There have been three general issues that the macro-fundamental picture has revolved around this year: trade, growth, and Brexit. On all three counts, conventional wisdom seems unduly optimistic, and this may have helped dampen volatility. A series of signals suggest that the US and China remain far apart in trade negotiations. The US wants China to promise to increase agriculture imports from American farms to more than twice the 2017 peak. Not only is China...

Read More »FX Daily, November 20: Dollar Snaps Back

Swiss Franc The Euro has risen by 0.14% to 1.0984 EUR/CHF and USD/CHF, November 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The idea that a US-China trade deal is proving more elusive than the agreement in principle on October 11 implied is being seized upon to spur what we suspect is an overdue round of profit-taking in global equities. The MSCI Asia Pacific Index snapped a three-advance, with over 1%...

Read More »FX Daily, November 19: Hong Kong Stocks Rally as Stand-Off Continues

Swiss Franc The Euro has risen by 0.25% to 1.0981 EUR/CHF and USD/CHF, November 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The run-up in equities continues to be the dominant development in the capital markets. Although the Japanese and South Korean bourses fell, the rise in Australia, China, Hong Kong, and Taiwan underpin the MSCI Asia Pacific Index. The Hang Seng’s gains (1.5% on top of yesterday’s...

Read More »FX Daily, November 18: Sterling Shines in Subdued Start to the New Week

Swiss Franc The Euro has unchanged by 0.00% to 1.0935 EUR/CHF and USD/CHF, November 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Equities in Europe and the US look to extend their six-week rally, while the MSCI Asia Pacific Index gets back on the winning way after stumbling last week. Despite the escalation of the conflict in Hong Kong, the Hang Seng rose 1.35% to lead the region and recoup a chunk of last...

Read More »FX Daily, November 15: Market Runs with US Line that US-China Deal is Close

Swiss Franc The Euro has risen by 0.39% to 1.0929 EUR/CHF and USD/CHF, November 15(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Comments by US presidential adviser Kudlow playing up the prospects of a trade agreement between the US and China, with other reports suggesting a key call be held today, is helping to underpin sentiment into the weekend. The MSCI Asia Pacific Index pared this week’s loss today, with...

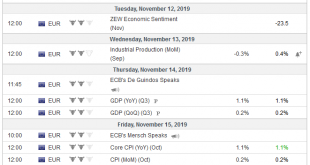

Read More »FX Daily, November 12: Farage Declares Truce with Tories after being Offered a Peerage, Underpins Sterling

Swiss Franc The Euro has risen by 0.01% to 1.0958 EUR/CHF and USD/CHF, November 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Global capital markets are calm as investors look for a new catalyst. The MSCI Asia Pacific Index snapped back after posting its first back-to-back decline in a month. All the equity markets were higher, but Australia. The Nikkei, Kospi, and Taiex led the advance with about a 0.8%...

Read More »FX Weekly Preview: Caution: Prices Diverging from Macro Drivers

Sometimes the news drives the markets and but now it seems that the markets are driving the news. The dramatic swing in market sentiment from fearing a repeat of Q4 18 and the pessimism of World Bank/IMF forecasts have been cast aside for a few data points and a tease from the world’s two largest economies that an agreement to begin a de-escalation process not just extending the third tariff truce. The Federal Reserve, the European Central Bank, the People’s Bank of...

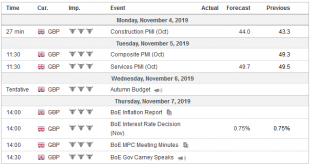

Read More »FX Daily, November 4: Investor Optimism Carries into the New Week

Swiss Franc The Euro has risen by 0.16% to 1.1015 EUR/CHF and USD/CHF, November 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Investor optimism is reflected by the risk-taking appetite that is lifting equity markets and bond yields. With Japanese markets closed for a national holiday, the MSCI Asia Pacific Index was led higher by more than 1% gains in Hong Kong, Taiwan, South Korea, and Thailand. The...

Read More »FX Weekly Preview: Synchonized Emergence from Soft Patch?

There have been plenty of developments warning of a global economic slowdown. Yet, seemingly to justify the continued advance in equity prices, there has begun to be talk of possible cyclical and global rebound. That is the new constellation, connecting the better than expected Japanese, South Korean, and Chinese September industrial output figures, a slightly stronger than expected Q3 GDP reports from the US and the eurozone. Ahead of the weekend, China reported...

Read More »FX Daily, October 31: No Good Deed Goes Unpunished

Swiss Franc The Euro has fallen by 0.32% to 1.0993 EUR/CHF and USD/CHF, October 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The equity and bond rally in North America yesterday carried over into today’s session. With some notable exceptions, like China, Taiwan, Australia, and Indonesia, most bourses in Asia Pacific and Europe traded higher. US shares are little changed in early Europe after the S&P...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org