[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in 2021.] In chapter 7 we summarized some of the major changes in how central banks have operated since the 2008 financial crisis. In the present chapter, we detail some of the even more recent changes in Federal Reserve operations since the onset of the coronavirus panic in March 2020. Size of the Fed’s Balance Sheet The most obvious change in Fed policy has been the dramatic expansion of its balance sheet since March 2020. As figure 1 indicates, the explosion in Fed asset purchases since March 2020 dwarfs even the three rounds of QE (quantitative easing) following the 2008 financial crisis. Indeed, from March 4, 2020, through March 3,

Topics:

Robert P. Murphy considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

[This article is part of the Understanding Money Mechanics series, by Robert P. Murphy. The series will be published as a book in 2021.]

In chapter 7 we summarized some of the major changes in how central banks have operated since the 2008 financial crisis. In the present chapter, we detail some of the even more recent changes in Federal Reserve operations since the onset of the coronavirus panic in March 2020.

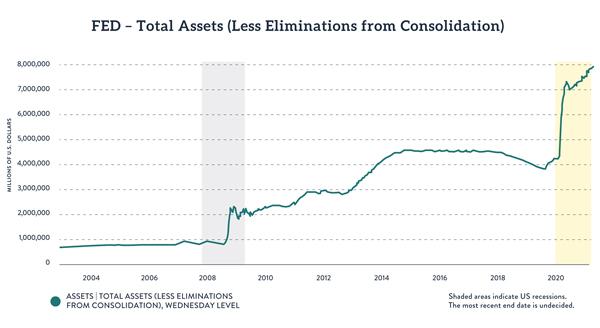

Size of the Fed’s Balance SheetThe most obvious change in Fed policy has been the dramatic expansion of its balance sheet since March 2020. As figure 1 indicates, the explosion in Fed asset purchases since March 2020 dwarfs even the three rounds of QE (quantitative easing) following the 2008 financial crisis. Indeed, from March 4, 2020, through March 3, 2021, the Fed increased its assets from $4.2 trillion to $7.6 trillion, an incredible one-year jump of $3.3 trillion (or 78 percent). Furthermore, as the graph reveals, the upward trajectory continues as of this writing. |

Total Assets Held by the Federal Reserve, 2004 - 2020 |

Composition of the Fed’s Balance Sheet

Besides the quantitative change in the Fed’s asset purchases, there has been a qualitative change in the type of asset. In particular, the Fed is now buying large amounts of private sector corporate bonds (both individually and exchange-traded funds); as of the mid-May 2021 balance sheet report, the Fed’s “Corporate Credit Facilities LLC” held almost $26 billion in assets.1 This change in policy would have been extremely controversial (if only for the potential corruption) prior to the financial crisis, but it is now a seemingly natural outgrowth of the expansion of Fed discretionary power that began in the fall of 2008.

The Fed announced the creation of the Primary and Secondary Corporate Credit Facilities LLC in March 2020 (though it did not begin aggressively buying corporate debt—which had to have been rated “investment grade” before the pandemic hit—until June 20202). At the same time, the Fed announced expansions of preexisting asset purchase programs, as well as the creation of a “Term Asset-Backed Securities Loan Facility (TALF), to support the flow of credit to consumers and businesses,” which would “enable the issuance of asset-backed securities (ABS) backed by student loans, auto loans, credit card loans, loans guaranteed by the Small Business Administration (SBA), and certain other assets.”3

At this point, the Federal Reserve now has the capability of influencing the credit markets not just for commercial banks, but for commercial and residential real estate, corporate bonds, commercial paper, cars, student loans, and even personal credit cards.

Abolition of Reserve Requirements for US Banks

In an emergency statement issued in the evening on Sunday, March 15, 2020, the Fed announced a host of new policies in light of the then emerging alarm over the coronavirus.4 In addition to cutting the target for the federal funds rate back down to 0 percent (with a range of up to 0.25 percent) and pledging to increase the scale of its asset purchases, the Federal Open Market Committee (FOMC) statement concluded with this tantalizing paragraph:

In a related set of actions to support the credit needs of households and businesses, the Federal Reserve announced measures related to the discount window, intraday credit, bank capital and liquidity buffers, reserve requirements, and—in coordination with other central banks—the U.S. dollar liquidity swap line arrangements. More information can be found on the Federal Reserve Board’s website. (bold added)

