Overview: The sharp sell-off in US equities yesterday, led by tech, is weighing on today’s activity. Most of the large Asia Pacific markets excluding Japan and India lost more than 1% today. The three-day rally in Europe’s Stoxx 600 is being snapped today. US futures are posting small losses. The US 10-year yield is little changed around 3.17%, while European benchmarks are narrowly mixed, with the periphery doing better than the core. The dollar is enjoying a firmer...

Read More »Is a 0.3% Miss on Headline CPI Really Worth a 77 bp Rise in the December Fed Funds Yield?

Overview: Better than expected Chinese data and an unscheduled ECB meeting are the highlights ahead of the North American session that features the May US retail sales report and other high frequency data before the outcome of the FOMC meeting. Asia Pacific equities outside of Hong Kong and China fell. Europe’s Stoxx 600 is up almost 1% as it tries to snap a six-day slide. US futures are posting modest gains. Bond markets in Europe and the US are rallying. The ECB...

Read More »Dollar Jumps, Stocks and Bonds Slide

Overview: The prospect of a more aggressive Federal Reserve policy has spurred a sharp sell-off in global equities and bonds and sent the dollar sharply higher. The large Asia Pacific bourses were off mostly 2%-4%. Europe’s Stoxx 600 is off 2.2%, its fifth consecutive losing session. US futures are off also. The NASDAQ was down 3.5% before the weekend and the S&P 500 fell 2.9%. The dollar rocks. The Scandis and Antipodean currencies are bearing the brunt and are...

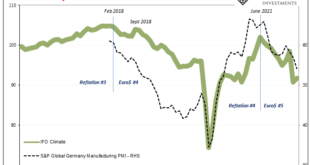

Read More »Euro$ #5 in Goods

Last Friday, S&P Global (the merged successor to IHS Markit) reported that its PMI for German manufacturing fell to 54.1. It hadn’t been that low for more than a year and a half. Worse than that, the index for New Orders dropped below 50 for the first time since the middle of 2020. The excuses are plentiful, as there’s COVID, supply problems, Russia, a drop in demand. Wait, what was that last one? The S&P Global Flash Germany Manufacturing PMI fell to 54.1...

Read More »FX Daily, March 17: Investors are Skeptical that the Fed can Achieve a Soft-Landing. Can the BOE do Better?

Swiss Franc The Euro has risen by 0.14% to 1.0387 EUR/CHF and USD/CHF, March 17(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The markets continue to digest the implications of yesterday’s Fed move and Beijing’s signals of more economic supportive efforts as the Bank of England’s move awaited. The US 5–10-year curve is straddling inversion and the 2-10 curve has flattened as the Fed moves from one horn of the...

Read More »Risk Assets Given a Reprieve

Overview: US equities failed to sustain early gains yesterday, but risk appetites have returned today. Asia Pacific equities had a poor start, with Chinese and Japanese indices losing ground, but the equity benchmarks in Taiwan, Australia, India, and most of the smaller markets traded higher. Taiwan’s 1.1% gain is notable as foreign investors continued to be heavy sellers. Europe’s Stoxx 600 is snapping a four-day drop with an impressive 3.3% gain, led by the...

Read More »Weekly Market Pulse: Oil Shock

Crude oil prices rose over 25% last week and as I sit down to write this evening the overnight futures are up another 8% to around $125. Almost every other commodity on the planet rose in prices last week too, as did the dollar. Those two factors – rising dollar and rising commodity prices – mean the likelihood of recession in the coming year has risen significantly in just the last week. Rising oil prices, in particular, have been a regular feature of past...

Read More »The Greenback Slips to Start the New Week

Overview: While the Belarus-Poland border remains an intense standoff, there have been a couple other diplomatic developments that may be exciting risk appetites today. First, Biden and Xi will talk by phone later today. Second, reports suggest the UK has toned down its rhetoric making progress on talks on the implementation of the Northern Ireland Protocol. Equities in the Asia Pacific region were mostly firmer, with China a notable exception among the large...

Read More »Big Week Begins Slowly

Overview: The global capital markets give little indication of the important economic and earnings data that lie ahead this week. There is an eerie calm. Equities in Asia were mixed. Japan and Hong Kong, and most small bourses were lower. Last week, the MSCI Asia Pacific Index gained almost 0.9%. Europe's Stoxx 600 is little changed after rising about 0.5% last week. US futures are firm. The S&P 500 and Dow Jones Industrials reached record-highs before the...

Read More »What to Expect When You are Expecting

Overview: The markets have stabilized since Monday's panic attack but have not made much headway. China and Taiwan returned from the extended holiday weekend. Mainland shares were mixed. Shanghai rose by about 0.4%, while Shenzhen fell by around 0.25%. Taiwan got tagged for 2%, and Japan's Topix was off 1%. Hong Kong and South Korean markets were closed. Europe's Dow Jones Stoxx 600 is firmer for the second day but is still lower for the week. US indices...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org