[This article is excerpted from a talk given June 17, 2021, at the Mises Institute’s Medical Freedom Summit in Salem, New Hampshire.] Ladies and gentlemen, why are we here today? First, in a certain sense medicine in America is broken. Doctors and patients are unhappy, the quality of care deteriorates, and costs keep increasing. Even before covid, US life expectancy declined three years running. Even before covid, too many Americans were sick, depressed, fat, and...

Read More »The Fed Plans to Raise Interest Rates—Years from Now

On Wednesday, the Federal Reserve’s Federal Open Market Committee voted to continue with a target federal funds rate of 0.25 percent, and to continue with large-scale asset purchases. According to the committee’s press release: The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s...

Read More »Governments Are Failing at Their Most Basic Duties—While Promising Free Stuff

[unable to retrieve full-text content]Three city blocks were systematically burned to the ground as hundreds of the local police stood by and viewed the violence. They were obeying orders not to harm the arsonists. The National Guard was called, adding more armed watchers. A passive gendarmerie consorting with open rebellion has rarely been seen in American history, until recently.

Read More »Why Monetary “Stimulus” Won’t Prevent an Economic Bust

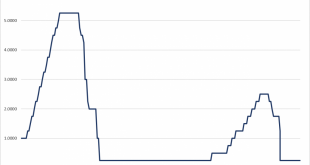

The increase in the growth rate of the Consumer Price Index (CPI) has fueled concerns that if the rising trend were to continue the Fed is likely to tighten its interest rate stance. Observe that the yearly growth rate in the CPI climbed to 4.2 percent in April from 2.6 percent in March and 0.3 percent in April 2020. We hold that because of massive increases in the money supply, it is likely that the growth momentum of prices is going to follow a rising trend....

Read More »A Libertarian Approach to Disputed Land Titles

The recent spate of bombing violence in Israel’s West Bank, East Jerusalem, and Gaza demonstrates the enduring attachment both Israelis and Palestinians have to physical land in the country. Both sides make claims—legal, moral, and political—to land within Israel, from the southernmost tip of Gaza to the northernmost tip of the Golan Heights. This ongoing and often violent dispute is based on interrelated historical and religious events reaching back thousands of...

Read More »The Economics of the Extended Family: From Risk Management to Human Capital

When we think of analyzing economic organizations, we generally think of firms and corporations. But there is another organization that is just as critical to economic development: the extended family. Indeed, the advantages offered by this institution are numerous and include risk sharing, mutual aid, human capital building, social capital building, and resource complementarity and coordination. Risk Sharing and Mutual Aid One of the most important roles of the...

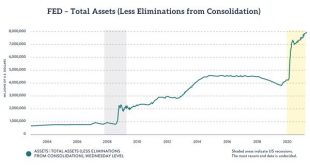

Read More »The Fed’s Policies since the 2020 Coronavirus Panic

[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in 2021.] In chapter 7 we summarized some of the major changes in how central banks have operated since the 2008 financial crisis. In the present chapter, we detail some of the even more recent changes in Federal Reserve operations since the onset of the coronavirus panic in March 2020. Size of the Fed’s Balance Sheet The most obvious change...

Read More »Private Security Isn’t Enough: Why America Needs Militias

[unable to retrieve full-text content]In late May we learned that, after a five-month deployment to one of the most dangerous cities in the world, the American military would finally be going home. Well, not really. They already were home. The dangerous warzone was the American federal capital, Washington, DC. And the “danger” that the military was supposed to be countering was entirely government made.

Read More »Decentralization: Why the EU May Be Better than the US

Over the years, I’ve been pretty hard on the European Union. Both as an editor and a writer, I’ve published articles criticizing its central bank and its unelected, bureaucratic central government. Especially objectionable is the EU ruling class’s propensity for cynical politics built around threatening and intimidating voters and national governments who don’t conform to Brussels’ wishes. Recall, for example, how the EU threatened the United Kingdom with retaliatory...

Read More »More Evidence the American Economic “Recovery” Will Disappoint

The University of Michigan consumer confidence index fell to 82.8 in May, from 88.3 in April. More importantly, the current conditions index slumped to 90.8, from 97.2 and the expectations index declined to 77.6, from 82.7. Hard data also questions the strength of the recovery. April retail sales were flat, with clothing down 5.1 percent, general merchandise store sales fell 4.9 percent, leisure and sporting goods were down 3.6 percent, with food and drink services...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org