The final word, “website,” contained a hyperlink to the Fed’s main website. Yet if one looked at the compilation of press releases, there was an additional item posted on March 15, 2020, titled “Federal Reserve Actions to Support the Flow of Credit to Households and Businesses,” which was alluded to in the official FOMC statement.5 For our purposes, we will highlight the last measure listed in this supplemental statement:

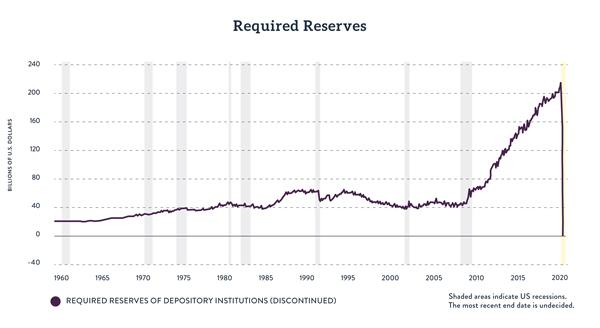

Since the Fed’s actions following the financial crisis of 2008, the US banking system as a whole has been awash with excess reserves (see the second chart in chapter 14). This is because following the Fed’s injections of new reserves under the various rounds of quantitative easing, the commercial banks did not create new loans for their own customers to the maximum amount legally allowed. Therefore, the immediate impact of the Fed’s 2020 decision to abolish reserve requirements should be minimal, since the original reserve requirements were not binding at the time of the change. However, even though the US banking system had more than enough reserves to cover its requirements, it is still the case that the level of required reserves rose dramatically—quintupling from about $40 billion to more than $200 billion—since the financial crisis, as the following chart reveals: |

Required Reserves of US Depository Institutions, 1960 - 2020 |

To avoid confusion, the reader should remember that in addition to the Fed’s direct actions that caused the monetary base to soar, money “held by the public” (which we can summarize by the monetary aggregate M1) also dramatically increased following the 2008 crisis. Later in this chapter we will explain the redefinition of M1 in 2020, but the graph of M1 we present in chapter 14 shows the measure in its old definition; the reader can see that it rose steadily after 2008, and jumped sharply in 2020. To the extent that much of this increase in money held by the public took the form not of actual physical currency, but of checking account balances at commercial banks, the statutorily required reserves rose correspondingly—as reflected in the chart above.

Some analysts argue that the Fed’s abolition of reserve requirements merely reflects the new realities of modern banking. With the 1994 introduction of retail “sweep accounts”6 and especially in the post-2008 era of large central bank balance sheets, some have argued that reserve requirements are anachronistic and no longer influence commercial bank lending decisions, except to necessitate cumbersome maneuvers.7

Although the situation is no doubt nuanced, some of the more glib defenses of the new Fed policy prove too much. For example, the Fed’s own explanation (quoted above) says, “This action eliminates reserve requirements for thousands of depository institutions and will help to support lending to households and businesses.” If it were indeed the case that the reserve requirements did not constrain bank lending—as claimed by some of those dismissing the announcement as a bit of trivia—then abolishing the requirements wouldn’t support lending to households and businesses.

To put it simply, if the abolition of reserve requirements really have no effect, then one wonders why the Fed decided to implement the move along with the other emergency measures activated at the onset of the coronavirus crisis. At the very least, abolishing the requirements will give the commercial banks freer rein to make loans down the road, if conditions return to a scenario where the original rules would have provided a check on additional bank credit inflation.

Redefinition of M1On February 23, 2021, the Fed announced:

