 – July 01:...

Read More »Bi-Weekly Economic Review: As Good As It Gets

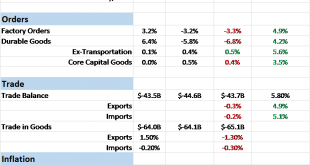

The incoming economic data hasn’t changed its tone all that much in the last several years. The US economy is growing but more slowly than it once did and we hope it does again. It is frustrating for economic bulls and bears, never fully satisfying either. Probably more important is the frustration of the average American, a dissatisfaction with the status quo that permeates the national debate. The housing bubble...

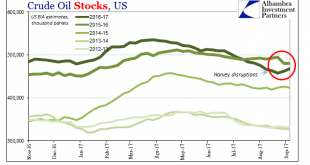

Read More »Harvey’s Muted (Price) Impact On Oil

The impact of Hurricane Harvey on the Gulf energy region is becoming clear. There have been no surprises to date, even though the storm did considerable damage and shuttered or disrupted significant capacity. Most of that related to gasoline, which Americans have been feeling in pump prices. According to the US Department of Energy, as of August 31, 10 refineries had been shut down with a combined capacity of 3.01...

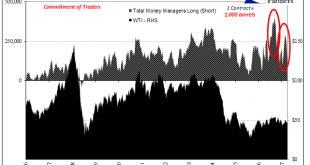

Read More »COT Report: Black (Crude) and Blue (UST’s)

Over the past month, crude prices have been pinned in a range $50 to the high side and ~$46 at the low. In the futures market, the price of crude is usually set by the money managers (how net long they shift). As discussed before, there have been notable exceptions to this paradigm including some big ones this year. It was earlier in February when money managers piled in to WTI longs, apparently expecting better things...

Read More »FX Weekly Review, September 04 – 09: Draghi Dovish? EUR and USD falling against CHF

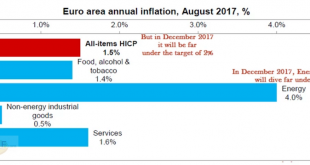

EUR/CHF The euro rose close to CHF 1.15 with the ECB meeting this week. Finally traders realized that the ECB committed not to hike rates for a very long time. The ECB will review and take a first decision on the bond purchasing program this autumn. However, this program will come to an end only when the inflation target of 2% becomes in reach. Strangely the EUR/CHF reacted with losses only on Friday. Where will Euro...

Read More »FX Weekly Review, August 28 – September 02: The end of big euro rise?

EUR/CHF Let us remember why the euro has risen from 1.08 to 1.14 between June and August: Hopes that the French president Macron will help the French economy, similarly to the Trump reflation trade. Hopes that the ECB will finish their bond buying program earlier combined with quite good economic data. We are of the opinion that both points may be illusionary. The euro should not rise further. Politicians cannot...

Read More »FX Weekly Review, August 21 – August 26: Dollar Loses its Gains Against CHF

USD/CHF The dollar had some gains versus the franc during the last month, but it lost all during the last days. EUR/CHF The euro is still around 1.14, this is up 2.5% against one month ago. The rising momentum for EUR/CHF, however, seems to be fading. EUR/CHF and USD/CHF, August 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3...

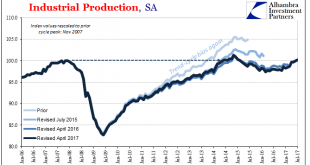

Read More »United States: Lack Of Industrial Momentum Is (For Now) Big Auto Problems

Industrial Production disappointed in the US last month, dragged down by auto production. Despite the return of an oil sector tailwind, IP was up just 2.2% year-over-year in July 2017 according to Federal Reserve statistics. It marks the fourth consecutive month stuck around 2% growth. The lack of further acceleration is unusual in the historical context, especially following an extended period of contraction. This...

Read More »FX Weekly Review, August 14 – August 19: CHF Recovers after Dovish Draghi Comments

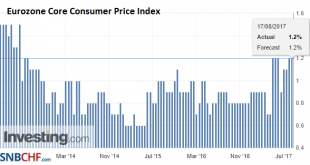

Overview The euro has lost some momentum versus the franc, the main reason is as usual monetary policy: Draghi does not want to talk about an early end of his bond buying programming at Jackson Hole. This had been confirmed by economic data: only 1.2% core inflation compared to a long-term inflation target of 2%. Consequently the Swissie appreciated during the week. Eurozone Core Consumer Price Index (CPI) YoY, Jul...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org