The US dollar is posting modest upticks against most of the European currencies and the Canadian and Australian dollars.However, it has fallen against the yen and taken out the recent low, leaving little between it and the May 3 low near JPY105.50. The New Zealand dollar though is the strongest of the major currencies; gaining 1.5% following the RBNZ’s decision to leave rates on hold, and signal of little urgency to...

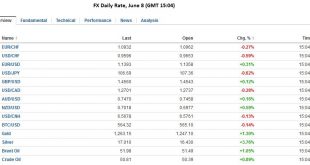

Read More »FX Daily, June 8: Currencies Broadly Stable, but Greenback is Vulnerable

On Swiss Franc Once again the Swiss Franc appreciates both against EUR and USD.The euro topped at 1.1095 shortly before the US payroll data and has fallen to 1.0932. The dollar has fallen from 0.9947 to 0.9596. New CHF trade recommendation by Dennis Gartman: We wish to sell the EUR and to buy the Swiss franc this morning upon receipt of this commentary. As we write, the cross is trading 1.0972:1 and we shall risk...

Read More »FX Daily, June7: Another Breakdown of EUR/CHF

Swiss Franc Once again both EUR and USD broke down against the franc. The adverse effect of the Friday US jobs reports is visible again.Moreover, CHF appreciated with the Asian block, with AUD and NZD and with the oil price. Swiss sales are pretty high to Asian countries. We also know that rising oil prices usually lead to a stronger CHF. Japan The Japanese yen is the major currency not to be gaining against...

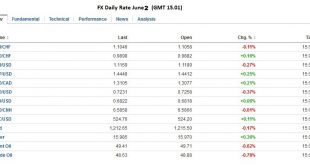

Read More »FX Daily, June 2: Greenback Mostly Softer Ahead of ECB and ADP

The US dollar remains under pressure. It is off for the third day against the yen and slipped below JPY109 for the first time in a little more than two weeks. The Nikkei struggled to cope with the foreign exchange developments, lost 2.3%, the most in a month, after gapping lower. At JPY108.50, the dollar would have given back 50% of its rally off the May 3 low near JPY105.50. Below there, the JPY107.80 is the 61.8% retracement. The euro is north of $1.12 after having briefly...

Read More »FX Daily, May 31: Sterling Slips and Aussie Pops as Investors Await Fresh Insight into Fed Trajectory

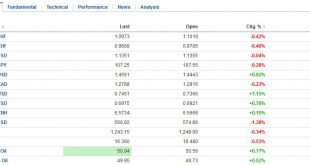

The US dollar is broadly mixed. The main narrative of increased prospects for a Fed hike in June or July has been pushed off center stage as the market reacts to local developments as investors await from US economic data. Ostensibly the data will determine whether the Fed raises rates in June or July. The Swiss Franc lost both against the dollar and versus the euro. Click to enlarge. On the other hand, despite the Fed’s data dependency, we argue that the determining factor is...

Read More »FX Daily, May 18: Greenback Recovers as Rate Support is Enhanced

The US dollar is rising against all the major currencies today. The Australian dollar is retracing a sufficient part of its recent gains to suggest that the current phase of the US dollar’s recovery is not over. Given that the Aussie topped out a week before the other major currencies, it is reasonable that it begins recovering first. Its recent resilience was noted, but that has evaporated today, but a 0.8% drop by early European activity. We had noted the divergence between what...

Read More »FX Daily, May 17: The Meaning of Sterling and Aussie’s Advance Today

The US dollar is mostly weaker today. It appears to be consolidating the gains scored since the reversal on May 3. Sterling and the Australian dollar are leading the way early in Europe. The Australian dollar’s gains appear more intuitively clear. The minutes from the recent RBA meeting indicated that it was a closer decision. This means that a follow-up rate cut next month is unlikely, which is what we have argued. While short-term participants may be surprised today, the...

Read More »Brief Look at the Start of the New Week’s Activity

The most notable thing is not what has happened, but what has not happened. The market has not responded to the soft Chinese data over the weekend. Chinese equities began softer but recovered fully and the Shanghai Composite closed on its highs. The MSCI Asia Pacific Index is snapping a two-day losing streak with a 0.5% gain. The Australian dollar is often perceived be influenced by developments in China. China’s disappointing industrial output figures (6.0% from 6.8% in March and...

Read More »FX Daily, May 5: Dollar Performance Turns More Nuanced

The US dollar is firm, near the best levels of the week against the euro, yen, and sterling. However, against the dollar-bloc and several actively traded emerging market currencies, including the Turkish lira and South African rand, the greenback has given back some of yesterday’s gains. Oil is snapping a four-day decline. News that US output fell by 113k barrels a day last week, the biggest drop in eight months, coupled with a Canadian wildfire that is threatening as much as one...

Read More »FX Daily April 27: Two Issues Loom Large Today: Soft Australia CPI and FOMC

The foreign exchange market is largely quiet as the market awaits fresh trading incentives and the FOMC statement later in the North American session. The main exception to the consolidative tone is the Australian dollar, which is posting its largest loss (~1.7%) in a couple of months. The short-term market was caught the wrong-footed when Australia reported an unexpected decline in Q1 CPI. The 0.2% decline contrasts to expectations for an increase of the same magnitude. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org