It went down to the wire, but the stadiums are complete, the brand-new metro line is up and running, and the 2016 Olympic Games in Rio de Janeiro are officially underway. When it comes to the Brazilian economy, on the other hand, there is still more work to be done. While there has been some progress in resolving the political uncertainty dogging the country, the fiscal consolidation that needs to happen for the sake of Brazil’s longer-term economic health still seems to be far off....

Read More »5 Things The Media Isn’t Telling You About The Olympics

Submitted by Alice Salles via The AntiMedia.org, This year’s Olympics have a particularly romantic setting: Rio de Janeiro. In the 1950s and 60s, Rio’s most prominent artists were international stars, which made the popularity of “Bossa Nova” the perfect opportunity for Brazilians to share their culture and approach to life with the world. But throughout the following decades, Brazil changed considerably in the eyes of foreigners. It became the land...

Read More »Central Bank Wonderland is Complete and Now Open for Business — The Epocalypse Has Fully Begun

The following article by David Haggith was first published on the Great Recession Blog. Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic...

Read More »Why A UK Billionaire Believes Brexit Would Be “Good For The UK”

The City of London and the pound would both benefit from the U.K. leaving the EU, says billionaire Peter Hargreaves. Brexit may knock the pound initially, but it would rebound, the co-founder of Hargreaves Lansdown — the largest U.K. retail broker, with more than $84.1 billion equivalent in assets — told Bloomberg Briefs' Geoff King in a June 17 interview. Q: Why do you support "Leave"? A: Every year in the EU it gets more political, it gets more legislative, more...

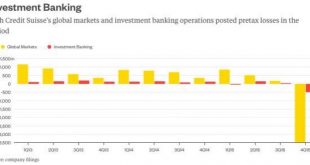

Read More »Why An Ex-Credit Suisse Banker In Brazil Made More Money Than The CEO

Ever had to testify in a trial involving your father’s dealings in corrupt activities, and as a result had your tax records leaked for all of the public to see? Sergio Machado, the ex-head of Credit Suisse’s Brazil fixed-income business has, and now everyone knows how much he made in 2015. Sergio’s father, who goes by the same name, is a former Brazilian politician who went on to head the state run oil company...

Read More »Global Peace Index: Only 10 countries not at war (among them Switzerland)

Authored by Adam Withnall, originally posted at The Independent, The world is becoming a more dangerous place and there are now just 10 countries which can be considered completely free from conflict, according to authors of the 10th annual Global Peace Index. The worsening conflict in the Middle East, the lack of a solution to the refugee crisis and an increase in deaths from major terrorist incidents have all...

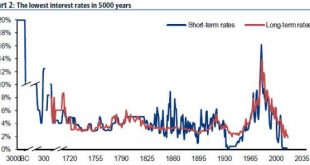

Read More »Visualizing “The 5000 Year Long Run” In 18 Stunning Charts

In the long run, as someone once said, we are all dead, but in the meantime, as BofAML’s Michael Hartnett provides a stunning tour de force of the last 5000 years illustrates long-run trends in the return, volatility, valuation & ownership of financial assets, interest rates & bond yields, economic growth, inflation & debt… The Longest Pictures reveals the astonishing history investors are living through...

Read More »Emerging Markets: What has Changed

Local press is reporting that RBI Governor Rajan does not want to serve another term The incoming Philippine government is signaling looser fiscal policies ahead Polish President Duda’s team of experts may present several plans for consideration A second cabinet minister in Brazil was forced to resign Colombia eliminated its FX intervention program The IMF boosted Mexico’s Flexible Credit Line (FCL) from $67 bln to $88 bln Equities In the EM equity space, China (+4.1%), Brazil...

Read More »Futures Flat, Gold Rises On Weaker Dollar As Traders Focus On OPEC, Payrolls

After yesterday's US and UK market holidays which resulted in a session of unchanged global stocks, US futures are largely where they left off Friday, up fractionally, and just under 2,100. Bonds fell as the Federal Reserve moves closer to raising interest rates amid signs inflation is picking up. Oil headed for its longest run of monthly gains in five years, while stocks declined in Europe. Treasuries retreated in the first full day of trading since Yellen said late Friday that the improving...

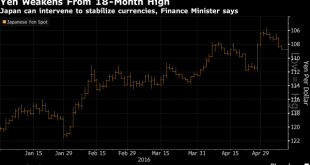

Read More »Global Stocks Jump; Oil Rises As Yen Plunges After Another Japanese FX Intervention Threat

In what has been an approximate repeat of the Monday overnight session, global stocks and US futures rose around the world as oil prices climbed toward $44 a barrel, with risk-sentiment pushed higher by another plunge in the Yen which has now soared 300 pips since the Friday post-payroll kneejerk reaction, and was trading above 109.20 this morning. At the same time base metals regained some of Monday’s steep losses following Chinese CPI data that came in line while PPI declined for 50...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org