Swiss Franc Currency Index With last Friday’s break-down of the dollar, the Swiss Franc index could recover a bit. Its loss over December is now 1%. But the dollar index had a gain of 2%. Trade-weighted index Swiss Franc, December 30(see more posts on Swiss Franc Index, ) Source: FT.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted currency...

Read More »FX Weekly Review, December 19 – December 23: Assessment of the Dollar’s Technical Condition

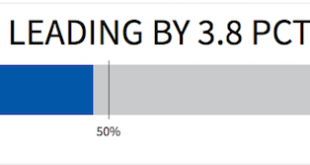

While few will be trading in the week between Christmas and New Years, we thought it might be helpful to review the dollar’s technical condition. We make two overall points. First, although the dollar’s rally strengthened and extended after the November US election, this leg up of the dollar’s longer-term rally began at the end of Q3. The anticipation of new policies by the Trump Administration, part of the story,...

Read More »FX Weekly Review, December 05 – December 09: Dollar Bulls Running Out of Time to See Parity vs Euro in 2016

Swiss Franc Currency Index The Swiss Franc index remained in a losing position compared to the dollar index. However since November 25, it has remained stable. Given that the ECB extended the QE period, the EUR/CHF has fallen to 1.0730 again. Trade-weighted index Swiss Franc, December 09(see more posts on Swiss Franc Index, ) Source: FT.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss...

Read More »FX Weekly Review, December 05 – December 09: Dollar Bulls Running Out of Time to See Parity vs Euro in 2016

Swiss Franc Currency Index The Swiss Franc index remained in a losing position compared to the dollar index. However since November 25, it has remained stable. Given that the ECB extended the QE period, the EUR/CHF has fallen to 1.0730 again. Trade-weighted index Swiss Franc, December 09(see more posts on Swiss Franc Index, ) Source: FT.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss...

Read More »Why Krugman, Roubini, Rogoff And Buffett Hate Gold

Why Krugman, Roubini, Rogoff And Buffett Dislike Gold By Jan Skoyles Edited by Mark O’Byrne A couple of weeks ago an article appeared on Bitcoin Magazine entitled ‘Some economists really hate bitcoin’. I read it with a sigh of nostalgia. As someone who has been writing about gold for a few years, I am used to reading similar criticisms as those bitcoin receives from mainstream economists, about gold. As with...

Read More »FX Daily, June 28: Markets Stabilize on Turn Around Tuesday

The global capital markets are stabilizing for the first time since the UK referendum. It is not uncommon for markets to move in the direction of underlying trends on Friday’s; see follow-through gains on Monday, and a reversal on Tuesday. That is what is happening today. Turnaround Tuesday after such dramatic price action over the last two sessions has the feel of the proverbial dead cat bounce. Brexit There has...

Read More »Rule Britannia

A Glorious Day What a glorious day for Britain and anyone among you who continues to believe in the ideas of liberty, freedom, and sovereign democratic rule. The British people have cast their vote and I have never ever felt so relieved about having been wrong. Against all expectations, the leave camp somehow managed to push the referendum across the center line, with 51.9% of voters counted electing to leave the...

Read More »The EU Begins to Splinter, a new Tsunami for Kuroda

Dark Social Mood Tsunami Washes Ashore Early this morning one might have been forgiven for thinking that Japan had probably just been hit by another tsunami. The Nikkei was down 1,300 points, the yen briefly soared above par. Gold had intermittently gained 100 smackers – if memory serves, the biggest nominal intra-day gain ever recorded (with the possible exception of one or two days in early 1980). Here is a...

Read More »Central Bankers Around The Globle Scramble To Defend Markets: BOE Pledges $345BN; ECB, Others Promise Liquidity

There was a reason why we warned readers two days ago that "The World's Central Bankers Are Gathering At The BIS' Basel Tower Ahead Of The Brexit Result": simply enough, it was to facilitate an immediate response when a worst-cased Brexit vote hit. And that is precisely what has happened today in the aftermath of the historic British decision to exit the EU. It started, as one would expect, with Mark Carney who said the Bank of England is ready to pump billions of pounds into the financial...

Read More »JPMorgan CIO Crushes Cameron’s Scaremongery: Brexit “Hardly The Stuff Of Economic Calamity”

First The Telegraph, then The Sun, and today The Spectator all came out on the “Leave” side of the Brexit debate. However, perhaps even more shocking to the establishment is the CIO of a major bank’s asset management arm dismissing the apparent carnage that Cameron, Obama, and Osborne have declared imminent, warning that, “many articles on the Brexit vote overstate its risks and consequences.” As JPM’s Michael...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org