Yield. It’s on the tip of every investor’s tongue, but it’s much harder to find than it used to be. A long time ago, in a galaxy far, far away (like the early 1980’s) one could simply open a savings account, purchase a CD or US 10-year notes, and earn between 7% to 14%. The idea of earning 14% on treasurys seems the stuff dreams are made of. And you must be dreaming if you think you can find that kind of yield today. Interest rates are at zero, near zero, or negative across much of the developed world. One of the many problems with falling interest rates is that it becomes near impossible to outpace inflation with your capital. This question becomes all the more relevant in light of the recent transitory inflation we’re facing. How can you generate a yield that

Topics:

Erik Oswald considers the following as important: 6a.) Monetary Metals, 6a) Gold & Monetary Metals, blog, Featured, newsletter

This could be interesting, too:

Clemens Schneider writes Café Kyiv

Clemens Schneider writes Germaine de Stael

Clemens Schneider writes Museums-Empfehlung National Portrait Gallery

Clemens Schneider writes Entwicklungszusammenarbeit privatisieren

Yield.

It’s on the tip of every investor’s tongue, but it’s much harder to find than it used to be.

A long time ago, in a galaxy far, far away (like the early 1980’s) one could simply open a savings account, purchase a CD or US 10-year notes, and earn between 7% to 14%.

The idea of earning 14% on treasurys seems the stuff dreams are made of. And you must be dreaming if you think you can find that kind of yield today. Interest rates are at zero, near zero, or negative across much of the developed world.

One of the many problems with falling interest rates is that it becomes near impossible to outpace inflation with your capital. This question becomes all the more relevant in light of the recent transitory inflation we’re facing. How can you generate a yield that will beat inflation?

The answer involves that four-letter word: gold.

Gold – To Yield or Not to Yield?

As interest rates continue to fall, many investors view gold as a safe-haven asset, protecting them from falling rates and currency debasement.

Others view it as nothing but a shiny, lump of metal. A “dead” asset, where you only “win” by buying low and selling higher to some greater fool. Warren Buffett epitomizes this viewpoint.

A growing minority view gold as money. In other words, they view gold as real money, and dollars as something else.

For much of the last century, buying gold looked a lot like Warren Buffet’s description: you pay people to dig it out of the ground, and pay others to put it back in the ground and stand guard. Gold did nothing productive and offered no yield, though its price in dollars rose considerably.