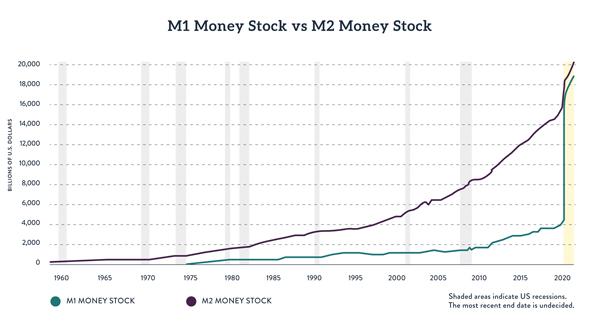

In other words, in late April of 2020, the Fed removed some of the limits on savings deposits in a way that made them equivalent to checking account deposits. As such, savings deposits from May 2020 forward are now included in M1, whereas before they had been excluded from it. Yet either way, savings deposits were always included in M2. Consequently, we can look at the Fed’s graphs of both M1 and M2 to isolate the impact of the reclassification: As the figure indicates, there was a massive spike in the official M1 measure in May 2020, largely (though not entirely) reflecting the reclassification of savings deposits as part of M1. However, note that M2 also rose sharply at exactly this time, reflecting a genuine increase in money held by the public because of the coronavirus panic and Fed policy. (Also remember that the M1 chart shown in chapter 14 was made based on the original M1 numbers, before the retroactive reclassification occurred. The chart in chapter 14 shows that M1, even according to the old definition, truly did spike in the spring of 2020.) |

M1 and M2 Money Stock, Showing Effect of May 2020 Redefinition |

Given the change in Regulation D, the reclassification of M1 made perfect sense. Some economists have speculated that the motivation for the Fed’s decision to discontinue publication of certain monetary measures—which occurred at the same time as the retroactive M1 reclassification—may have been to obscure the large increase in US Treasury and foreign bank deposits with the Fed, as such data might fuel concerns that the Fed is acting to monetize US government spending.9

Switch to Average Inflation Targeting

On August 27, 2020, the Fed posted its “2020 Statement on Longer-Run Goals and Monetary Policy Strategy,” which amended the original statement adopted back in 2012. The following excerpt highlights the major change in the 2020 amendment:

The inflation rate over the longer run is primarily determined by monetary policy, and hence the Committee has the ability to specify a longer-run goal for inflation. The Committee reaffirms its judgment that inflation at the rate of 2 percent, as measured by the annual change in the price index for personal consumption expenditures, is most consistent over the longer run with the Federal Reserve’s statutory mandate. The Committee judges that longer-term inflation expectations that are well anchored at 2 percent foster price stability and moderate long-term interest rates and enhance the Committee’s ability to promote maximum employment in the face of significant economic disturbances. In order to anchor longer-term inflation expectations at this level, the Committee seeks to achieve inflation that averages 2 percent over time, and therefore judges that, following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time. (bold added)10

Before the August 2020 change, the Fed had adopted a constant (price) inflation target, which reset anew each period. For example, if the Fed wanted inflation (in the Personal Consumption Expenditure index) to average 2 percent in 2020, but in actuality the desired inflation measure came in at only 1 percent, then under the old system, the Fed in 2021 would try again to hit 2 percent. But under the new system, the Fed might shoot for inflation of 2.5 percent for both 2021 and 2022 to make up for the initial undershooting of the target back in 2020. (We are ignoring the complications of exponential growth to keep the arithmetic simple.) This is what the Fed authors mean by saying they are switching to an average inflation target: in our example, if the Fed undershoots the target in 2020, the average over the three-year period can only hit the target if the Fed overshoots in 2021 and 2022.

At the Jackson Hole monetary conference held in late August 2020, Fed chair Jay Powell gave the opening remarks. He first summarized some of the major changes in the global economy and central bank practice since 2012, and then explained the new Fed policy by saying:

The key innovations in our new consensus statement reflect the changes in the economy I described. Our new statement explicitly acknowledges the challenges posed by the proximity of interest rates to the effective lower bound. By reducing our scope to support the economy by cutting interest rates, the lower bound increases downward risks to employment and inflation. To counter these risks, we are prepared to use our full range of tools to support the economy.11

Specifically, Powell argued that the fall in real interest rates, as well as muted (price) inflationary expectations, made the “zero lower bound” a much more potent threat in 2020 than it had been a decade earlier. When short-term nominal interest rates hit 0 percent, it is difficult for the central bank to cut further; why would people lend out their money at a negative interest rate when they could just hold cash and earn 0 percent? According to some economists, at the zero lower bound conventional monetary policy loses traction and other measures are needed.

In theory, the switch to average inflation targeting can help alleviate the problem posed by the zero lower bound. Investors know that if the Fed runs into trouble during a sluggish year and inflation falls short of the target, then the Fed is required to let the economy “run hot” for a while in order to make up for the lost ground. Even if nominal interest rates stay at 0 percent, the increase in expectations of future inflation lower real interest rates and have the same impact as if the Fed had more room to cut nominal interest rates in the present.

