“You never want a serious crisis to go to waste. And what I mean by that, it’s an opportunity to do things you think you could not do before.” -Rahm Emanuel, Barack Obama’s Chief of Staff from 2009 to 2010. Only a couple of weeks ago, if anyone told you that your entire country would be basically shutting down, that events and public gatherings would be outlawed, that you’d be looking at empty shelves in your local supermarket and that the global stock market would...

Read More »Don’t Panic – Prepare

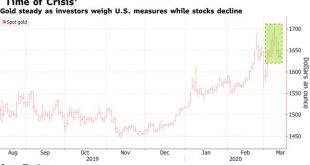

“Let’s Deal With The Facts Now” – Watch Interview Here ◆ Markets have collapsed around the world as we predicted as the ‘Giant Ponzi Everything Bubble’ meets the massive pin that is the coronavirus’ impact on already vulnerable indebted economies. ◆ Stocks have crashed and bond markets and banks may be next … “bank holidays”, bail-ins and currency resets are likely ◆ The virus is a final “snow flurry” which is unleashing the financial and economic avalanche. ◆...

Read More »Is Now a Good Time to Buy Gold? Market Report 16 March

We got hate mail after publishing Silver Backwardation Returns. It seems that someone thought backwardation means silver is a backward idea, or a bad bet. “You are a *&%#! idiot,” cursed he. “Silver is the most underpriced asset on the planet,” he offered as his sole supporting evidence. He doesn’t know that backwardation means scarcity, not that a commodity’s price is too high. Since we wrote that on March 2 (our Reports are always based on the prior Friday’s...

Read More »Gold Hedging Stock Market Crash: Euro Stoxx -6%, FTSE -5.7% and DAX -5.6%

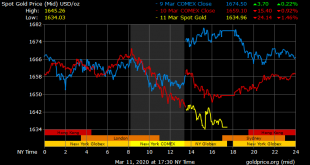

◆ Stock markets around the world are collapsing today as the financial and economic implications of the impact of the pandemic on already massively indebted companies and governments is realised. ◆ Investors are liquidating en masse risk assets from equities to industrial commodities, while gold has held its ground. ◆ The FTSE 100 is down 5.8% in early trade, while Frankfurt’s DAX 30 plunged 6.8% the CAC 40 tumbled 6.5% and Dublin’s ISEQ index collapsed another...

Read More »Gold Gains As Bank of England Slashes to Emergency Rate of 0.25percent and ECB Warns Of 2008 Style “Great Financial Crisis”

◆ Gold prices rose by 0.6% today as the Bank of England slashed rates in an emergency move to 0.25% and the ECB looks set to follow as it warned of a 2008 style crisis overnight. ◆ The Bank of England slashed its main interest rate to 0.25 percent this morning in a emergency move to combat the fallout from the coronavirus outbreak on the UK economy. Gold only saw a marginal gain of 0.45% in sterling to £1,285/oz but remains near all time record highs of...

Read More »Gold Surges 3 percent After U.S. Fed’s First Emergency Rate Cut Since 2008

◆ Gold surges 3% and has largest daily gain since June 2016 as the Fed delivers a surprise emergency rate cut, the first since 2008 ◆ Gold has gained over 10% in dollars and by more in other currencies so far in 2020 and along with U.S. Treasuries, it is a one of the best performing assets in 2020 as stock markets globally fall sharply (see 2020 Asset Performance table) ◆ G7 officials say there will be “appropriate” policy moves in a desperate attempt to prevent the...

Read More »Socialism and Gold

Most people assume that the central bank prints money when it buys bonds. They further assume that this increase in the quantity of money causes an increase in the general price level. And, this leads them to assume that the value of the money is 1 / P (P is the general price level). Therefore, when the central bank prints money to buy bonds, it is diluting the value of the money held by everyone—in proportion to the amount printed divided by the total amount in...

Read More »Silver Backwardation Returns, Gold and Silver Market Report 2 March

The big news this week was the drop in the prices of the metals (though we believe that it is the dollar which is going up), $57 and $1.81 respectively. Of course, when the price drops the injured goldbugs come out. We have written the authoritative debunking of the gold and silver price suppression conspiracy here. We provide both the scientific theory and the data. So we won’t say anything more about it today. On 17 Feb, we wrote about the widening bid-ask spread...

Read More »Goldman: 3 Key Reasons Why We Are Bullish On Gold

On “Bloomberg Commodities Edge”, Bloomberg’s Alix Steel and Naureen Malik talk with Jeff Currie, global head of commodities research at Goldman Sachs. They discuss Goldman’s bullish stance on gold. Gold is gaining on mounting speculation China and other central banks will unleash stimulus to counter the economic pain from the coronavirus outbreak, boosting liquidity in the market and devaluing currencies. UBS are also bullish on gold as a hedge on dollar and...

Read More »Gold May Rise To $2,000/oz This Year Due To Strong Coin and Bar, ETF and Central Bank Demand

IGTV interviewed Mark O’Byrne, Research Director at GoldCore about the outlook for gold and silver bullion. He is bullish on both precious metals in the medium and long term. The fundamentals are very strong with strong central bank demand and ETF gold holdings reaching an all time record high due to deepening political and economic risks. Silver at $18/oz and one eightieth of the price of gold is fundamentally undervalued and at some stage it will surge in value to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org