Swiss Franc Click to enlarge. FX Rates European bourses are mixed, and this is leaving the Dow Jones Stoxx 600 practically unchanged in late-European morning turnover. Financials are the strongest sector (+0.4%), and within it, the insurance sector is leading with a 0.8% advance and banks are up 0.4%. The FTSE’s Italian bank index is up 1.4% to extend its recovery into a fifth session. Bond markets are broadly...

Read More »FX Daily, August 04: The BOE Owns Today, but Tomorrow is a Different Story

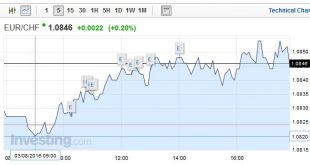

Swiss Franc The Swiss Franc appreciated today against the euro. Given that the Bank of England started monetary easing, this slight appreciation is unexpectedly weak – reason was probably intervention. The SNB intervention level should be around 1 billion francs. Numbers revealed in next week’s sight deposits. Click to enlarge. Bank of England The Bank of England owns today, though tomorrow will be about the US...

Read More »FX Daily, August 03: Consolidation Featured

Swiss Franc Click to enlarge. FX Rates The US dollar is consolidating yesterday’s losses. The greenback’s upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week’s RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week. The asset markets are more...

Read More »FX Daily, August 02: Greenback Slides Despite RBA Rate Cut and 7-year Low in UK Construction PMI

Swiss Franc The euro appreciated against both Swiss Franc and dollar. Swiss retail sales was again very weak, but emphasize our last month comment: The measurement of retail sales (and also GDP) ignore the active second-hand markets in Switzerland. The Swiss SVME PMI was at 50.1 close to contraction, another piece of bad data. Click to enlarge. FX Rates The US dollar is offered against the major currencies, but...

Read More »FX Weekly Preview: After this Week, Does August Matter?

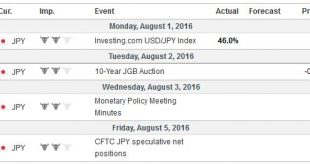

Summary: RBA meeting is a close call. BOE meeting consensus on rate cut, maybe new QE and lending-for-funding. More details of Japan’s fiscal policy. U.S. jobs data. After this week, and outside of RBNZ rate cut, August may be uneventful. There are four events this week that will command the attention of global investors. The Reserve of Bank of Australia is first.It is a close call, though the median in the...

Read More »FX Daily, July 28: Dollar Pulls Back Further Post-FOMC

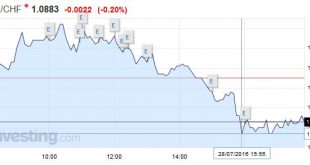

Swiss Franc The Swiss Franc is having a very volatile week. With the European stress tests approaching and with a bad U.S. durable goods release, the EUR/CHF is on the descent again. Data on net immigration to Switzerland has been published. The number of people who are leaving Switzerland is on the rise and the net immigration number has fallen. This is positive for the euro and negative for CHF. This decrease in...

Read More »FX Daily, July 27: Yen Falls on Fiscal Stimulus, while Sterling and Aussie Can’t Sustain Upticks

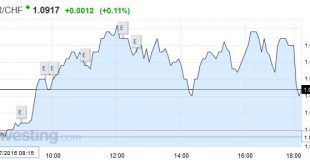

Swiss Franc The Euro kept on climbing, after yesterday’s rapid rise. Click to enlarge. The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy. Switzerland UBS Consumption Indicator Japan As uncertainty over Japan’s fiscal stimulus roiled the yen and domestic...

Read More »FX Daily, July 26: Strange Day: Yen Soars , Swissie Falls

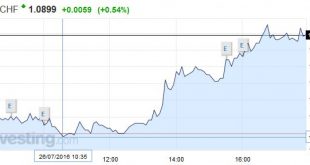

Swiss Franc The Swiss Franc strangely depreciated on a day, when the other safe-haven, the yen strongly improved. The euro went up to 1.0899 by 0.54%. The reason seems to be technical. USD/CHF Finally over 200DMA? After USD/CHF broke the 200 days moving average (0.9854), and a descending channel since November 2015. This break could lead to a new pattern building. If the SNB has sustained the rise with some...

Read More »Weekly Speculation Positions: Bullish on Dollar and Dollar-Bloc

Speculators made several significant position adjustments in the CFTC reporting period ending 19 July. Swiss Franc Speculators reduced their long Swiss Franc position from 6.7K contracts to 4.7K contracts (against USD). The 2K was certainly smaller than the increase of 15K shorts in the euro (against USD) Euro The euro bears added to their gross short position for the fourth consecutive week and for...

Read More »FX Daily, July 22: Flash PMIs Show Brexit Impact Localized

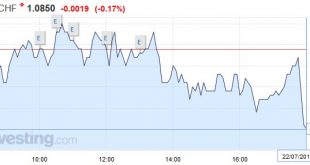

Swiss Franc The EUR/CHF ended lower today. Today’s data showed that Germany has stronger growth than the rest of the Eurozone. Given the strong Swiss trade ties with Germany, the Swiss franc appreciated. See more in Correlation between CHF and the German Economy Click to enlarge. FX Rates As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org