In contrast to this optimistic interpretation of the Fed’s new regime, a more cynical take is that Federal Reserve officials knew that their massive monetary expansion in 2020 would lead to higher price inflation, and they wanted to provide themselves with a framework to justify their failure to stay within their own guidelines.

- 1. See the discussion and citation in Joseph T. Salerno, “The Fed’s Money Supply Measures: The Good News—and the Really, Really Bad News,” Mises Wire, Mar. 6, 2021, https://mises.org/wire/feds-money-supply-measures-good-news-and-really-really-bad-news.

- 2. See Board of Governors of the Federal Reserve System, “2020 Statement on Longer-Run Goals and Monetary Policy Strategy,” Aug. 27, 2020, last modified Jan. 14, 2021, https://www.federalreserve.gov/monetarypolicy/review-of-monetary-policy-strategy-tools-and-communications-statement-on-longer-run-goals-monetary-policy-strategy.htm.

- 3. Jerome H. Powell, “Opening Remarks: New Economic Challenges and the Fed’s Monetary Policy Review” (speech given at the Navigating the Decade Ahead: Implications for Monetary Policy economic policy symposium, Jackson Hole, WY, August 2020), https://www.kansascityfed.org/documents/7832/JH2020-Powell.pdf.

- 4. For the connection between sweep accounts and reserve requirements, see Richard G. Anderson and Robert H. Rasche, “Retail Sweep Programs and Bank Reserves, 1994–1999,” Review 83, no. 1 (January/February 2001): 51–72, https://files.stlouisfed.org/files/htdocs/publications/review/01/0101ra.pdf.

- 5. For example, in his February 10, 2010, testimony before the House Committee on Financial Services, then Fed chair Ben Bernanke said that the “Federal Reserve believes it is possible that, ultimately, its operating framework will allow the elimination of minimum reserve requirements, which impose costs and distortions on the banking system.” Benjamin Bernanke, “Federal Reserve’s Exit Strategy” (statement before the Committee on Financial Services, US House of Representatives, Washington, DC, Feb. 10, 2010), quoted in Vijay Boyapati, “Why Credit Deflation Is More Likely Than Mass Inflation,” Libertarian Papers 2, art. no. 43, (2010): 1–28, https://cdn.mises.org/-2-43_2.pdf.

- 6. The block quotation is taken from the February 23, 2021, announcement available at this feed: Board of Governors of the Federal Reserve System, “Money Stock Revisions,” H.6 (Money Stock Measures) statistical release, Mar. 23, 2021, https://www.federalreserve.gov/feeds/h6.html.

- 7. For the current summary of the Fed’s balance sheet, see Board of Governors of the Federal Reserve System, “Factors Affecting Reserve Balances of Depository Institutions and Condition Statement of Federal Reserve Banks,” H.4.1 (Factors Affecting Reserve Balances) statistical release, May 27, 2021, https://www.federalreserve.gov/releases/h41/current/h41.pdf.

- 8. See Nancy Marshall-Genzer, “The Fed Starts Buying Corporate Bonds,” Marketplace, June 16, 2020, https://www.marketplace.org/2020/06/16/the-fed-starts-buying-corporate-bonds/.

- 9. See the Fed’s announcement of its new facilities in its March 23, 2020, press release: Board of Governors of the Federal Reserve System, “Federal Reserve Announces Extensive New Measures to Support the Economy,” press release, Mar. 23, 2020, last modified July 28, 2020, https://www.federalreserve.gov/newsevents/pressreleases/monetary20200323b.htm.

- 10. See the FOMC statement of March 15, 2020: Board of Governors of the Federal Reserve System, “Federal Reserve Issues FOMC Statement,” press release, Mar. 15, 2020, https://www.federalreserve.gov/newsevents/pressreleases/monetary20200315a.htm.

- 11. The supplemental Fed posting from March 15, 2020, is Board of Governors of the Federal Reserve System, “Federal Reserve Actions to Support the Flow of Credit to Households and Businesses,” press release, Mar. 15, 2020, https://www.federalreserve.gov/newsevents/pressreleases/monetary20200315b.htm.

Tags: Featured,newsletter