The Reemergence of Gold Interest Rates

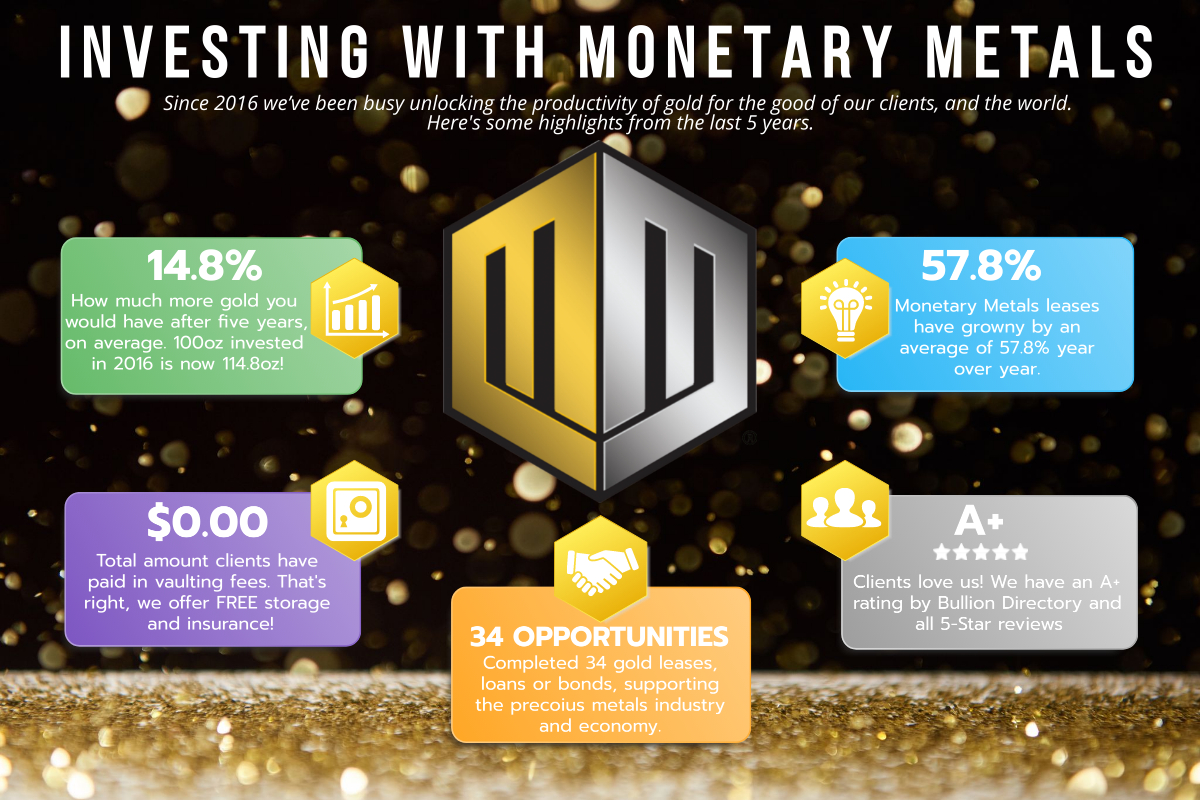

In 2016 something changed – gold offered a yield again. We say “again” because back when gold was legal money, it had always offered a yield. Only when it was banished from the monetary system, did interest on gold dry up. Since Monetary Metals started paying interest on gold again, one-year gold leases have generated yields between 2%-4.5% per year, paid in gold (and silver too).

A Yield on Gold to Outpace Inflation

Let’s revisit our question from before: how to earn a yield to outpace inflation? With CPI touching 5.4% in July of this year some might look at a rate of 2%-4.5% interest on gold or silver and say, “Neat concept, but aren’t I still losing my principal to inflation?”

This is the classic example of comparing apples to oranges. Is a 2% interest rate on gold the same as a 2% interest rate on dollars? Is the gravity of Earth the same as the gravity of Jupiter?

We think not. A little history lesson to explain what we mean.

Inflation Erodes Yield Purchasing Power

In 1970, the average price of an ounce of gold was approximately $36 per ounce and the yellow metal was still intrinsically linked to the value of the USD. The median home price was $17,000, while the median household income was $9,870. Priced in gold, the average cost of a home was 472.22 ounces of gold and the average household income was 246.16 ounces of gold.

Consider that for a moment.

In 1970, assuming no expenses, many families in America could purchase a home with savings amounting to just two years of the average household income.

Fast forward to 2020.

Last year, the average price of an ounce of gold was $1,770, but no longer linked to the paper notes we call “money”. Median home prices in 2020 were $358,700 and the median household income was $67,521. Priced in gold at $1,770 per ounce, the average home price in 2020 was 202.65 ounces of gold and the average household income was 38.14 ounces of gold.

Priced in gold, home prices have fallen by more than half! Great! Until you realize that household incomes have fallen 86% over the last 50 years when priced in gold.

Wow.

That’s what happens when you take the money (gold) out of “money” (dollars).

A Yield on Gold to the Rescue

A Yield on Gold to the Rescue

And that’s why earning 2% in dollars just isn’t the same as earning 2% in gold.

Over the millennia, an ounce of gold has always remained an ounce. While in just two centuries, the dollar has been twisted, and distorted so many times it’s a mere shadow of what it once was (i.e. a note redeemable in a specific weight of gold).

Yet, most of the world is content (discontent?) to chase a yield on dollars. It’s like walking up an escalator the wrong way. You’re working really hard, but are you getting anywhere?

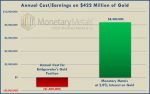

Exhibit A: classic case of dollar fixed income fatigue. The patient shows symptoms of utter exhaustion from trying to build wealth in dollars. It’s a real problem many investors suffer from. Thankfully, there’s a cure – Monetary Metals Gold Fixed Income.

Meanwhile, a yield in gold preserves and grows real wealth and purchasing power.

Put it this way, would you rather earn 2% interest in gold or 2% in dollars that are perennially losing value year after year, decade after decade?

Additional Resources for Earning Interest on Gold

If you’d like to learn more about how to earn interest on gold with Monetary Metals, check out the following resources:

In this paper we look at how conventional gold holdings stack up to Monetary Metals Investments, which offer a Yield on Gold, Paid in Gold®. We compare retail coins, vault storage, the popular ETF – GLD, and mining stocks against Monetary Metals’ True Gold Leases.

Adding gold to a diversified portfolio of assets reduces volatility and increases returns. But how much and what about the ongoing costs? What changes when gold pays a yield? This paper answers those questions using data going back to 1972.

Tags: Blog,Featured,newsletter