Swiss Government Pension Fund Allocating 2% Of Pension Fund To Gold Bars via IPE Quest The Swiss government pension fund, Switzerland’s AHV/AVS fund, has decided to diversify into physical gold bars in their substantial CHF35.2bn (€30.5bn) pension portfolio. At the end of last week the first pillar buffer fund tendered a custodianship and storage for CHF 700m (EUR 600m / USD 700m / GBP 525m) in gold bars via IPE Quest....

Read More »Industrial Commodities vs. Gold – Precious Metals Supply and Demand

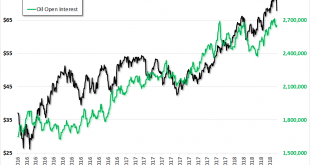

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Oil is Different Last week, we showed a graph of rising open interest in crude oil futures. From this, we inferred — incorrectly as it turns out — that the basis must be rising. Why else, we asked, would market makers carry more and more oil? We are grateful to Peter Tenebrarum at Acting Man and Steve Saville at The...

Read More »Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” Later

Get “Positioned In Gold” Now As “You Will Not Have Time To Get Positioned” In Physical Later Guest post by Dominic Frisby of Money Week This year’s “gold standard” of gold-related research has just come out. Conveniently enough – given gold’s “safe haven” reputation – it’s arrived just in time for another major financial market scare, this time in the form of Italy. Below, I consider some of the most pertinent points…...

Read More »Gold And Silver Bullion Obsolete In The Crypto Age?

Are Gold And Silver Obsolete In The Crypto Age? What is the outlook for the global economy, financial markets, crypto currencies such as bitcoin and gold and silver bullion in the digital age? TOPICS IN THIS INTERVIEW 01:00 Diagnosis of the economy and rising inflation 06:00 Possible stock market correction? 09:30 What is triggering higher oil prices? 13:05 Impacts of rising oil prices on the mining sector 14:40 Gold...

Read More »In Gold We Trust, 2018

The New In Gold We Trust Report is Here! As announced in our latest gold market update last week, this year’s In Gold We Trust report by our good friends Ronald Stoeferle and Mark Valek has just been released. This is the biggest and most comprehensive gold research report in the world, and as always contains a wealth of interesting new material, as well as the traditional large collection of charts and data that...

Read More »Wild Speculation in Crude Oil – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Crude Oil Market Structure – Extremes in Speculative Net Long Positions On May 28, markets were closed so this Report is coming out a day later than normal. The price of gold rose nine bucks, and the price of silver 4 pennies. With little action here, we thought we would write 1,000 words’ worth about oil. Here is a chart...

Read More »Gold Back Above $1300 – Trump Cancels Historic Summit – Silver “Ready To Breakout”

– Trump Cancels Historic Summit with North Korea – US 10-Year Falls Below 3%, Gold Jumps Back Above $1300 – “Inflation Overshoot Could Be Helpful” – Latest FOMC Minutes– Gold Demand in Turkey as Lira falls sharply, true inflation near 40%– EU Crisis Looming as Italy Plan Outright ‘Money Printing’ with ‘Mini-Bots’– Silver Trading in Tight $1 range, Pressure Building for a Breakout Weekly Report by Daniel MarchEditor...

Read More »‘Nightmare Scenario’ For EU Bond Markets As Anti-Euro Italian Goverment Takes Power

by Ambrose Evans-Pritchard, Daily Telegraph Firebrand populists of Left and Right are poised to take power in Italy, forming the first “anti-system” government in a major West European state since the Second World War. Leaders of the radical Five Star Movement and the anti-euro Lega party have been meeting to put the finishing touches on a coalition of outsiders, the “nightmare scenario” feared by foreign investors and...

Read More »Gold Looks A Better Bet Than UK Property

Gold Looks A Better Investment Than UK Property Dominic Frisby of Money Week looks at the historical relationship between UK house prices and gold (including some great charts), and concludes that your money is better off in the yellow metal than bricks and mortar. Today we return to a subject that has been a favourite of mine over the years: UK house prices – but with a twist. We don’t consider them in the debased,...

Read More »US 10-Year Surges, Emerging Markets Implode…Where Next for Gold?

US 10-Year Surges, Emerging Markets Implode…Where Next for Gold? US 10-Year Yields Top 3%, US Dollar Pushes Higher Brent Hits $80, Highest in 4 years Emerging Market Chaos, the Lira and Peso in Freefall Italy’s New Coalition Signal Their Plans, Yields Jump Japanese Economy Contracts, GDP Worst Since 2015 And Where Next for Gold? Gold and silver ended the week down (USD -2.2%, GBP -1.4%, and EUR -0.5%) as rising US...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org